Retail banking

Click. Swipe.

Deposit. Welcome to Modern Banking.

The way we bank is evolving. Today’s users require digital-first, future-ready financial solutions to access and manage their finances.

Exceed expectations and engage users like never before with our modern Retail Banking solutions.

Legacy banking technologies aren’t keeping up with the expectations of users. People will switch to financial institutions that offer modern banking experiences with digital-first solutions accessible anywhere, anytime, with any device.

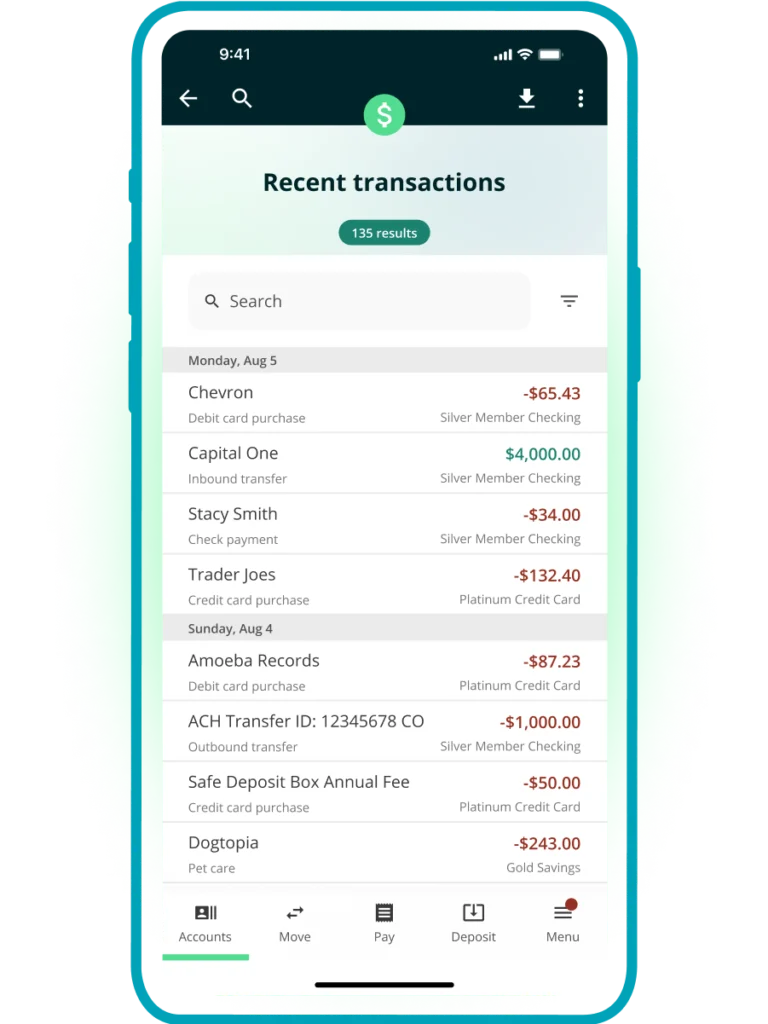

Account Management

Simplified and engaging

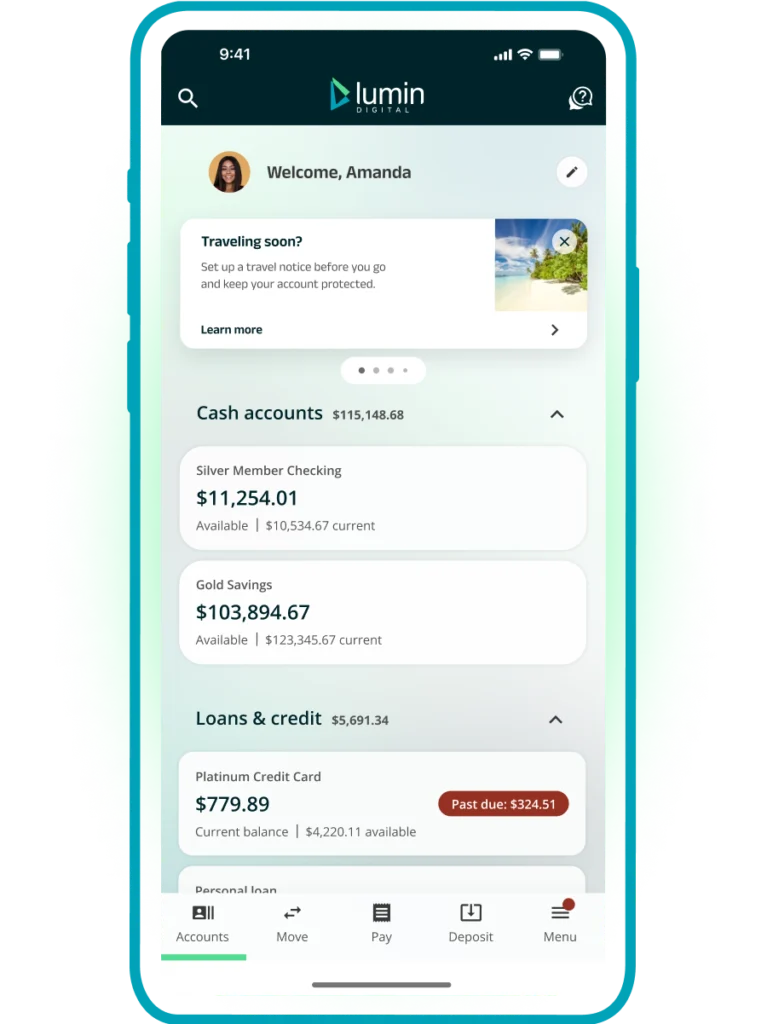

Whether viewing account balances, toggling between alerts and notifications, monitoring transaction activity, or managing family members, we make account management easy, quick, and personalized—across all devices.

Increase user engagement and loyalty by delighting users with an exceptional digital experience for self-serve tasks, freeing up time for your operations staff to focus on other responsibilities.

