Recent news from Lumin Digital welcomed over 20 new partners from its client community as investors in its shared success. This follows on the heels of the growth equity funding announcement in December 2024. These announcements cement Lumin Digital’s category leadership in digital banking—providing a solid foundation for future innovation, expansion, and long-term client success.

Client excitement about the Lumin Digital platform is also witnessed in how clients rate the platform on review sites designed to help companies make informed purchasing decisions. Lumin has been awarded the high-performer badge from G2 for digital banking platforms, ranked solely by verified customers and compared to competitors. Equally, Lumin Digital has been recertified as a Great Place to Work(r), a certification based on employee feedback and an independent analysis of a company’s workplace culture.

Jeff Chambers, founder and CEO of Lumin Digital, views these announcements and rankings as inextricably linked. Together, they are a strong indicator and validation of this founder’s philosophy of building a lasting company that impacts employees, customers, and their users and is ultimately resetting the bar on the standard of excellence.

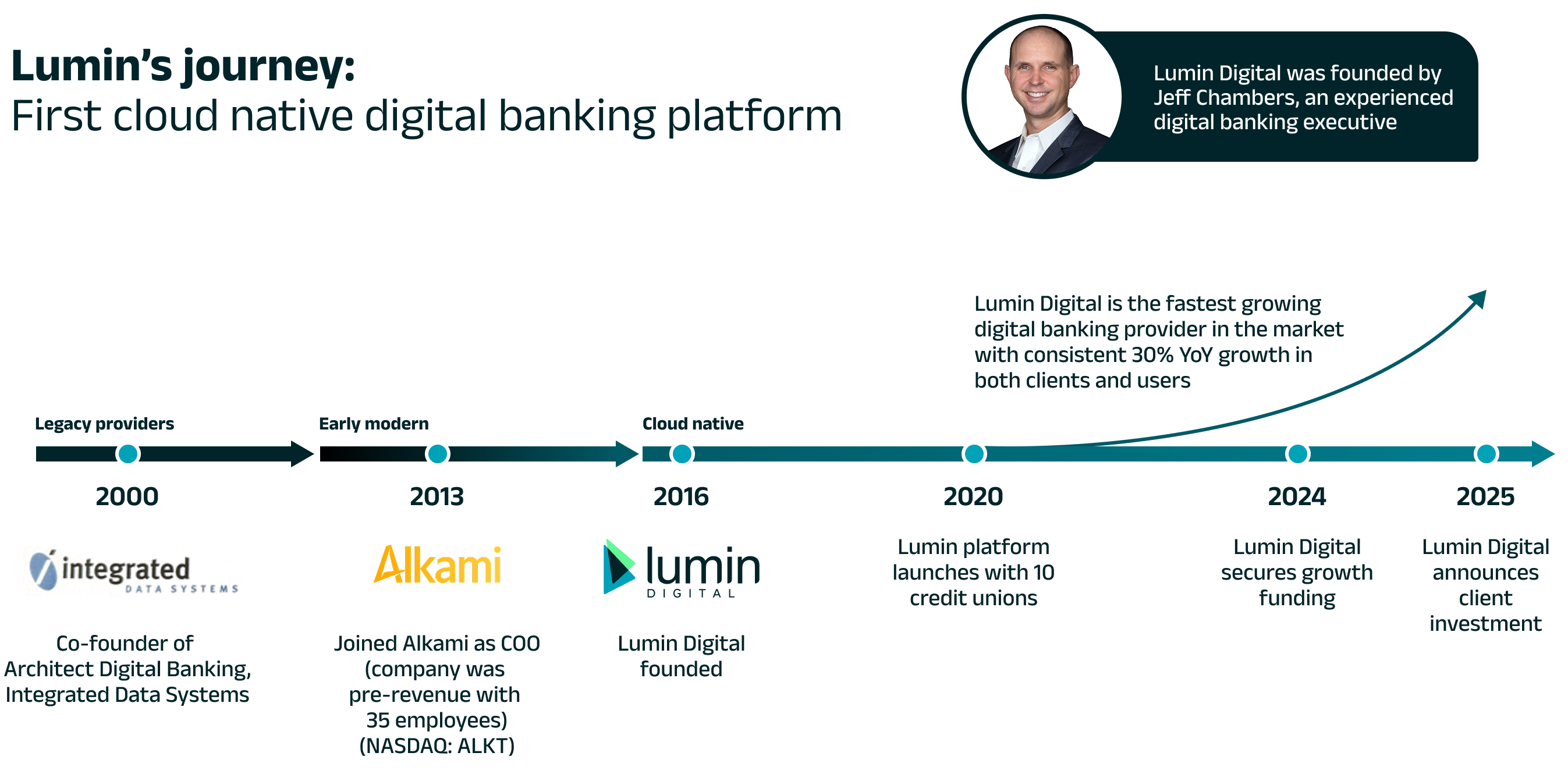

Jeff Chambers shares the story behind the company’s origin, its impact, and what’s next for the company he founded in 2016. And, for the future of digital banking

Q: Let’s start at the beginning. What inspired you to start Lumin Digital?

