Risk management

Reduce fraud and keep users safe from external threats.

Keeping users safe from malicious threats is paramount. Threat vectors are constantly evolving, and your users may not be aware of ever-changing risks.

Cyber breaches are costly for you and your users and impact your institution’s brand and reputation.

Lumin’s platform provides multiple threat mitigation tools to enable your institution and users to mitigate potential risks.

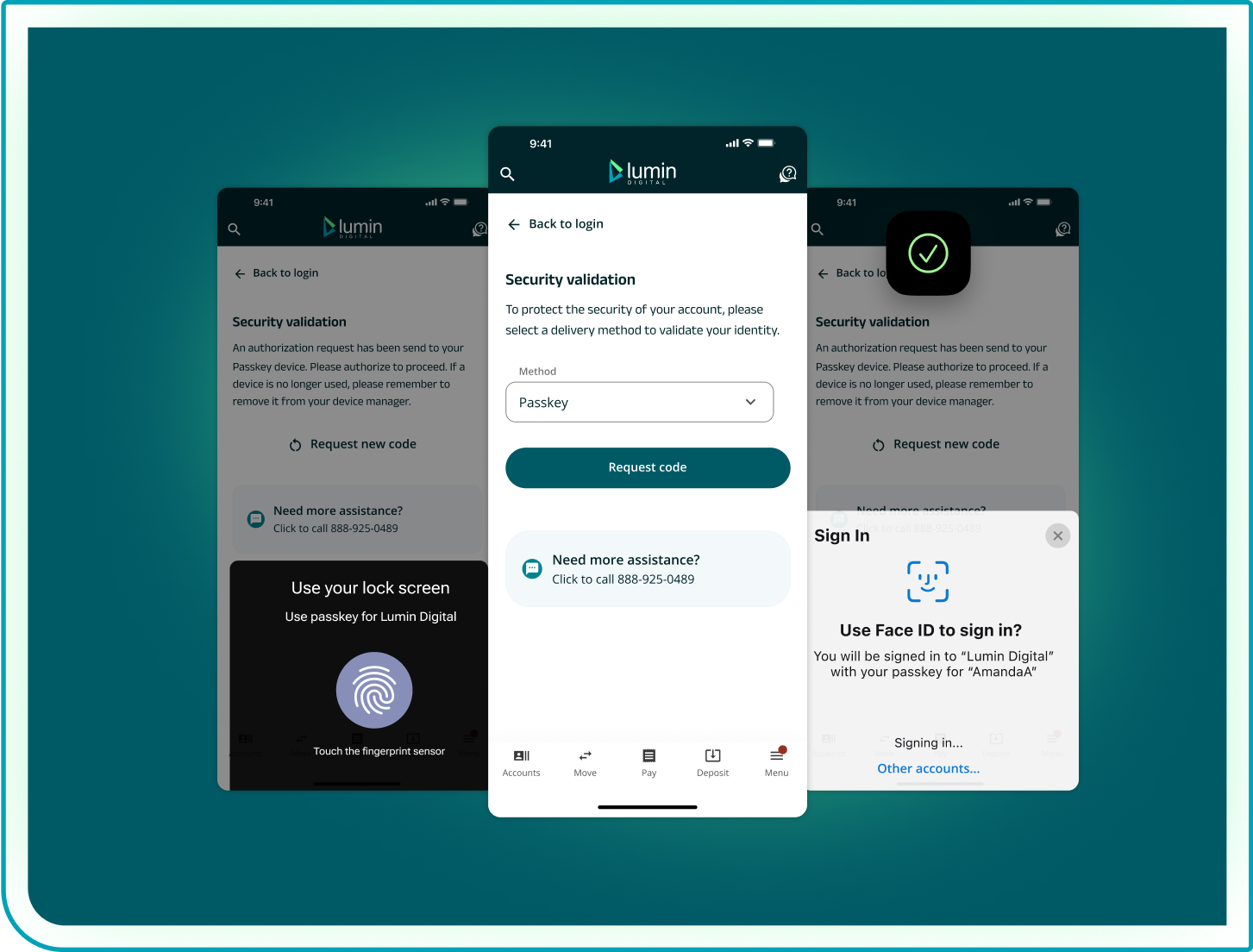

Advanced MFA

Configure options and enable users to log into digital banking with safe and secure advanced multi-factor authentication (MFA) methods, including passkeys, push authentication messages, various one-time password (OTP) options, and international MFA.