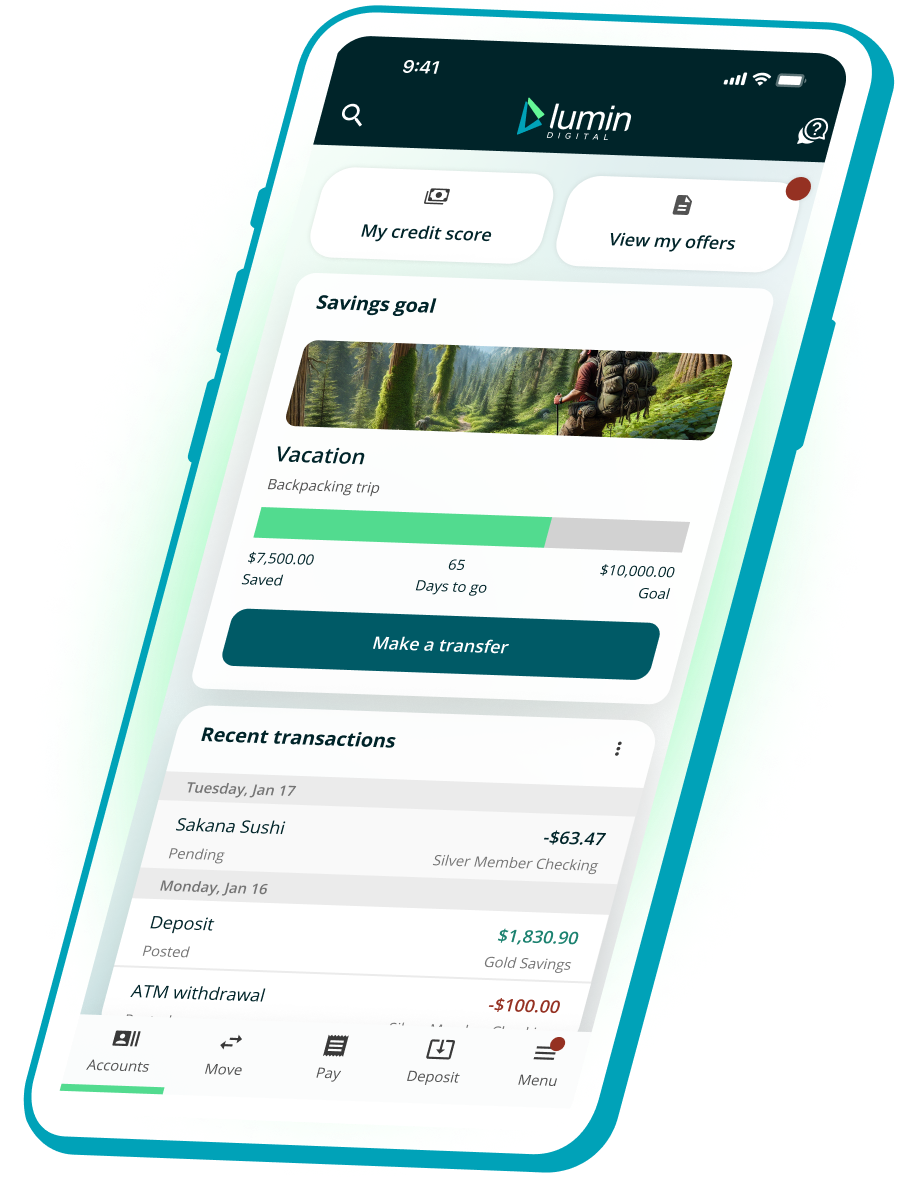

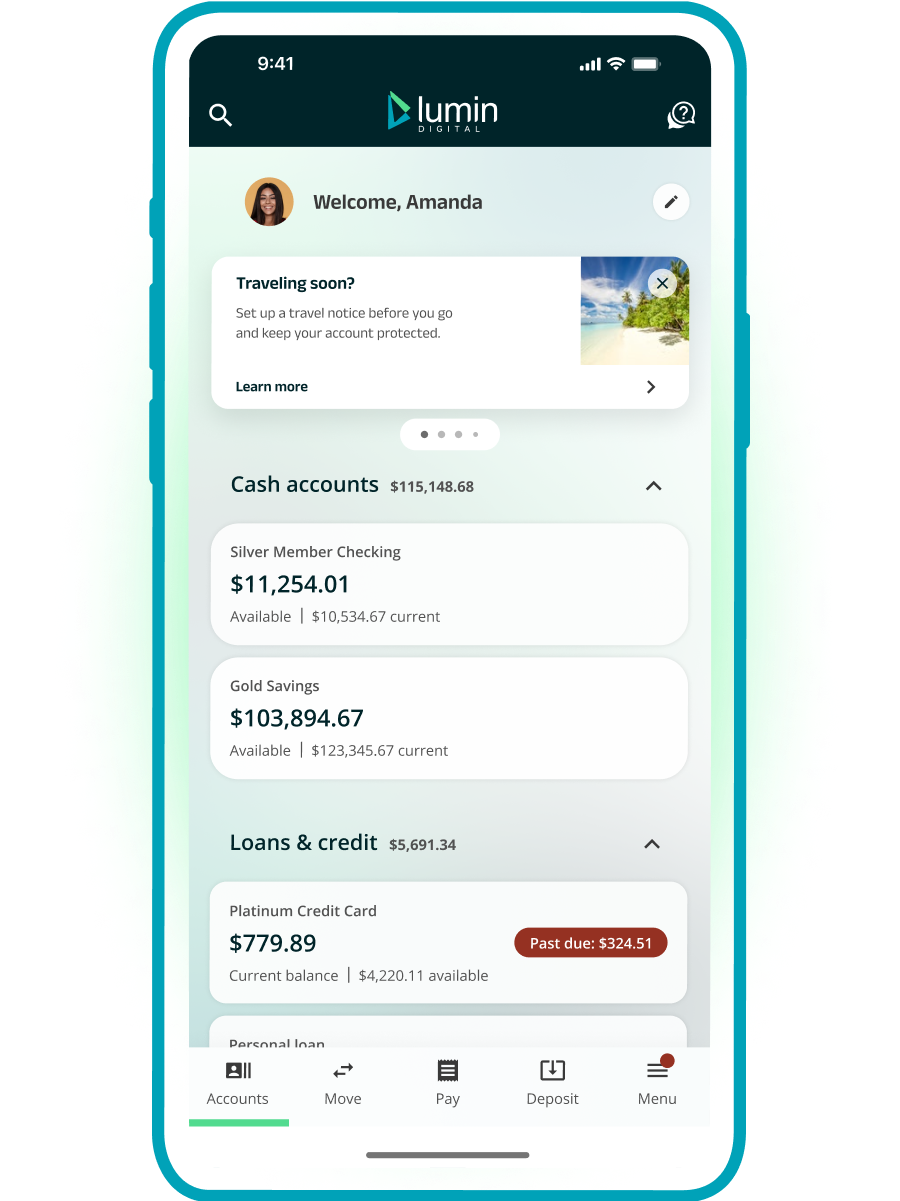

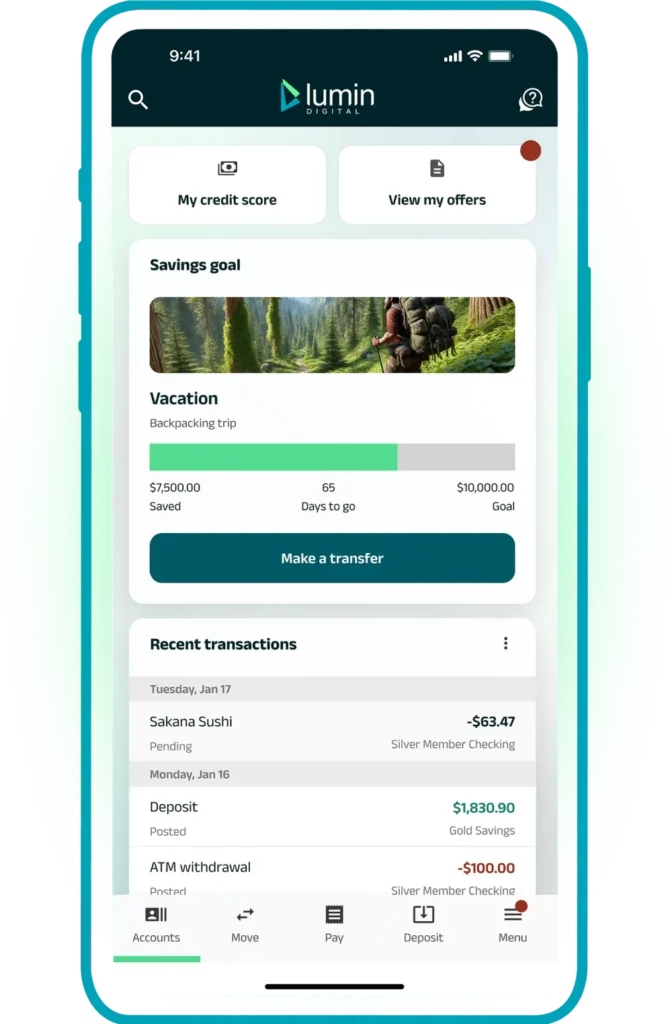

Customizable dashboard

With a purposefully engaging design, the customizable dashboard provides users with all of their banking information in one easily accessible location. Increase user satisfaction with a single-page, fully customizable dashboard to quickly view account balances, monitor transactions, complete tasks, and find new products or promotions.

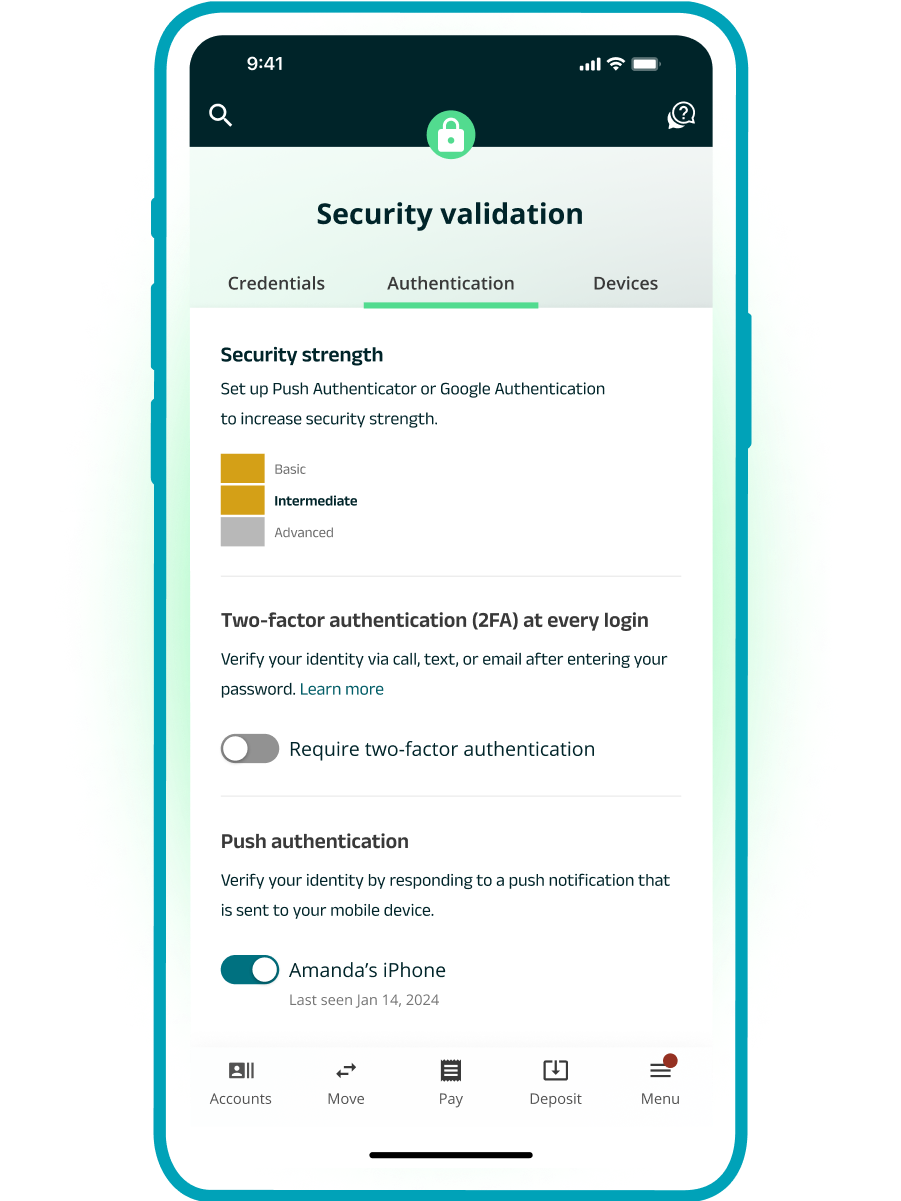

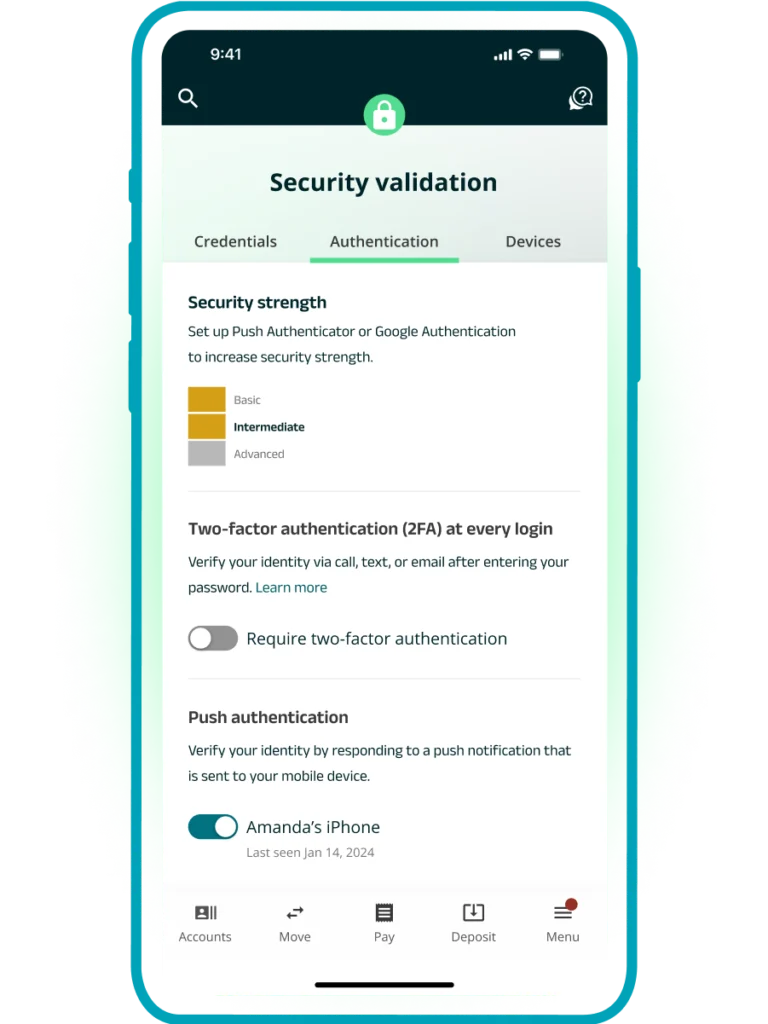

Profile management

Give your users control over their digital banking experience with full autonomy over their settings and preferences. Users can easily upload profile pictures, set alert preferences, choose preferred authentication methods, and track their own digital banking activity.