Jeff Chambers: By training and passion, I’m an engineer, and I’ve spent my career building and working in digital banking. In 2000, I co-founded Architect Digital Banking, which was ultimately acquired by Fiserv in 2015 and is still in use. I joined Alkami in 2013 as Chief Operating Officer as they launched their early-modern digital banking suite. As digital tech evolved and moved to the cloud, I recognized a gap that would ultimately lead a small group of innovators and pioneers in 2016 to build Lumin Digital’s cloud-native banking platform. Our platform is not just an incrementally better product but fundamentally changing the game for our clients and the industry. We’re solving real problems. Credit unions and banks are looking for a digital partner who understands them, listens to them, sets and keeps the pace of innovation, and helps them grow.

We’re not just selling software—we’re delivering a platform that empowers financial institutions to compete and thrive in the digital age. Our clients are now successfully competing against the largest banks with a digital platform that delivers the experience that digital-first generations expect, built on an architecture that delivers operational efficiencies for the FI.

Q: What makes Lumin Digital different from other digital banking providers?

Jeff Chambers: On the technology front, the most important difference is that we have built our platform on a cloud-native architecture from day one. That allows us to offer the speed, scalability, extensibility, and security that legacy on-prem providers and the early-modern digital suites can’t match. Because our platform is future-ready and built in the cloud, we can continuously innovate and release updates seamlessly—no downtime, no costly upgrades, no long windows of testing, no queues of unhappy users.

But technology aside, what sets Lumin Digital apart is our belief in how we operate our company. We fundamentally believe that intentional and collective success is exponentially realized. Here’s how it works. We hire a great, smart, collaborative team and create a workplace environment where people want to work, unencumbered by traditional enterprise workplace processes and stressors. Engaged employees innovate for our clients, building a great product and delivering exceptional customer service. Without employee turnover or client attrition, our teams become true, long-term partners. Intentional growth, for us, means that we only take on what we can deliver. Delighted users adopt more services, invest, meet their financial goals, and plan for a brighter future. Thriving customers achieve goals, build trust in the market, make referrals, and ultimately result in more clients. That’s our flywheel. And, it’s not just about growth; we are creating lasting impact.

Q: Is this bold vision working?

Jeff Chambers: By the measures that matter to our clients, investors, and to us, it’s working. Our clients want to invest in our future. The G2 high performer ranking and GPTW certifications are two great proof points. Our employees and clients are vocal champions and evangelists of our impact. But it does not stop there.

- We have less than 4% voluntary turnover, a perfect 5.0 Glassdoor score, and an eNPS of 100.

- We release over 200 product enhancements per year. Our clients reap the benefit of our investments in user experience and architecture efficiencies. Our recent announcement of more than $160M in growth equity financing means we can invest even more in innovation and products to drive value for clients, their users, and shareholders.

- We have never lost a client. Our client NPS is nearly 90, unheard of for a SaaS company.

- We always launch on time. Always. We hear the stories of transformation projects taking years with other tech. That does not happen at Lumin Digital.

- We are meeting our growth targets with strategic, methodical, and unwavering expansion. In the past year, we have increased our client base by 24% and the number of users under contract by 33%. We are growing; our clients are growing.

Q: Lumin recently announced a funding round and a secondary offering to clients. How has that changed your vision for the company?

Jeff Chambers: We are convicted in our company; it’s been humbling to recognize that so many others are as well. PSCU (now Velera) became an early supporter of our vision, helping us to get our start as an independent entity. Over the next decade, Lumin continued to grow with intention: our company, our product, our client base, and our partner network. When we went to market to raise capital to accelerate our innovation pipeline, we were able to choose the investors who believed in our mission and vision. We ultimately added Lightstreet Capital, NewView Capital, and Partners Group (more here) in growth equity funding. And then, because our clients are such ardent supporters, LightStreet Capital managed an SPV where clients invested in our shared future. This unique structure demonstrates our dedication to client partnerships.

Q: What’s next for Lumin Digital?

Jeff Chambers: We’re focused on pushing the boundaries of what’s possible in digital banking for our clients. That means deeper personalization, smarter AI-driven experiences, and even more seamless integrations, including new products like loan origination. Our clients are telling us to do more, build more, and keep delivering the same great service.

We’re just getting started.

For more about Lumin Digital.