- Passkeys

- Push authentication

- Authenticator applications

- Hardware tokens

- International MFA (SMS text & WhatsApp)

- One-time password (OTP) via SMS, email, push notifications, or voice authentication

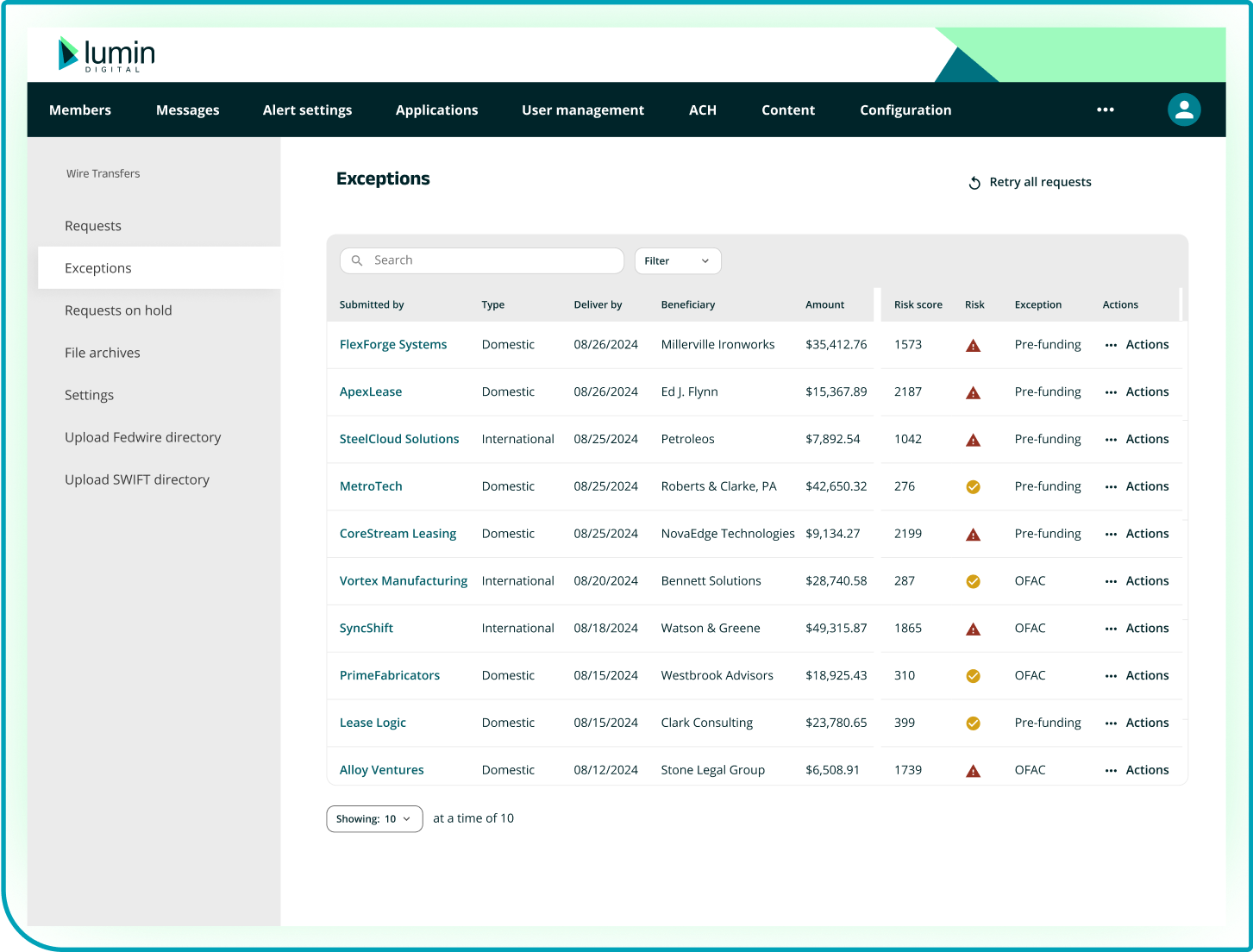

Transaction risk management

Review pending ACH and wire transactions across retail and business users with system-generated risk scores that indicate potentially fraudulent or suspicious transactions, making it easy for your employees to identify potential fraud before it happens. Place limits on transactions to manually approve large transfers and safely and securely send international wires.