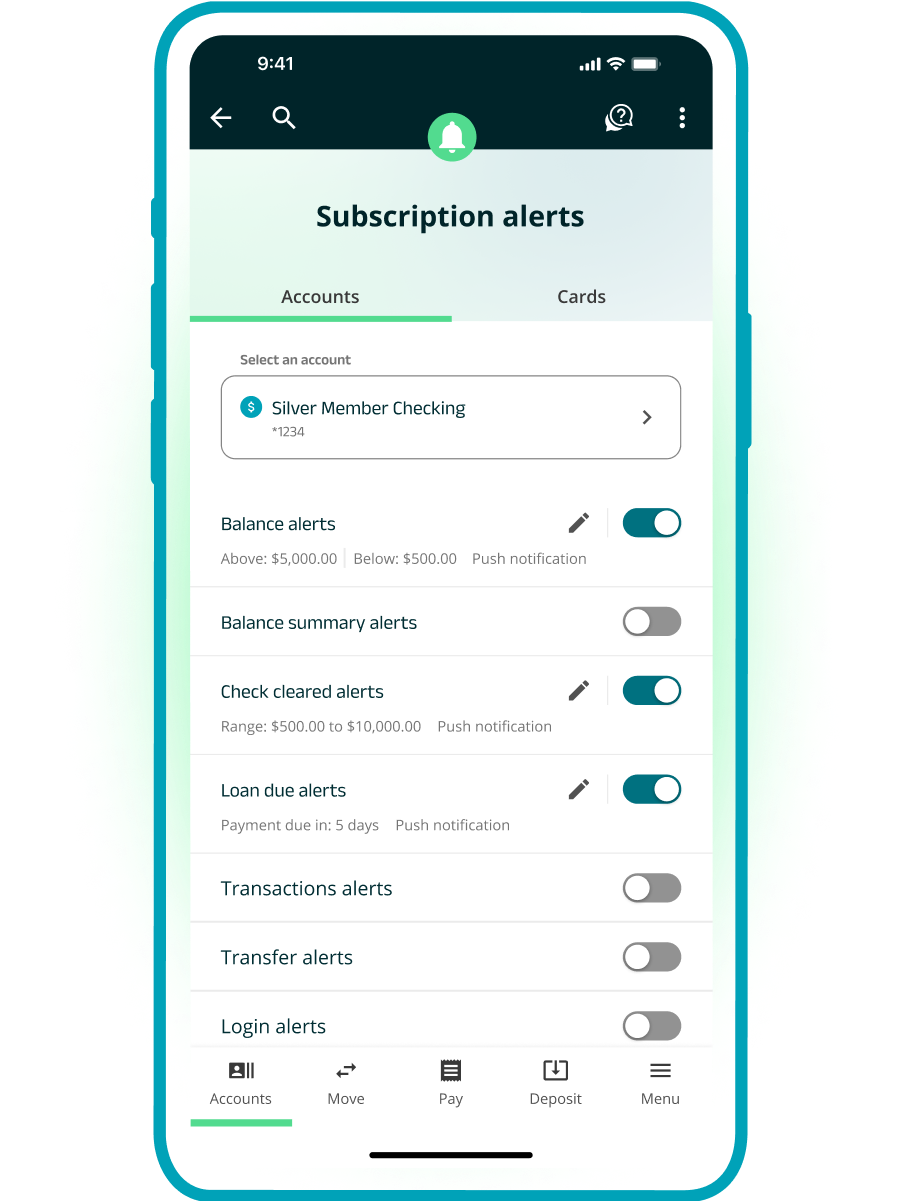

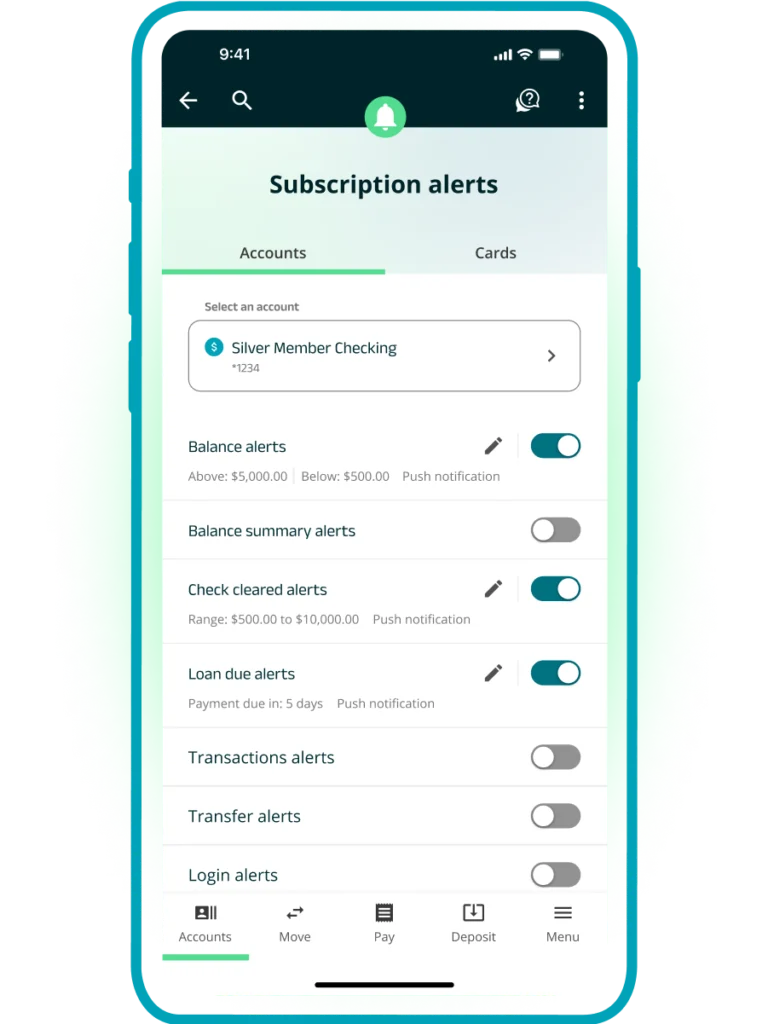

Alerts

Stay connected with users while reducing branch visits and customer service calls with automated, user-configured alerts. With the ability to independently manage how and when they receive alerts for transactions, balances, or transfers, users will be kept safe and secure from fraud.

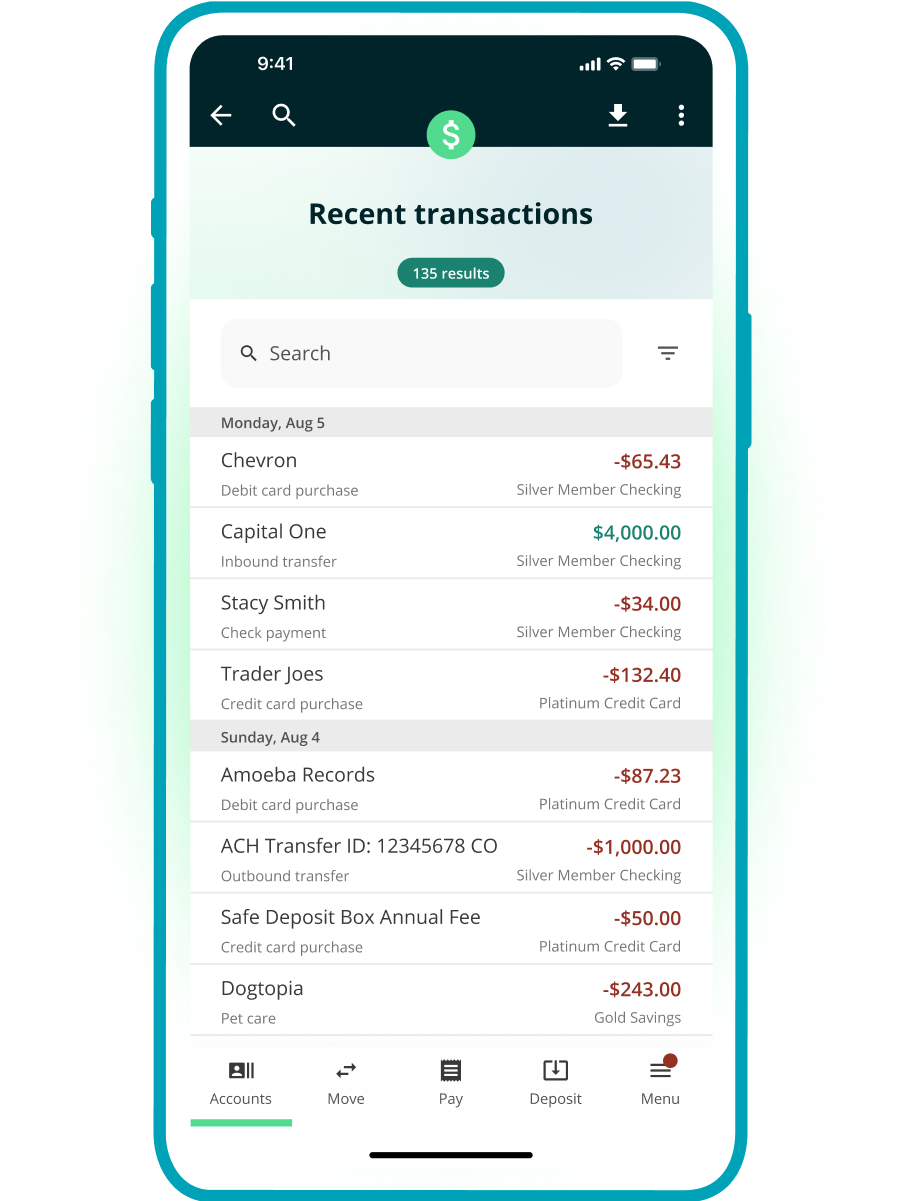

Account reports

Equip users with data and insights via personalized account reports, which give users a 360° view of their transaction data and insights into their spending and savings habits.

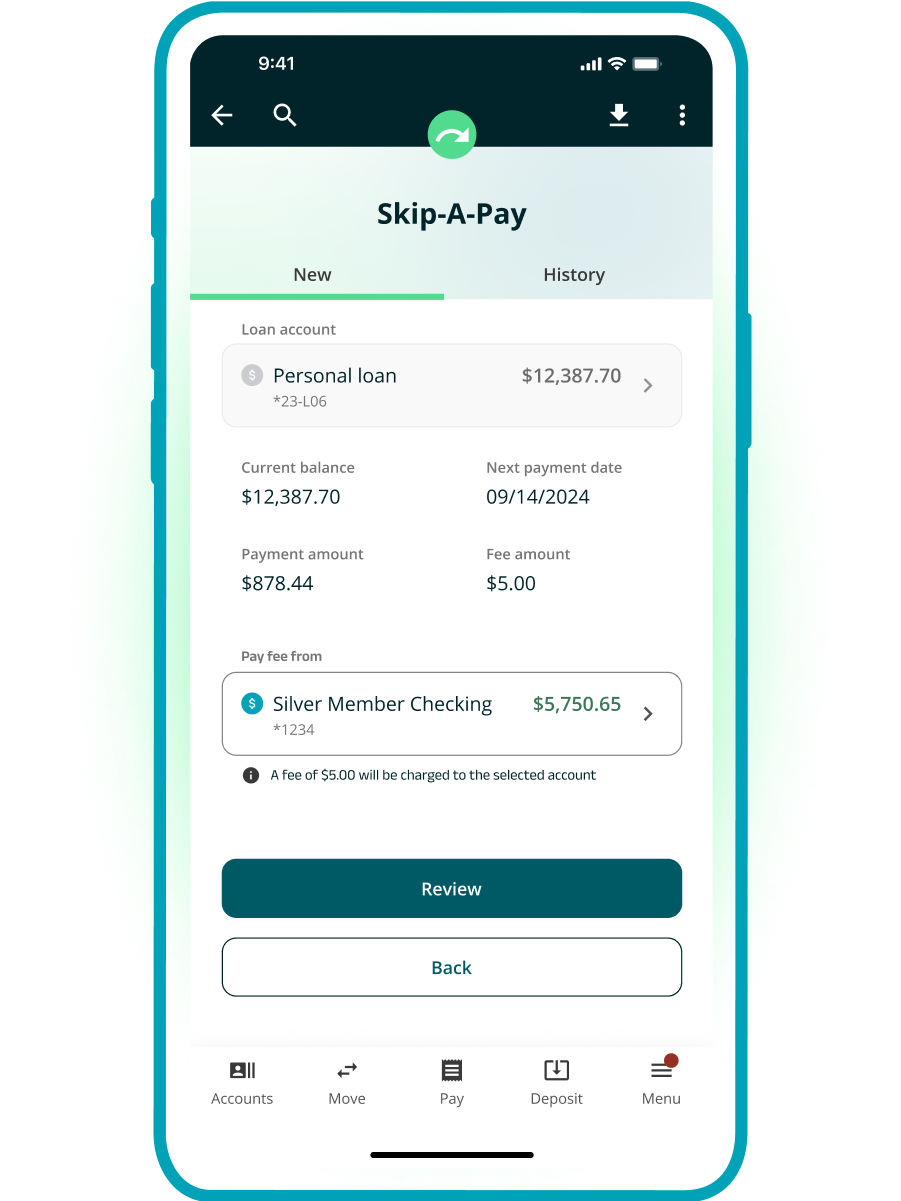

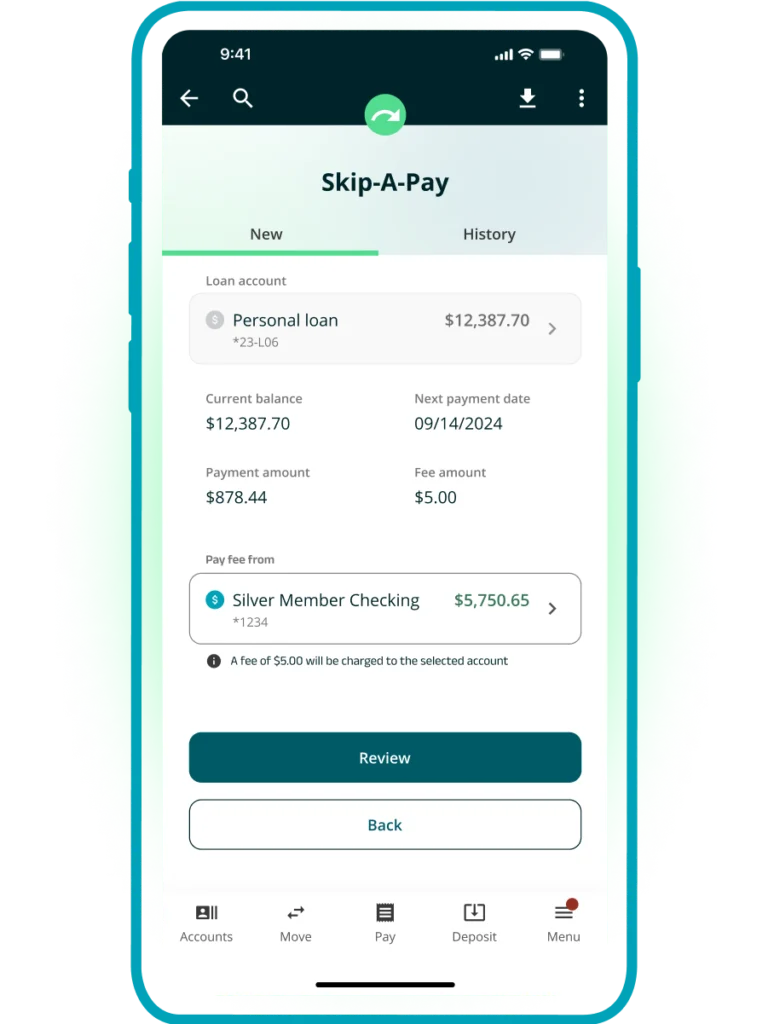

Self-service

Users have full control over their finances and transactions. From initiating Skip-a-Pay for specific loans, to managing CDs at maturity, or signing up for eStatements, provide your users with a broad array of self-service options that eliminate the need to visit a branch or call your customer support team.

