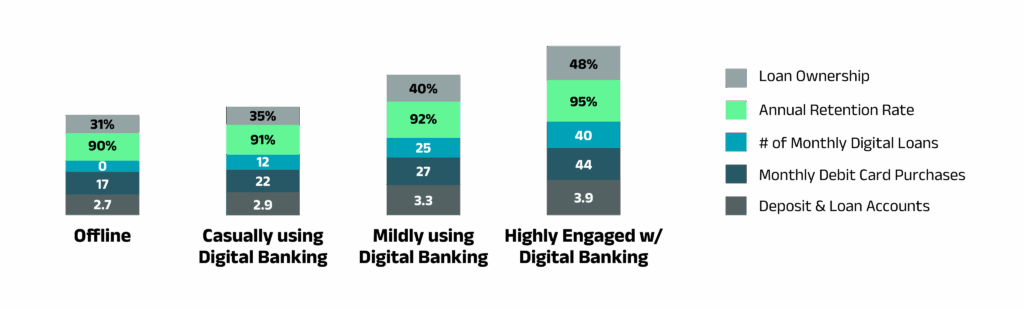

Digital engagement has become one of the strongest predictors of long-term financial institution growth. Highly engaged digital banking users have a 95% annual retention rate, and with many institutions spending $800 or more to acquire a single new customer or member, the economics of engagement are critical to sustained profitability.

That’s why we set out to quantify how digital behavior changes after a financial institution launches digital banking with Lumin Digital. Using combined data from FedFis and Lumin Analytics, we measured adoption patterns, active user growth, and membership trends across our client base over the last two years.

What we found is clear: Lumin Digital consistently drives meaningful, sustained increases in digital engagement, with an average of 10–12% growth within two years of launch.

Why digital engagement has become a strategic priority

Digital usage has become a measure of relationship depth and institutional health.

McKinsey’s research, and Lumin Digital’s own findings from analysis of client data, show that engaged digital users log in more frequently, adopt more products, and stay with their primary financial institution longer. “Engaged” is defined by the quantity of digital banking services being used—services such as account opening, budgeting, card controls, credit score, travel notifications, and others. With retention rates at 95%, each highly engaged user represents long-term value. Boosting digital activity doesn’t just enhance the customer experience—it has a meaningful impact on the bottom line.

Overcoming user hesitation

Even as digital-first banking has become the standard, a number of factors still keep some users from adopting it:

- Security concerns remain top of mind for many consumers.

- Some legacy platforms lack feature depth and relevant, engaging functionality.

- Certain demographics strongly prefer in-person interactions for financial decisions.

There are also market dynamics that have expanded the number of non-primary relationships—members or customers who don’t typically use digital banking:

- Growth in indirect lending portfolios.

- A surge in high-interest CD openings during the recent high-rate environment.

These consumers historically haven’t engaged heavily with digital channels. But once institutions move to Lumin Digital, we see consistent improvements, even among these harder-to-engage groups.

Lumin clients see roughly a 10% increase in digital engagement over two years, and in a landscape where engagement directly supports retention, revenue, and profitability, that lift is transformative.

What the data shows: Steady engagement growth

One year following go-live with Lumin Digital: Strong start

Among clients with at least one year of data:

- 94% saw positive growth in Monthly Active Users (MAU) as a percentage of users.

- The average increase was 5.9%, with some standout performers as high as 23%.

This early momentum suggests that consumers are quickly responding to a more modern, intuitive, and personalized digital experience.

- Growth in indirect lending portfolios.

- A surge in high-interest CD openings during the recent high-rate environment.

Two years in: Sustained momentum

For the clients with two full years of post-launch analytics:

- MAU as a percentage of customers/members increased 11.6% on average.

- Growth was consistent across institution size and market type.

The longer institutions are on Lumin Digital, the more digital engagement improves. The data tells a story of steady adoption, not a short-term spike.

How Lumin drives higher digital adoption

The steady growth we see across clients reflects core strengths of the Lumin platform:

- An inviting, intuitive interface that encourages frequent use.

- Personalized financial wellness tools that build trust and relevance.

- Consistent cross-device experience, from desktop to mobile.

- High performance and reliability that reduce friction.

- Deep security features that address consumer concerns.

- Built-in engagement mechanisms that promote recurring interactions.

- The ability to add new products and services with frictionless fulfillment.

Combined, these capabilities help convert infrequent or hesitant users into confident digital consumers.

What’s next: Turning insights into best practices

Our active user and membership growth dashboards allow us to track performance over time and identify high-performing institutions whose strategies can inform future best practices. As our dataset grows, so will our ability to:

- Highlight success stories.

- Identify common drivers of above-average growth.

- Guide clients toward the features and experiences that create the biggest lift.

With Lumin Digital profitability studies, institutions will soon be able to quantify exactly how much value digital engagement unlocks.

A 10% lift that reshapes growth economics

Lumin clients see roughly a 10% increase in digital engagement over two years, and in a landscape where engagement directly supports retention, revenue, and profitability, that lift is transformative.

Digital adoption is a growth engine. Lumin Digital is helping institutions of all sizes capture that value with a platform designed for engagement, built for scale, and grounded in measurable results.

If your institution is evaluating digital banking partners, the question isn’t just who provides the most features, it’s who delivers the most engagement. The data shows that Lumin does exactly that.

Jason Weinick

Analytics & Insights, Lumin Digital