- Wire risk scores

- ACH risk scores

- Transaction limits

- International payments

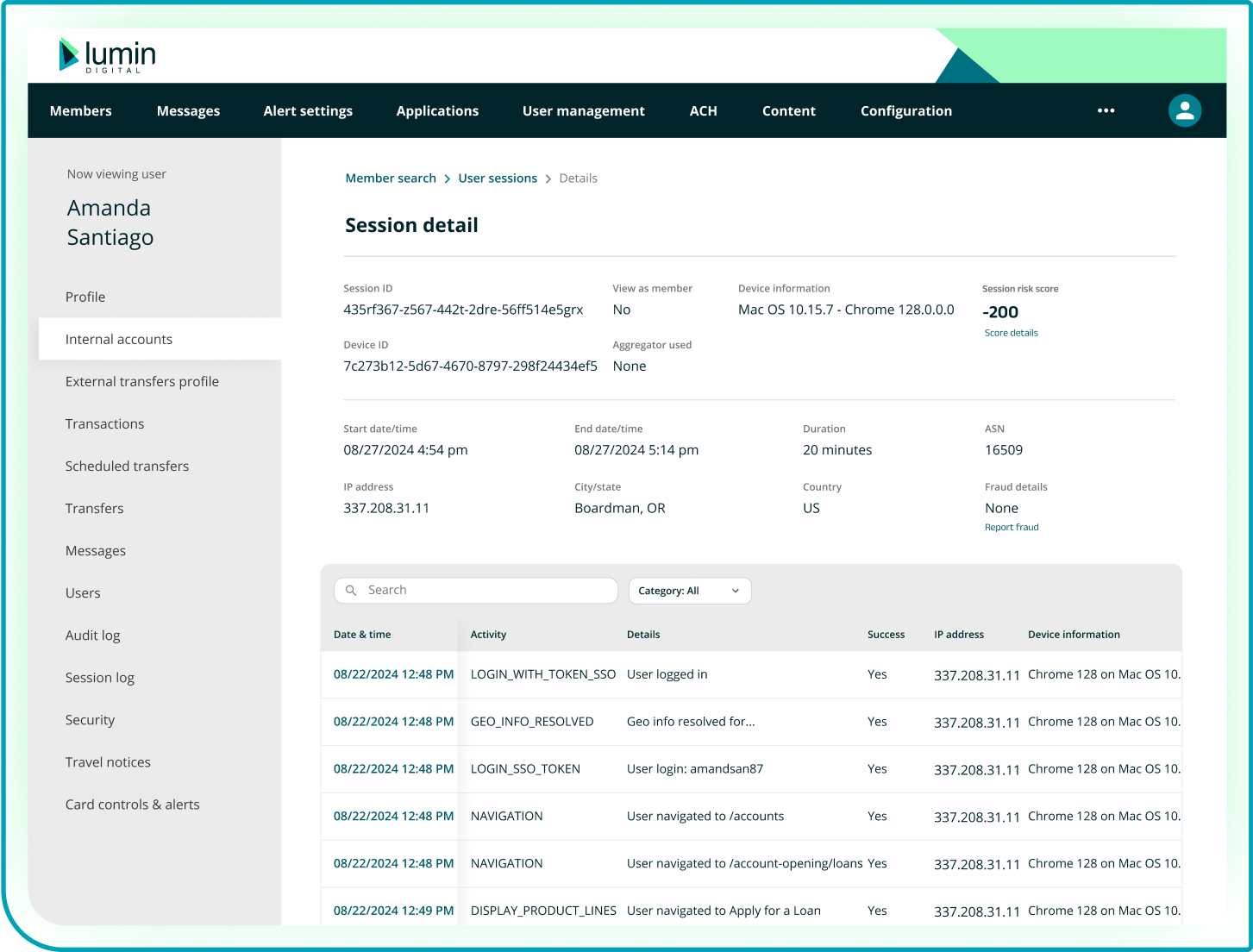

Session fraud controls

Review user and device sessions to catch fraudulent actors. We offer a variety of activity logs across user activity, session logs, and device logs to help you block devices or users when needed.