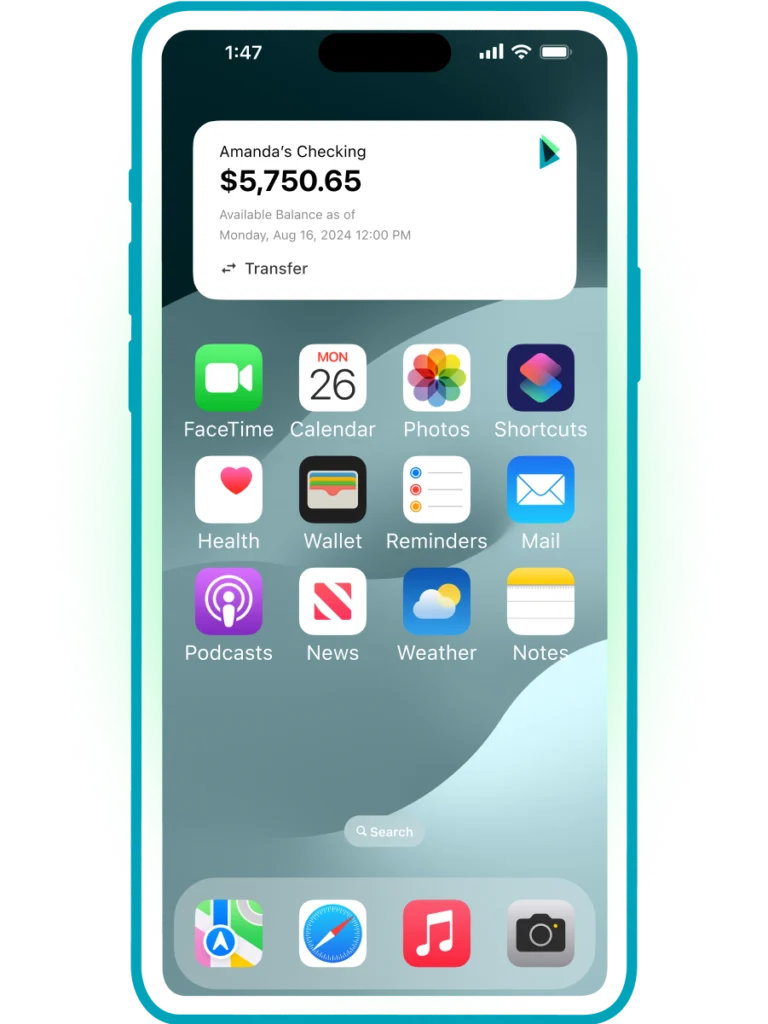

Mobile widgets

Provide speed and convenience at the push of a button on a mobile phone, tablet, or smart watch to quickly view account balances without opening the digital banking app.

Money Movement

Versatile and flexible

Help users stay financially connected with versatile money movement options that are easy, safe, and secure.

Increase your institution’s efficiency with fewer manual workflows, branch visits, and call center volumes with our robust offerings that empower users with what they need, when they need it, from the palm of their hands.

Money transfers

Provide quick and easy ways for users to transfer money with family, friends, and organizations. Enable options that matter most to them:

- Internal transfers

- External transfers

- User-to-user transfers

- P2P payments

- Donations

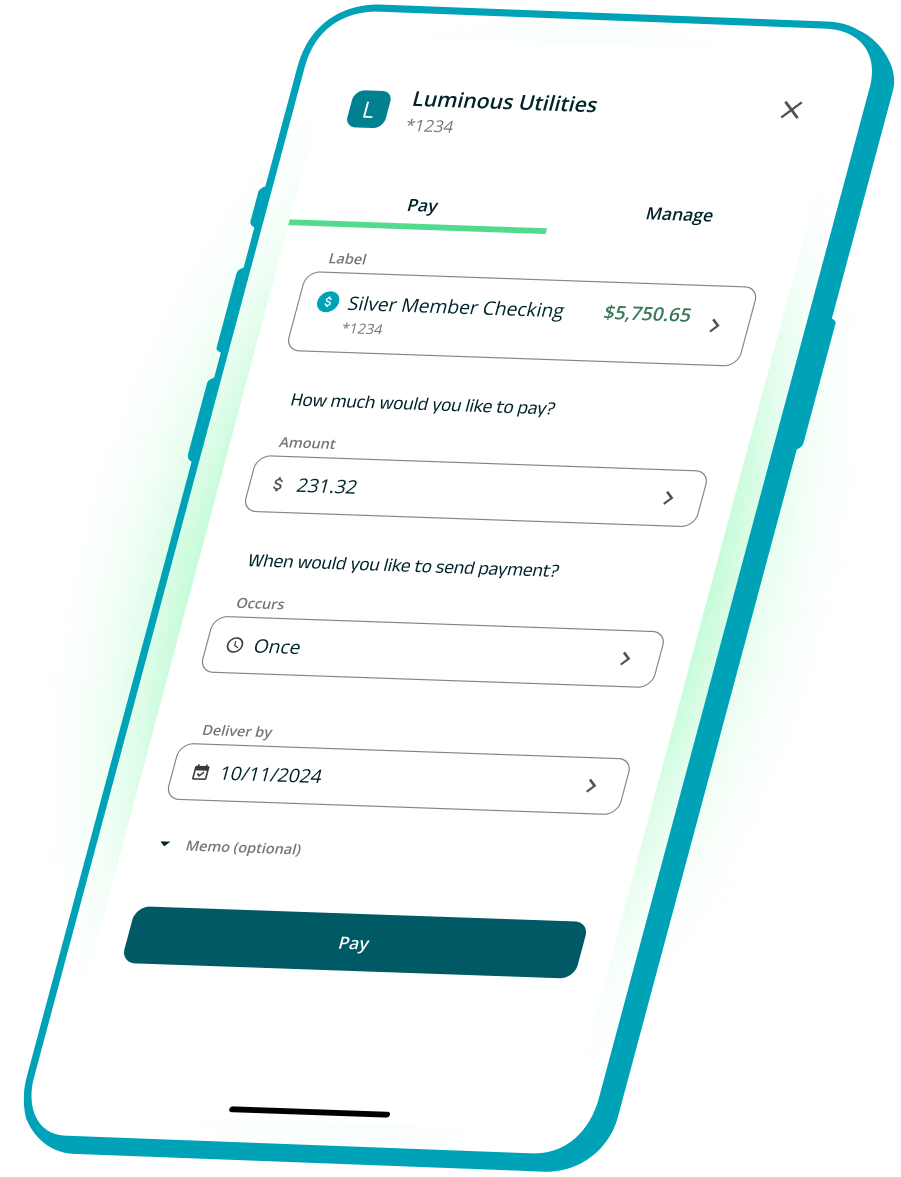

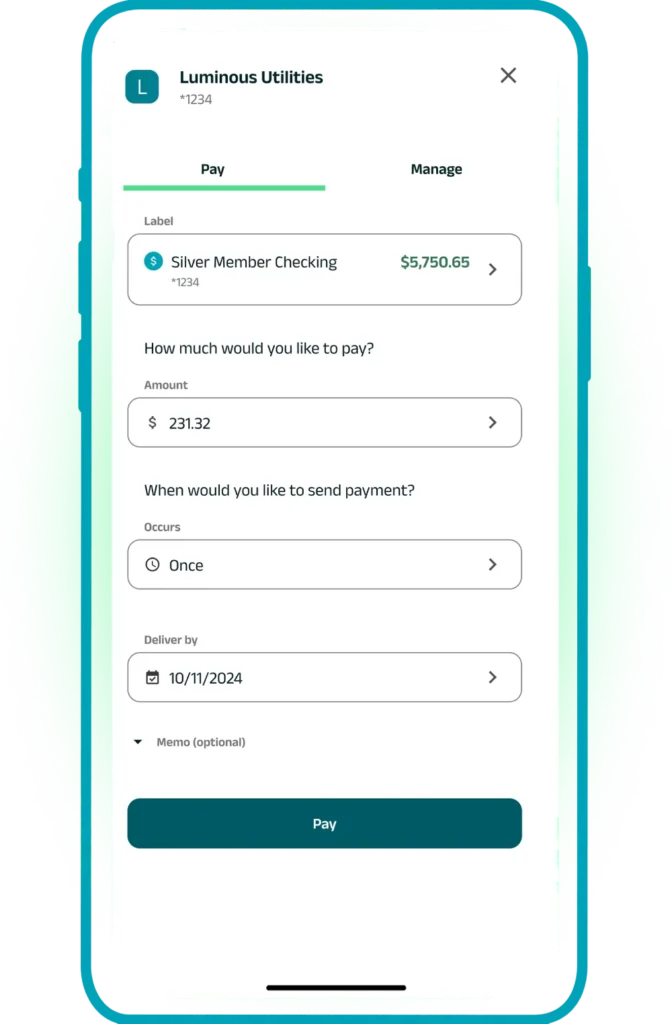

Payments

Provide versatile options for users to quickly and easily make various types of payments:

- Bill pay

- Buy now pay later

- Credit card payments

- Mortgage payments

- Loan payments via debit card

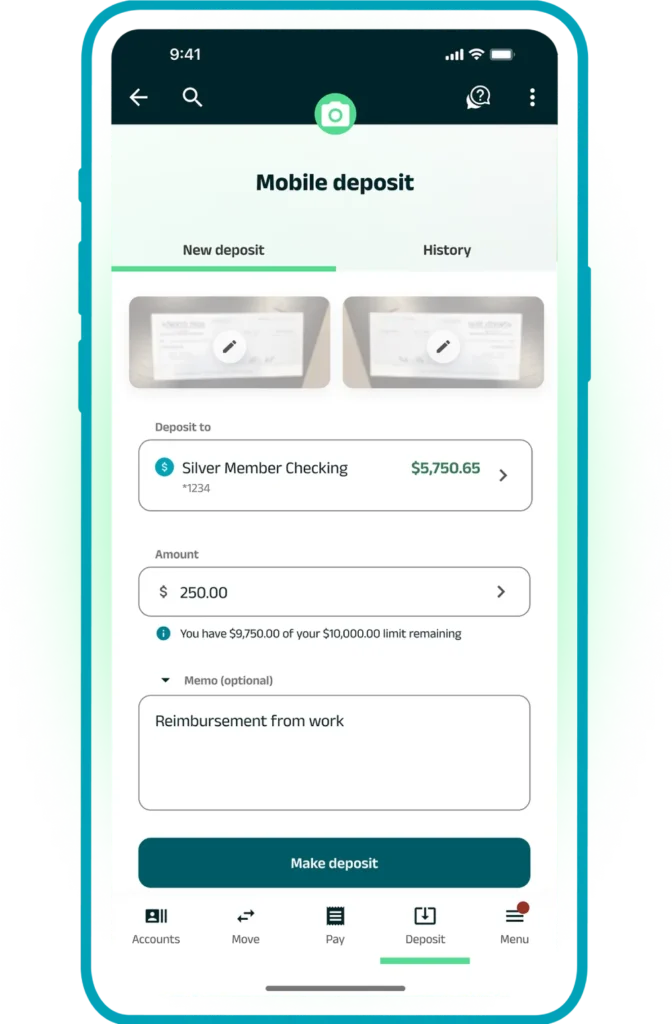

Remote deposit capture

Enable users to deposit single or multiple checks quickly and easily from their devices.

Instant account verification

Enable users to authenticate external accounts instantly and make transactions immediately, helping you improve fraud detection and enhance the user experience.

