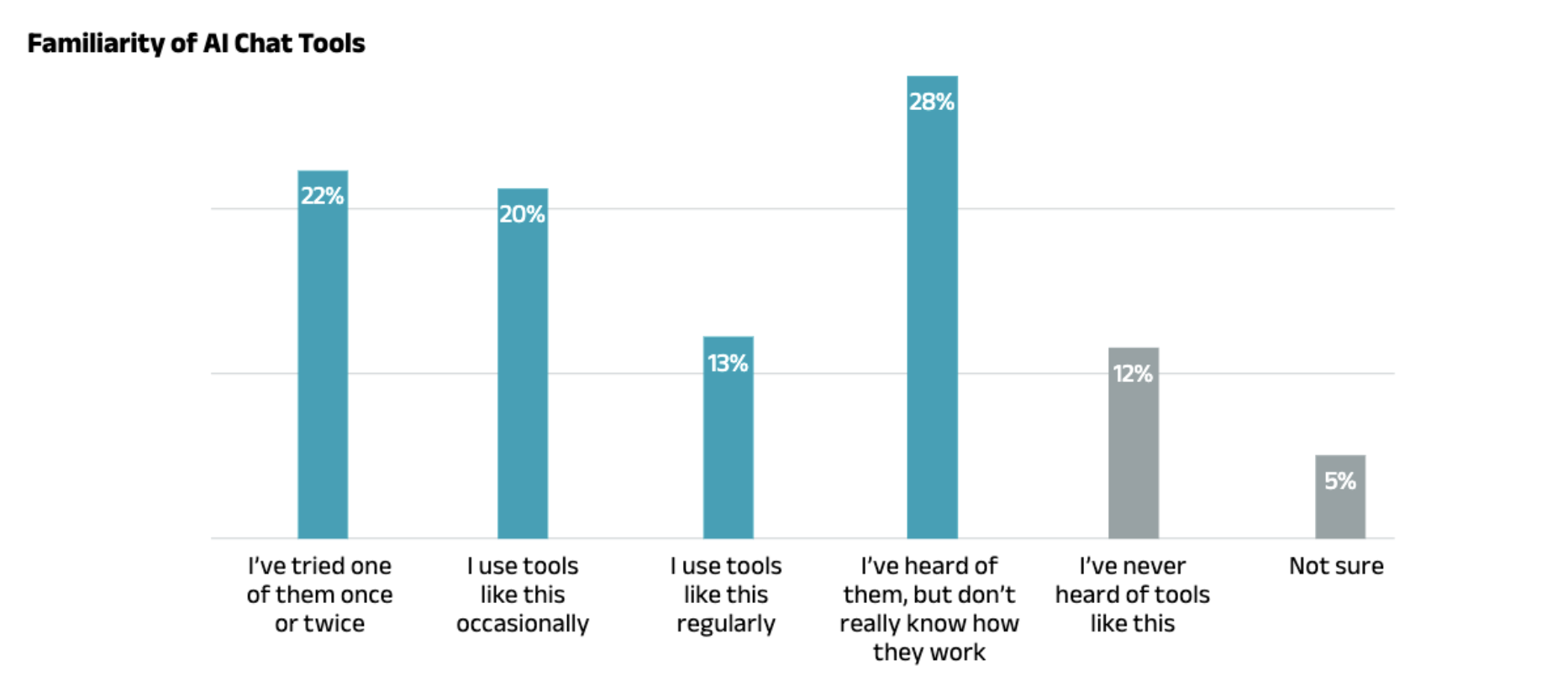

AI is becoming more efficient, affordable, and accessible, lowering barriers to advanced AI and accelerating adoption. And yet, widespread consumer adoption is still in its early days. According to Lumin Digital’s consumer study, 83% of digital banking users are aware of AI tools (from any sector), but only 13% use them regularly.

This signals an important principle: while technological readiness accelerates, user readiness may not keep pace and will require trust-building, transparency, and intentional design.

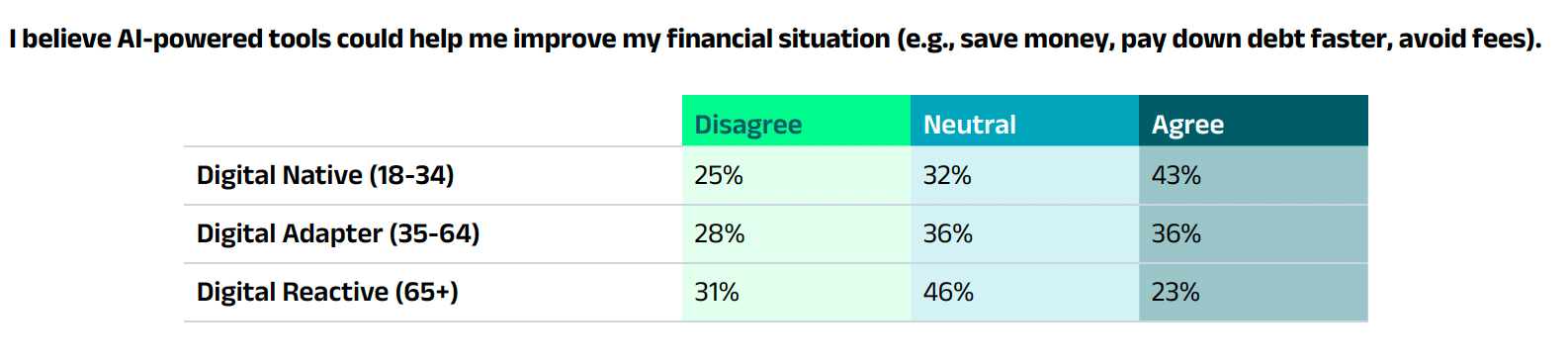

Younger banking users are driving early adoption of AI tools, but older users are cautiously warming to AI

Both the youngest and middle-aged banking users appear to be ready to engage with AI, especially if it can provide useful financial information. Forty-three percent of these youngest users and 36% of the middle-aged users believe that AI has the potential to improve their financial situation.

While the 65+ crowd remains more hesitant than their younger counterparts, they show signs of growing interest. Only twenty-three percent of these users believe AI could help them improve their financial situation, but 46% report a neutral response (neither agreement nor disagreement), indicating they have not completely dismissed AI’s potential.

The study’s insights point to a linkage between familiarity and trust, suggesting that exposure to AI may play a key role in future user acceptance. And while AI holds great promise for guiding users and providing hyper-personalized solutions, users need to believe that the tools can provide the value promised without compromising security and privacy. Download our latest report for more insights into consumers’ perceptions of AI use in financial services.