- User activity logs

- Session logs

- Device logs

- Device blocking

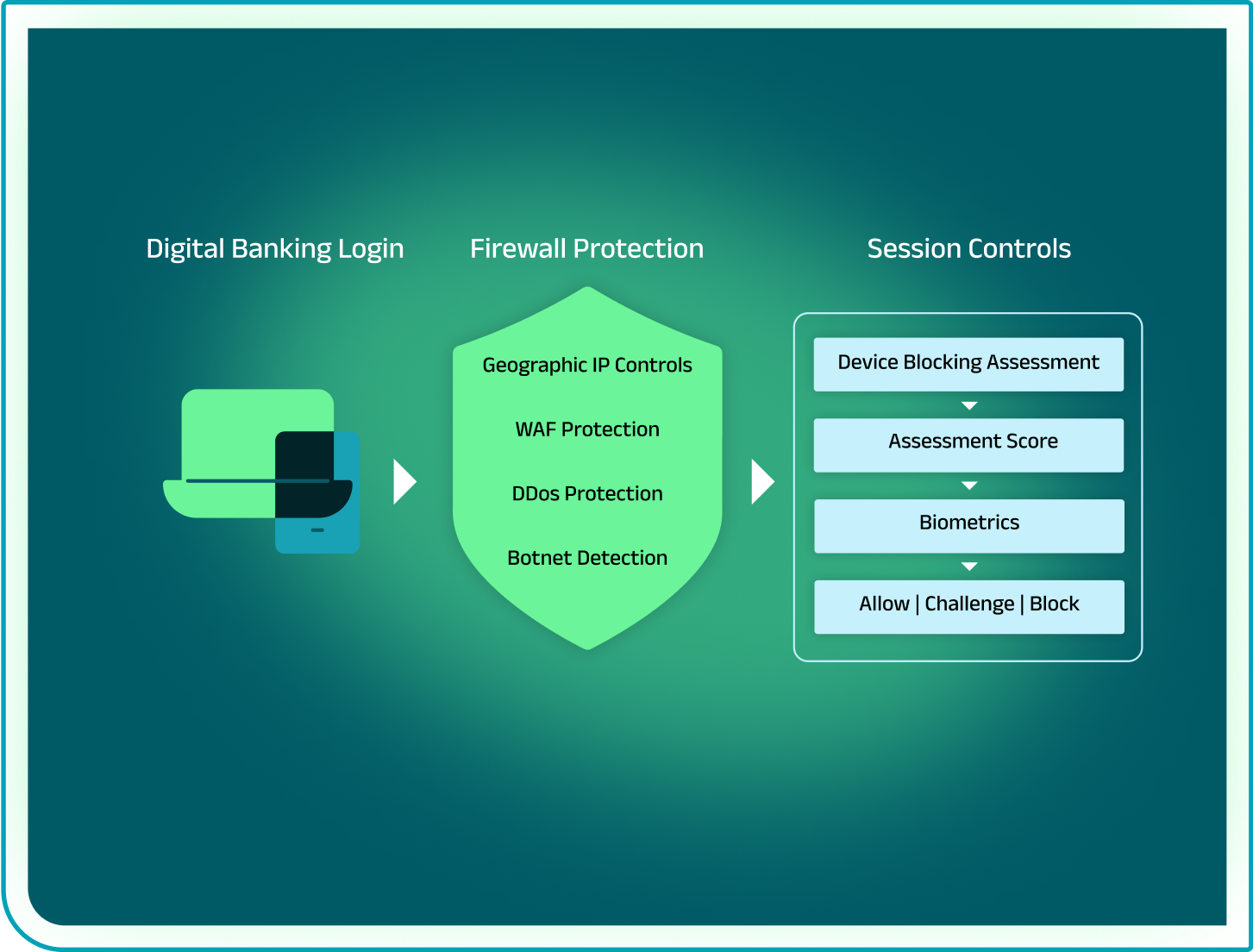

Advanced fraud detection

Use biometric data points to assess each user’s digital banking session to identify fraud through our integration with Biocatch. Our unique integrations use various authentication techniques to identify fraudulent sessions and protect users.

- MFA hooks

MFA event triggers are built across 40+ pre-integrated locations within digital banking where MFA can be evaluated if behavioral anomalies are detected. - Proactive mule account detection

We search across accounts to identify known mule accounts looking to launder money or commit fraud.

Client Experience

Focus on your business—we’ve got your back

We’re on top of digital threats so you don’t have to be. Together with our tech partners and our clients, we’re constantly analyzing data and industry trends to stay ahead of fraud and security issues. We continuously improve our products to ensure a safe and secure platform for our financial institutions and all of the users who depend on them.