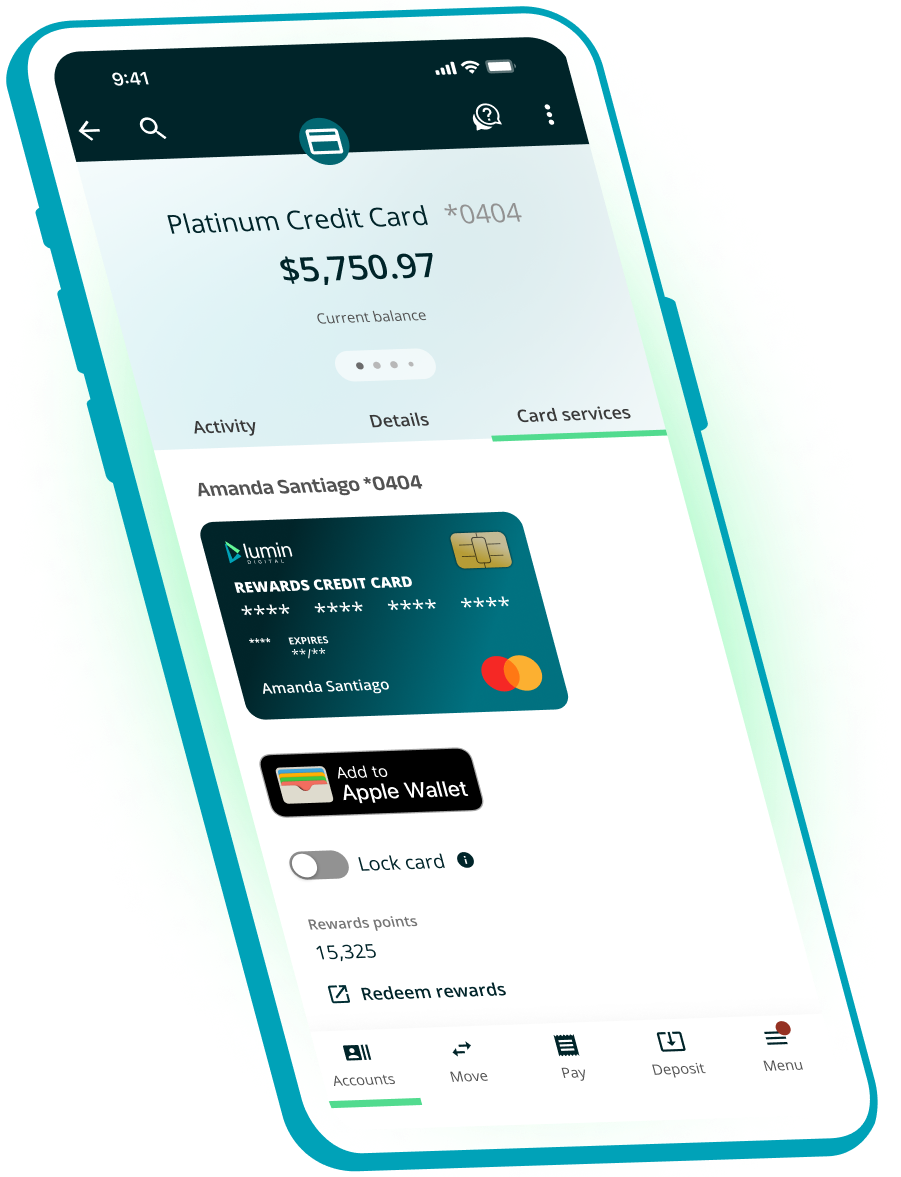

Card Management

Accessible and comprehensive

Help users navigate their primary forms of payment—and keep their physical wallets thinner—with wide-ranging card management options.

Providing users with a complete set of card management tools strengthens your institution’s ability to increase interchange income through increased digital wallet adoption and card usage.

Digital issuance

Keep users in your financial ecosystem with digital-first payment options that give them access to cards immediately, without having to wait for a physical card. And if it’s lost, stolen, or damaged, a new card can be issued digitally for immediate use.

Push provisioning

Give users financial flexibility with options to quickly add cards to their preferred digital wallets for immediate use at terminals, online shopping, or to pay vendors without having to manually enter card details.

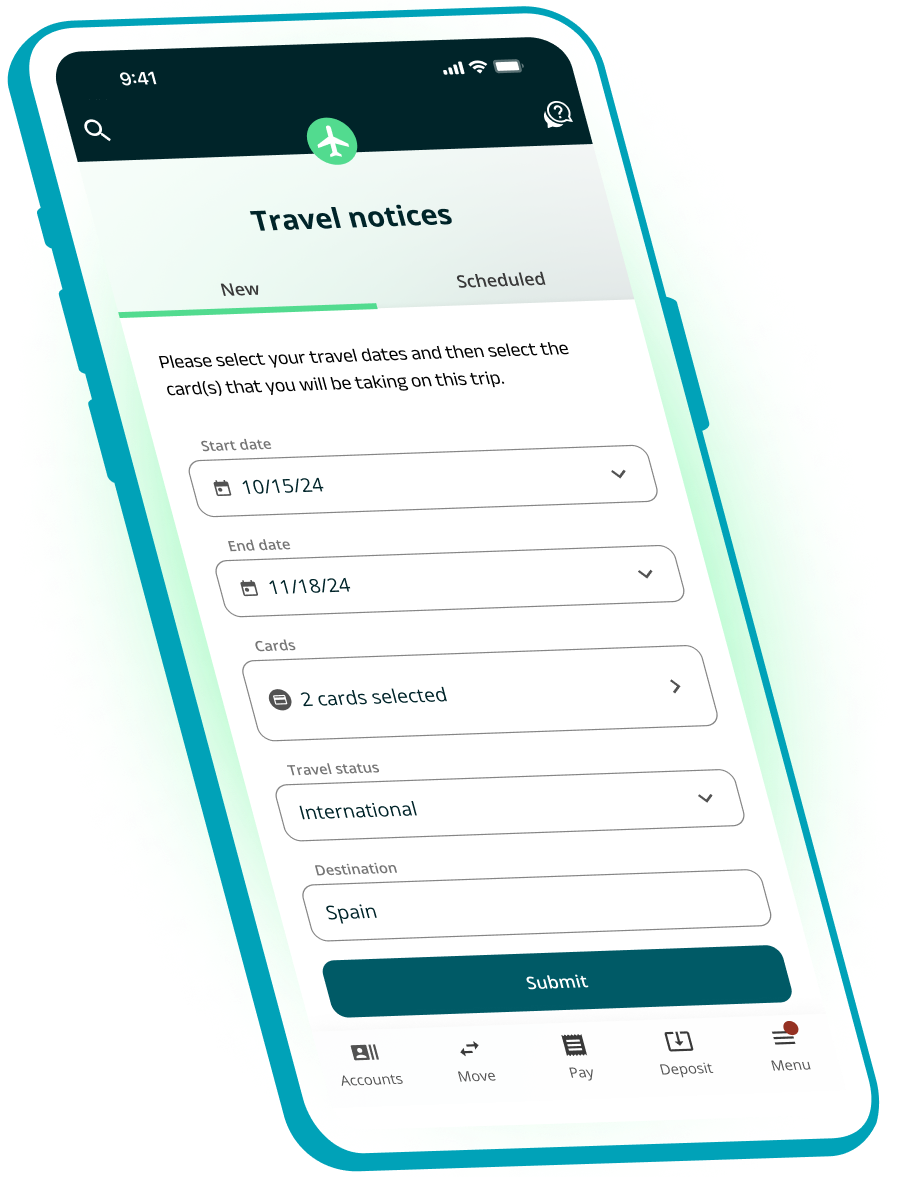

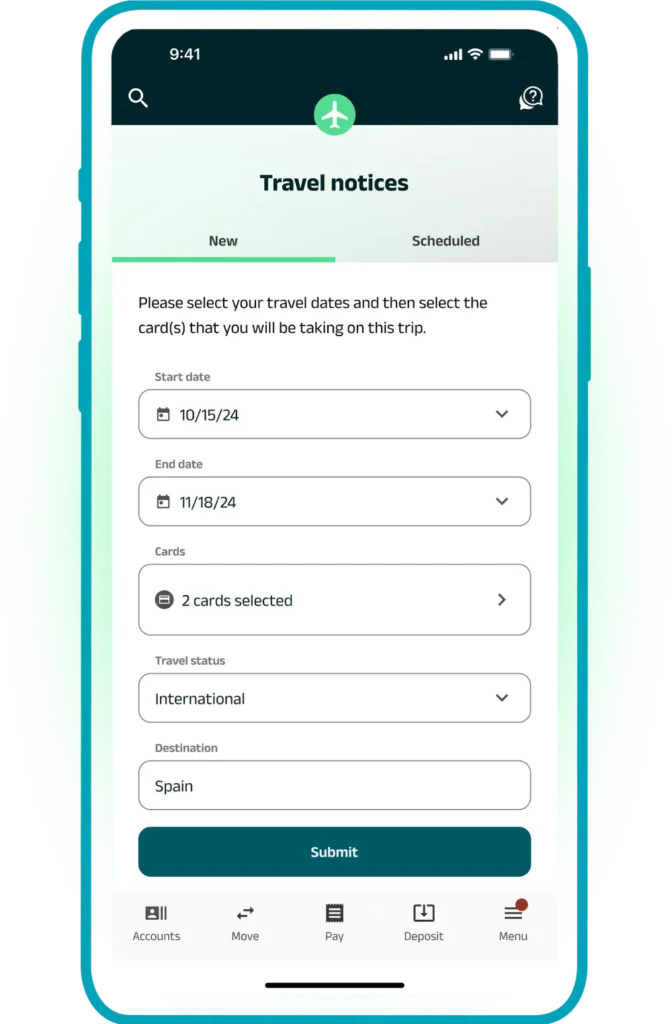

Self-serve travel notifications

Reduce in-branch visits and call center volumes by providing users the autonomy to set travel dates within the digital banking app to ensure cards keep working as expected while on the go.

Card controls

Our robust debit and credit card controls ensure your users have all the tools they need to manage their cards. Users can lock and unlock specific cards at any time, set merchant preferences, transaction alerts, and spending limits without having to download an additional application or leave digital banking.

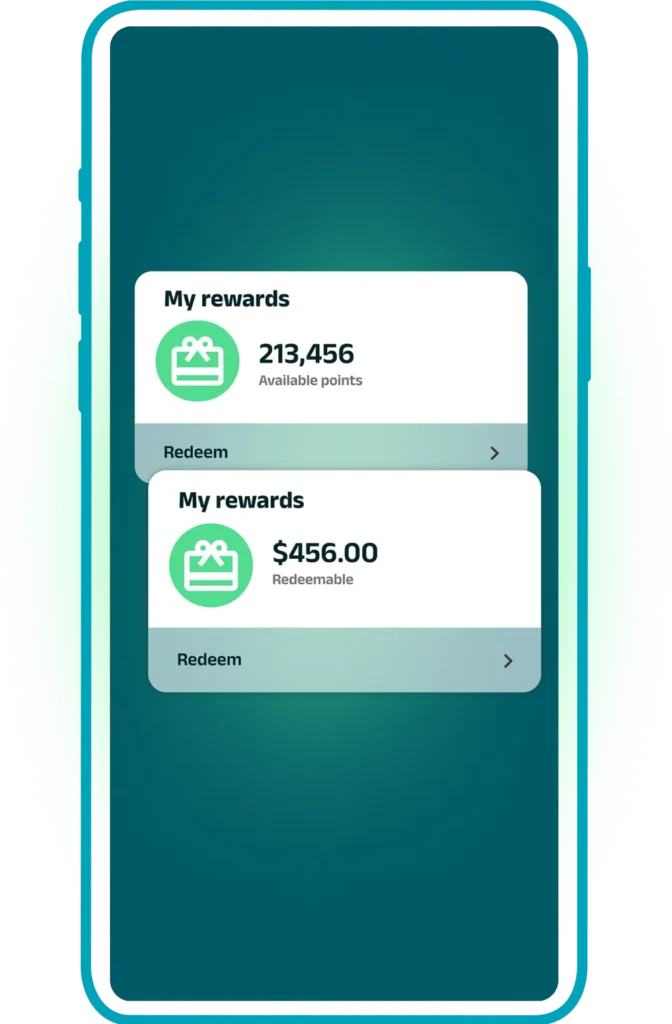

Card rewards

Enable viewing and card reward redemption within the digital banking app to centralize all aspects of card management in one place.

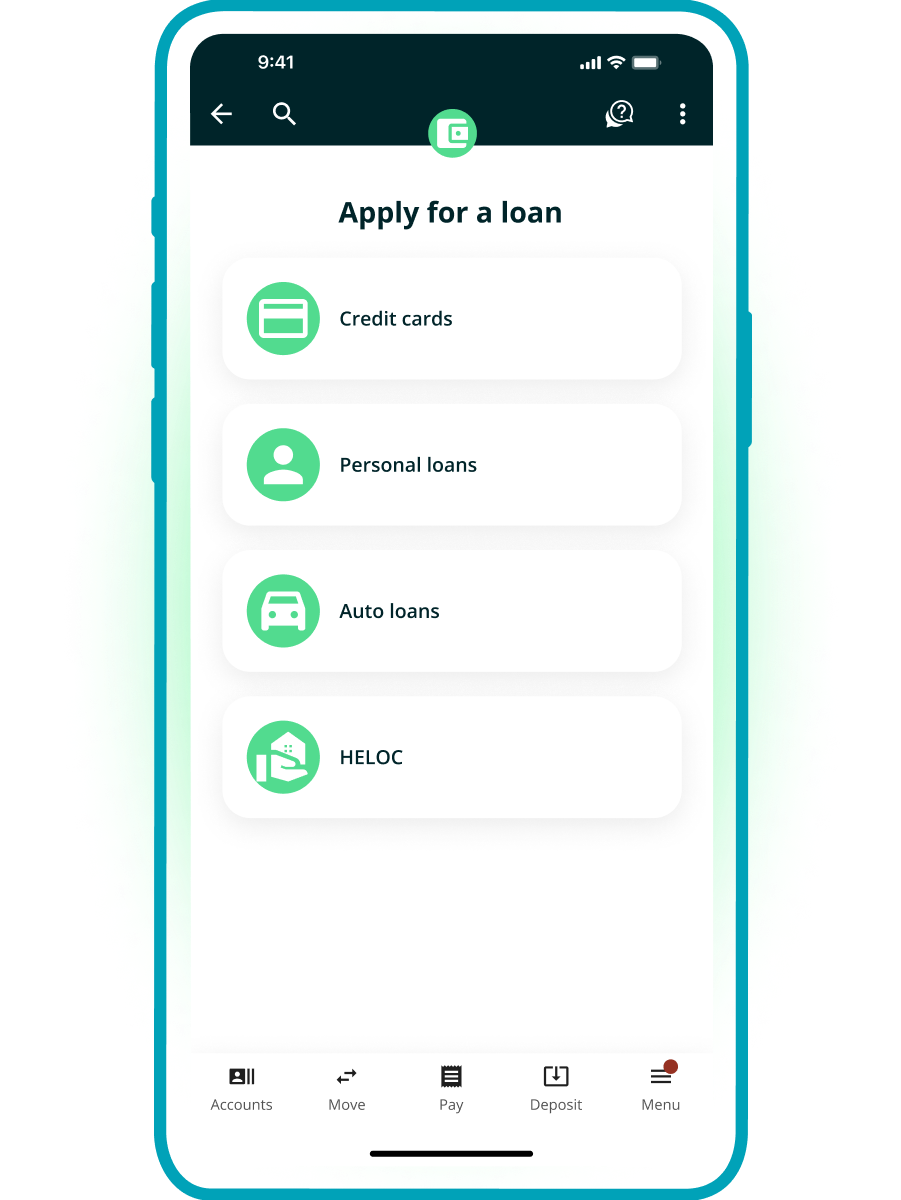

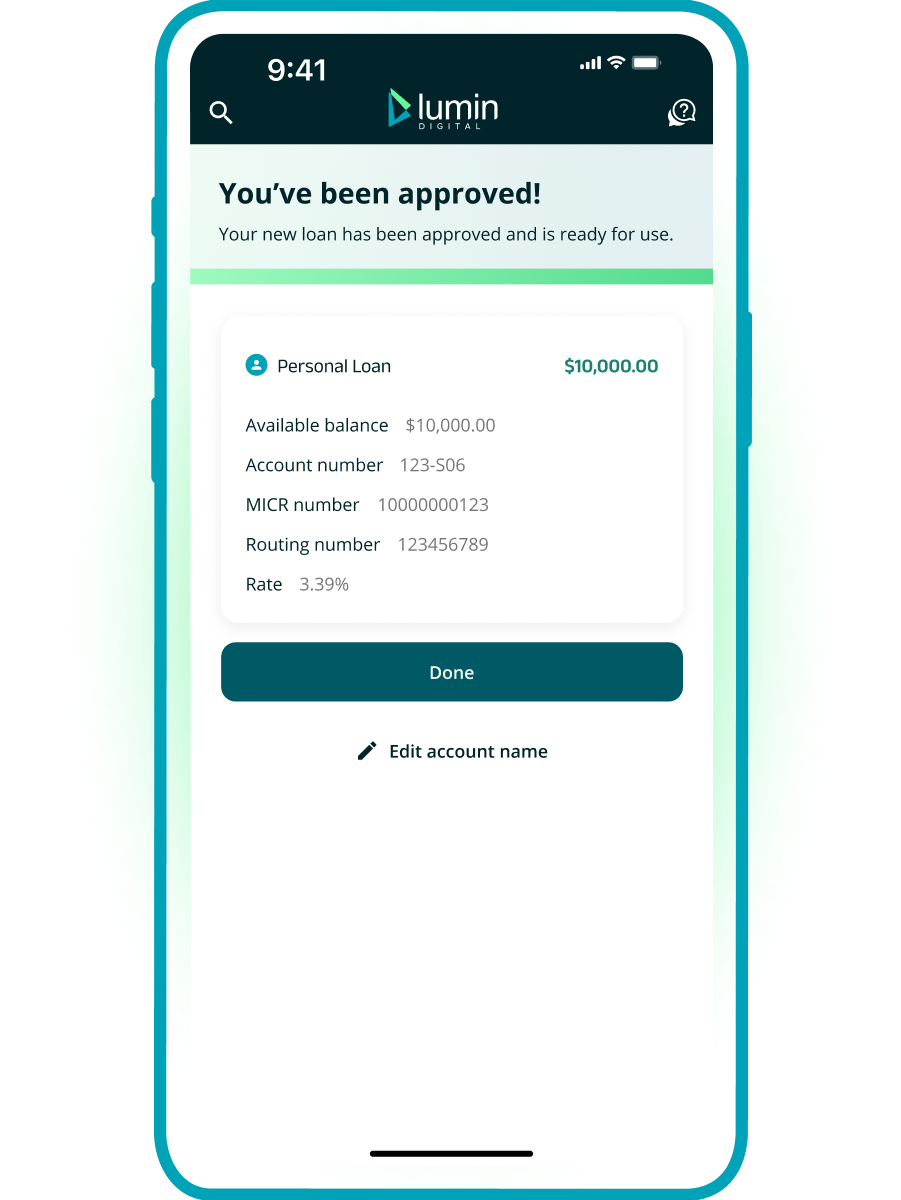

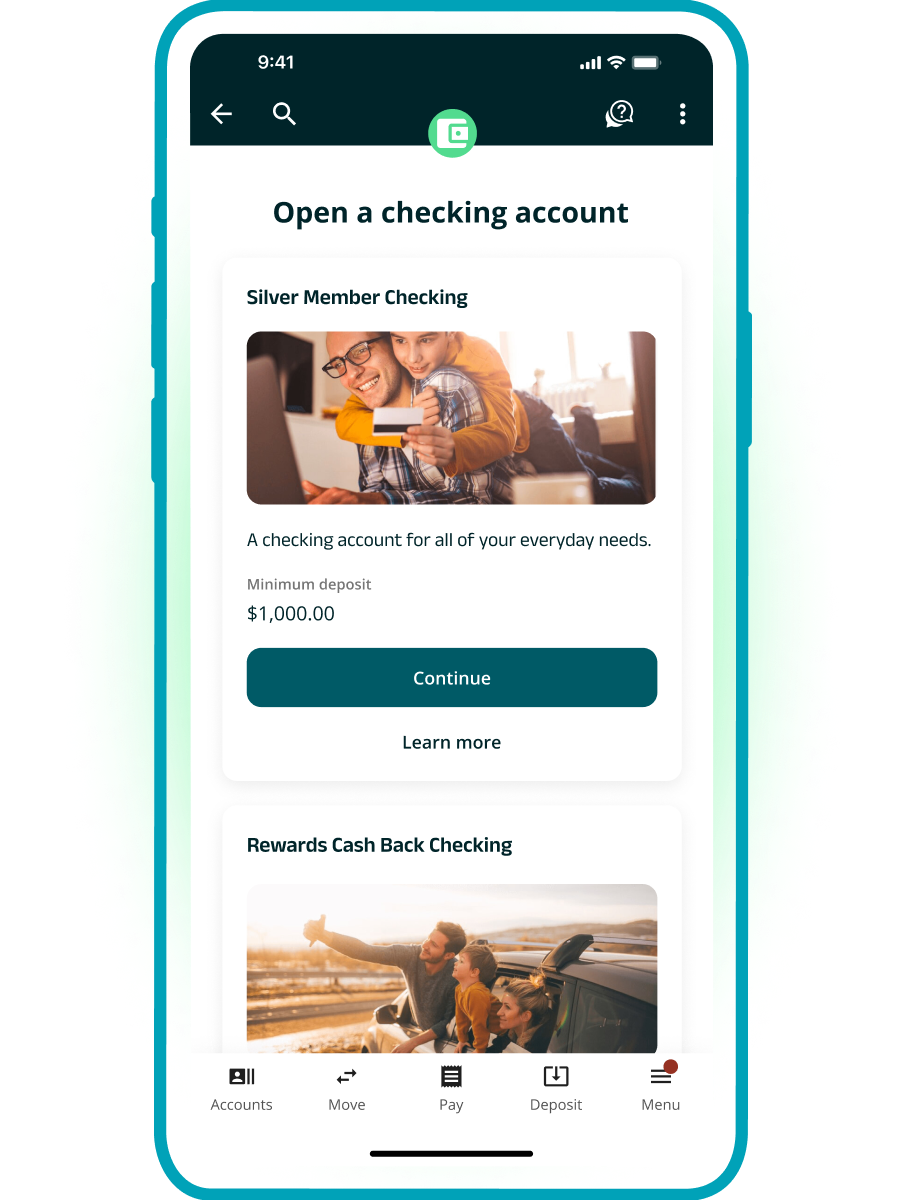

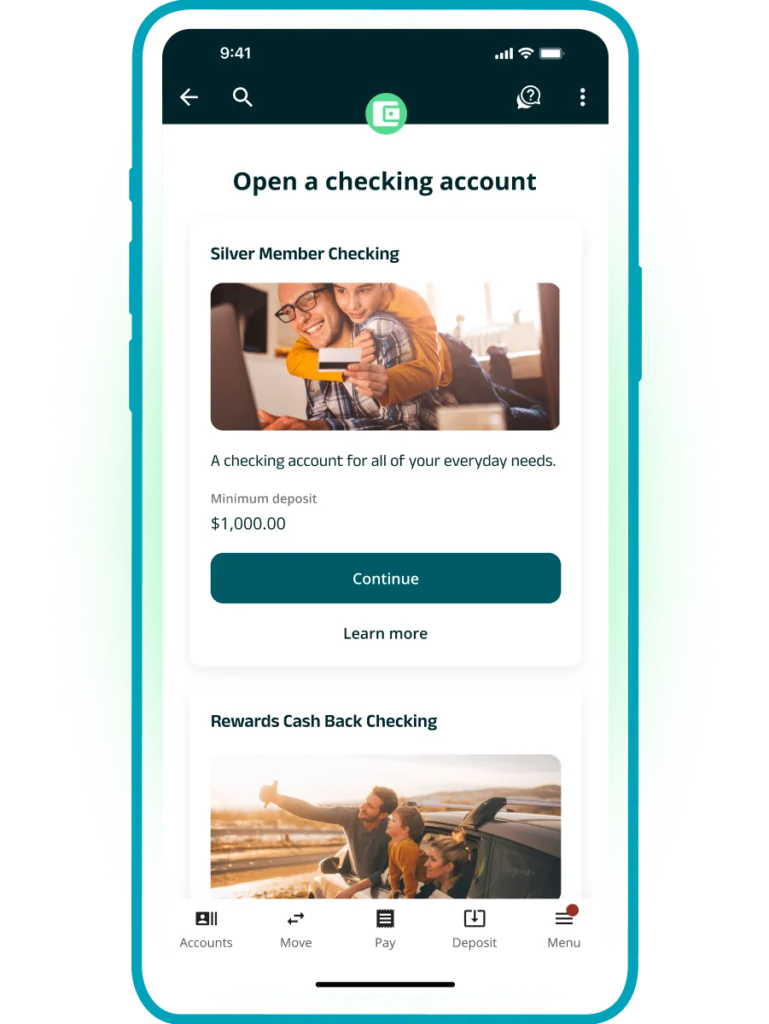

Account Opening & Lending

Simple and instant

Keep users close with easy and quick access to open accounts and manage loans anytime and anywhere on one digital banking app.

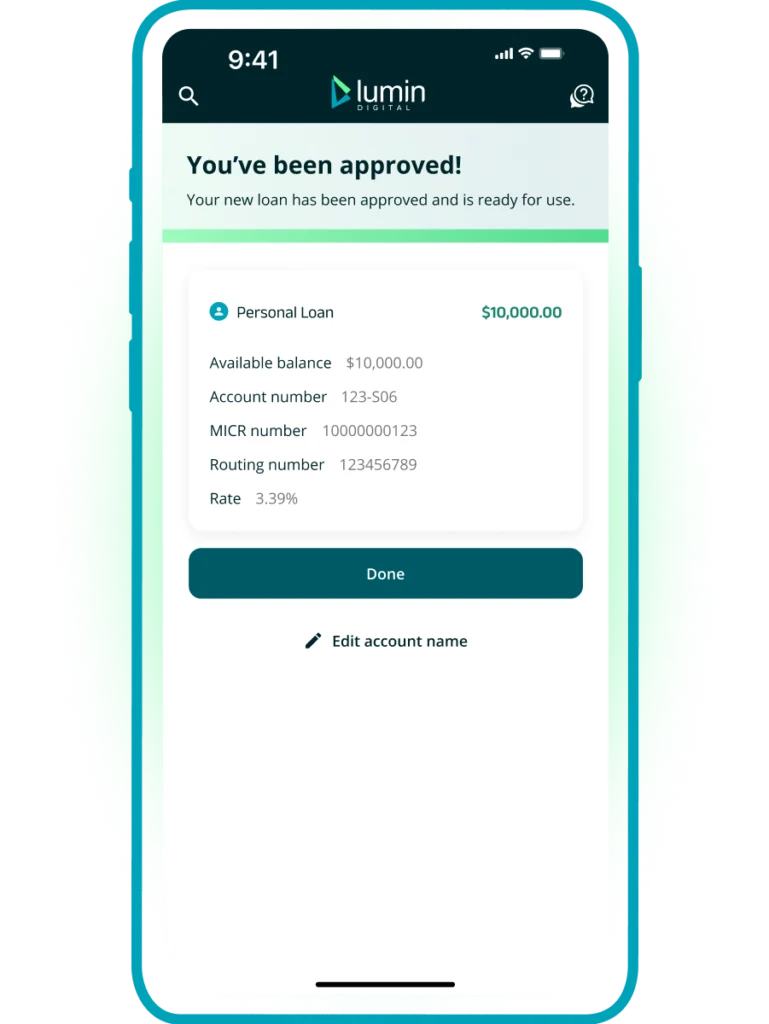

Within minutes, account holders can open new accounts for deposit products or apply for loans from any device. Satisfy your users with easy and simple digital account opening workflows while increasing application completions. Improve operational efficiencies by eliminating branch visits and paperwork.

Deposit product account opening

Users can open any type of deposit account quickly and easily from mobile or desktop. Accounts are immediately available for use upon application completion, enabling users to complete transactions right away.

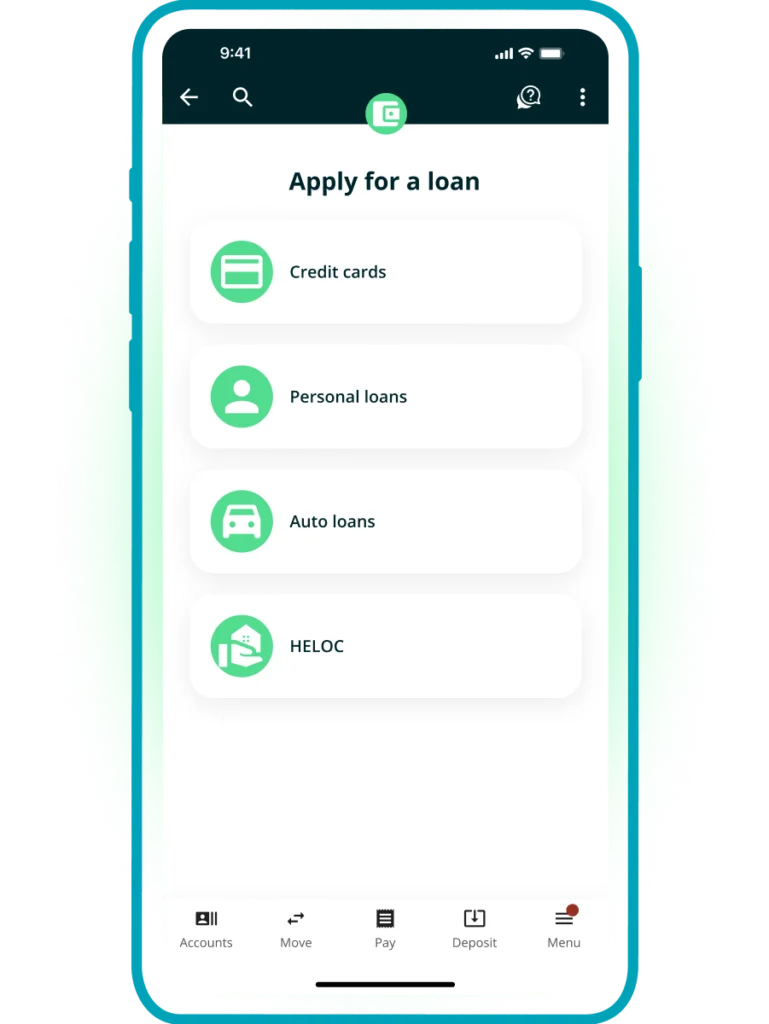

Loan origination API integrations

Configure loan products and coordinate with loan origination providers via API to provide users with a seamless process to apply for credit cards, personal loans, HELOC, and vehicle loans.

Loan applications

Easily configure multiple loan applications based on product types to meet your unique needs. Enable users to easily and quickly apply for loans digitally, eliminating the need for users to leave the digital banking platform to complete a loan application.

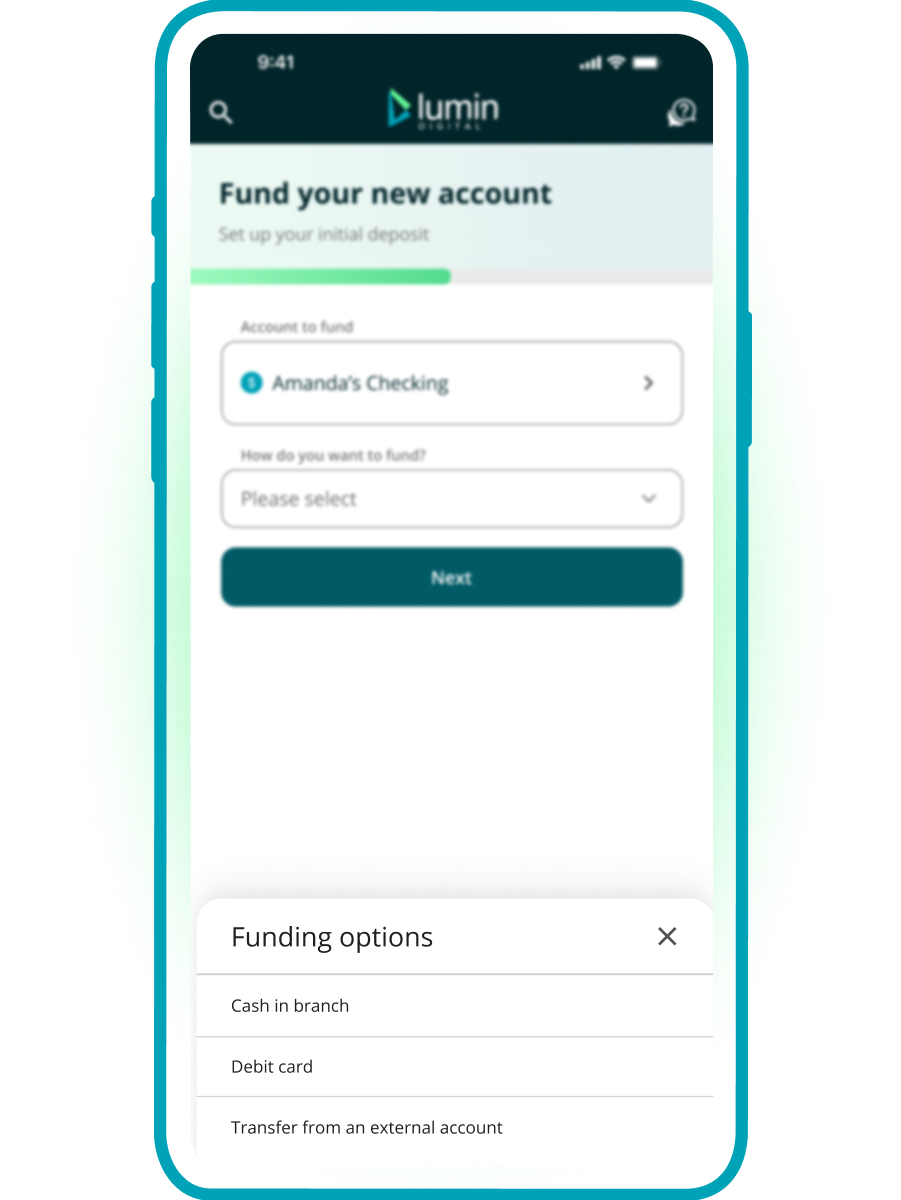

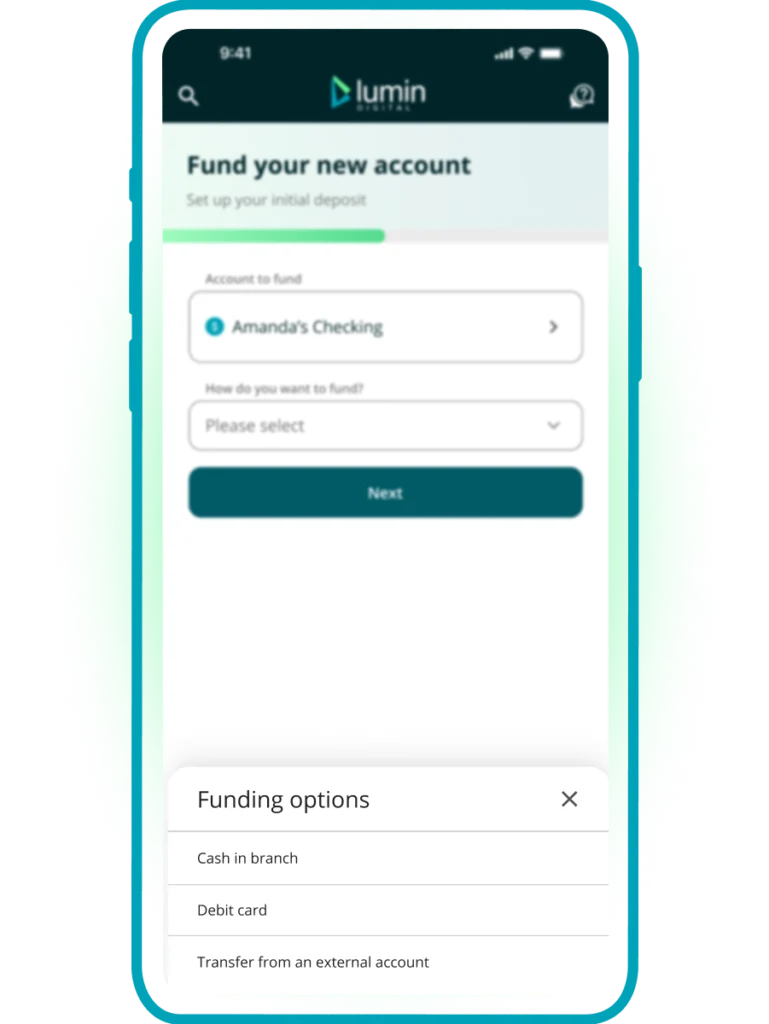

Account funding options

Improve the overall experience with several account funding options for users to choose internal or external accounts to fund new products adopted within the digital banking platform.

Financial Wellness

Informed and intelligent

Financial wellness plays an important role in the overall health of our communities. Our financial wellness tools foster healthy financial habits—from setting savings goals and assessing cash flows to monitoring credit scores and tracking spending habits. Our solutions allow you to provide additional tools and financial wellness support to your users to further bolster their financial wellness experience.

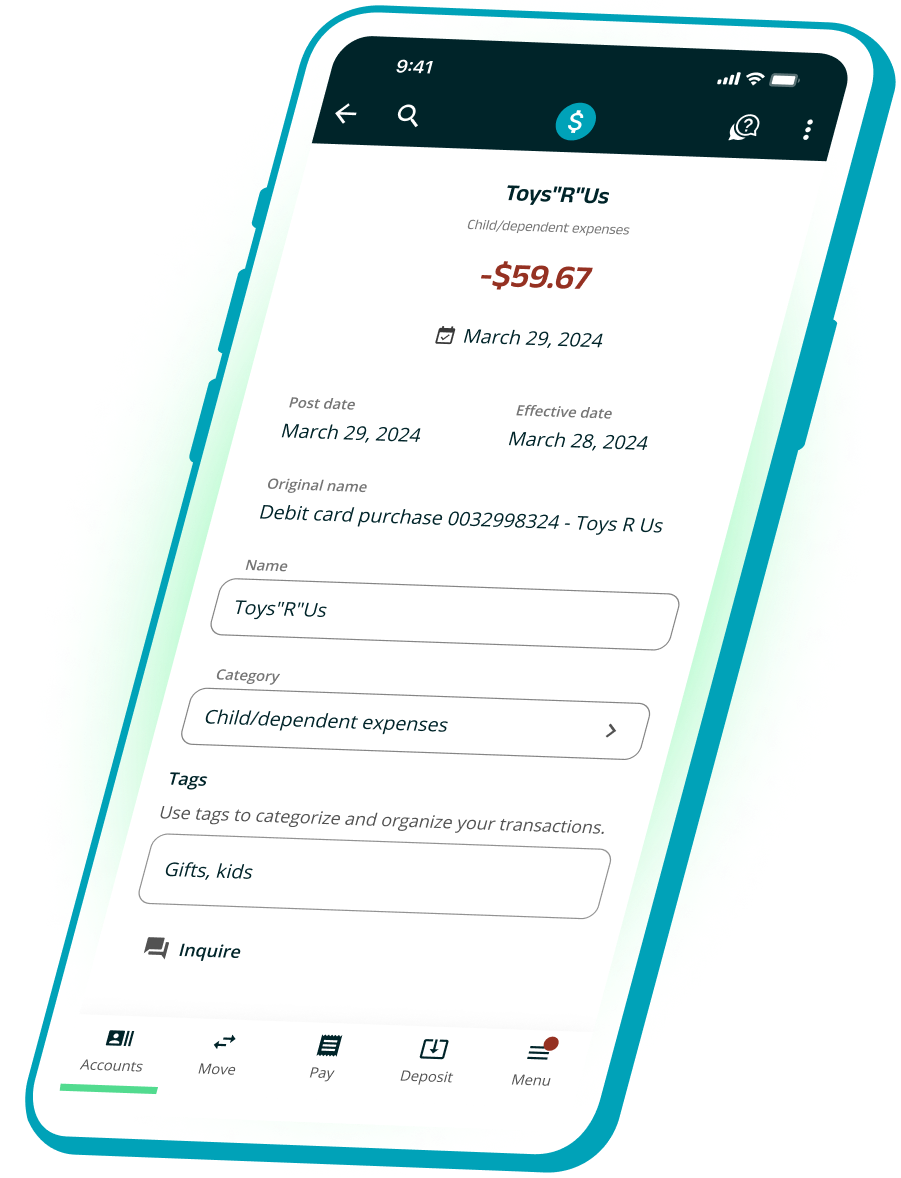

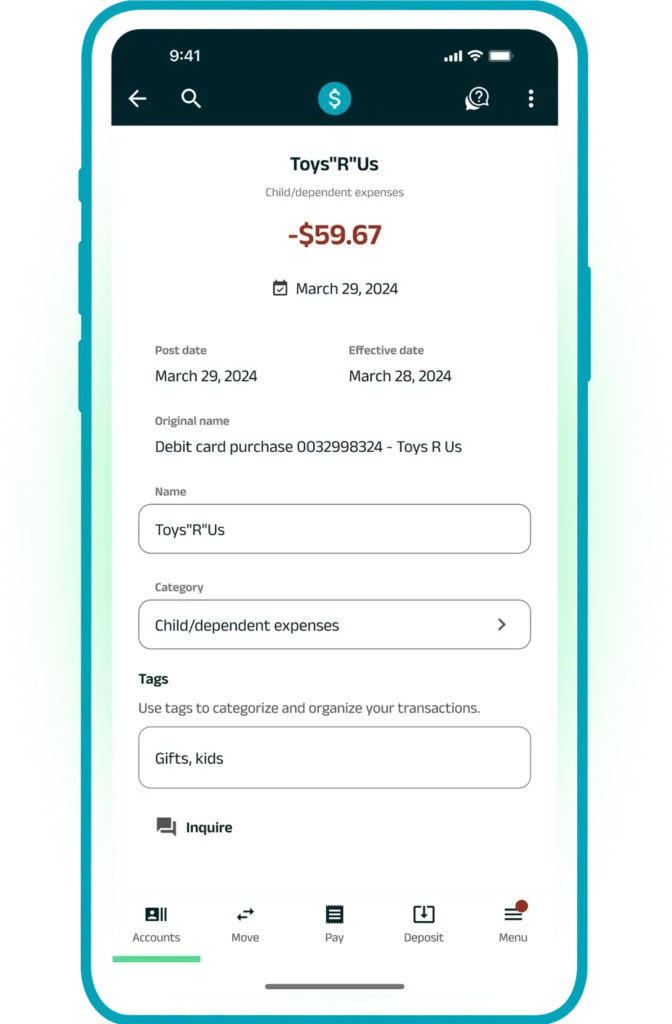

Transaction data enrichment

Automatically cleanse and enrich complicated transaction data to provide clarity and greater detail across transactions.

Savings goals

Users can create savings goals for large purchases, vacations, or other major life commitments. Users can set recurring transfers to specified accounts to automate savings habits.

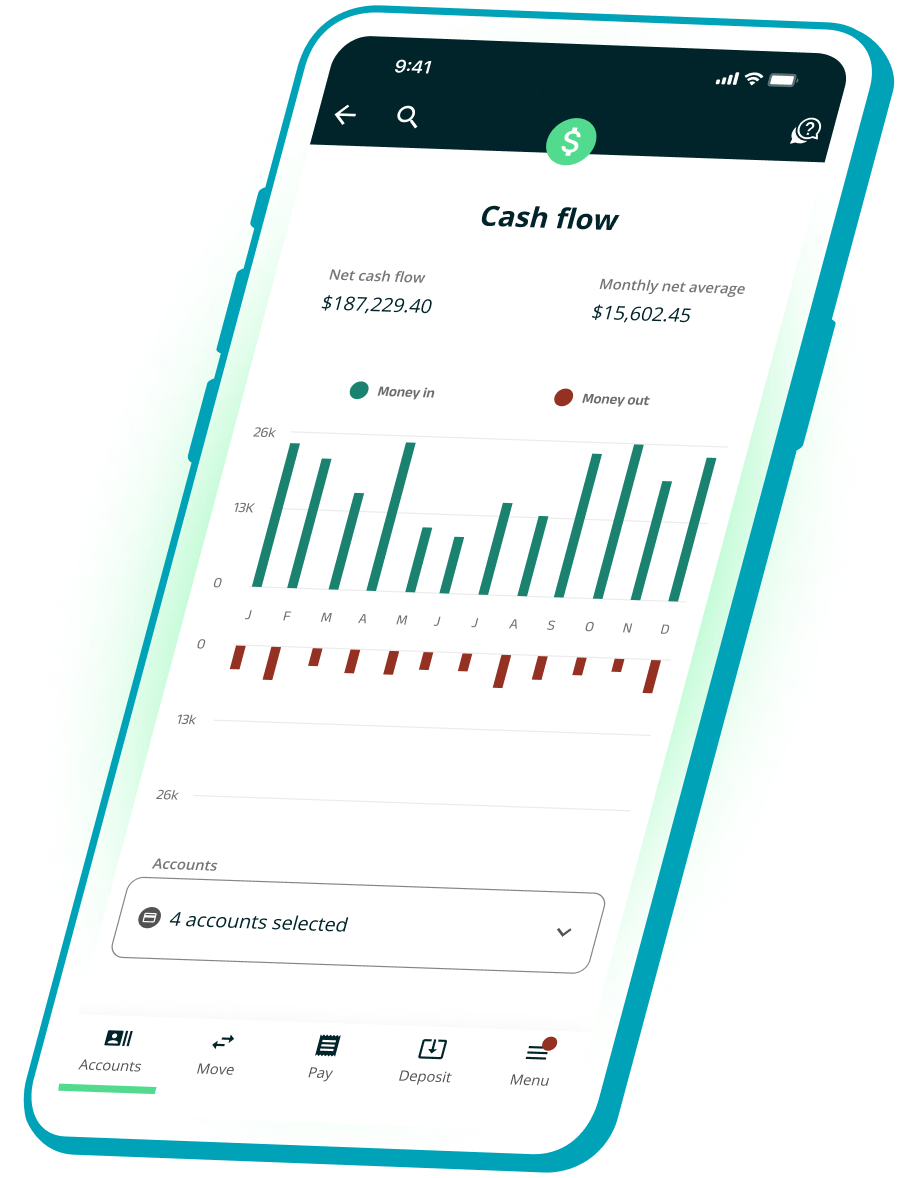

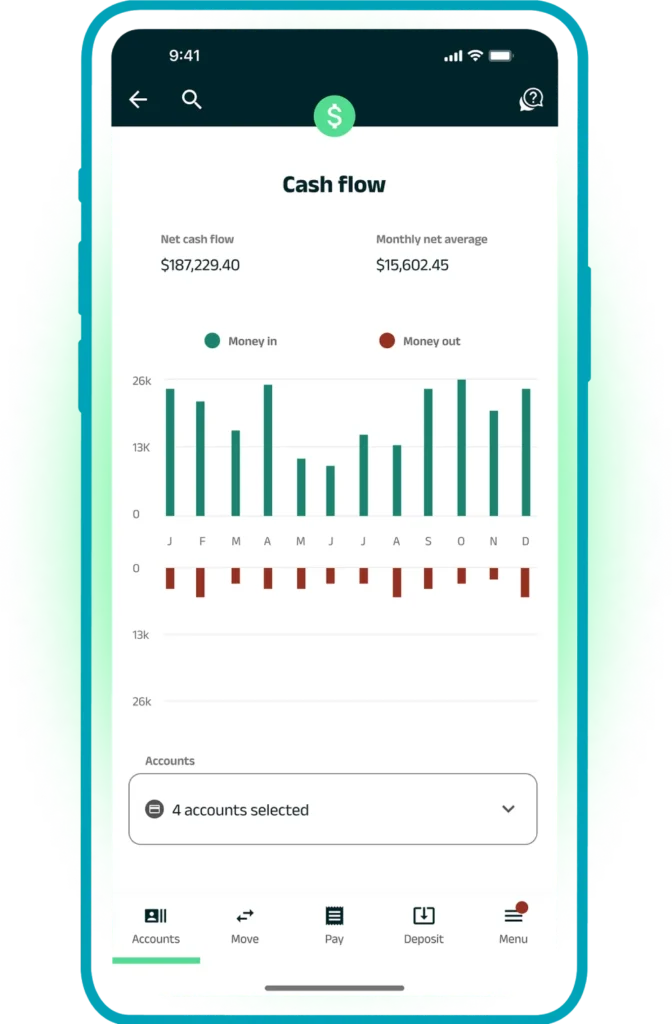

Cash flow analysis

Users can monitor cash inflow and outflow across all of their accounts, view specific transaction details, and access interactive graphs to view cash flow trends over time.

Advanced Financial Wellness

Our platform provides advanced financial wellness features that allow you to offer an even more comprehensive set of financial wellness tools to your users.

Account aggregation

Account aggregation connects bank accounts at other financial institutions in a single consolidated dashboard. Transactions from external accounts are used in the financial health applications across the platform to provide users with a complete picture of their finances.

Financial health checkup

Financial health checkup assesses spending, debt, credit score, planning behaviors, and savings to establish a dynamic financial well-being score for users. As they continue to learn and make decisions that improve their financial well-being, the score is regularly updated to keep users up-to-date on their progress.

Spend forecast

Spend forecast uses machine learning models to automatically calculate users’ forecasted spending and income obligations, providing dynamic, ongoing projected balances so users know how much money they will have in the future.

Client experience

Building for tomorrow’s expectations

As digital experiences and user expectations evolve, we partner with our clients to develop what’s next. From gaining insights from interactions to listening to client feedback to applying learnings across our platform, our approach is based on continuous improvement and partnership—keeping our clients at the forefront of change.