Evaluating how users manage their accounts

Lumin Digital’s User Experience (UX) team monitors and evaluates user data from over 5M users to uncover opportunities to improve the digital banking experience and provide additional value to end-users. Lumin’s UX team discovered an opportunity to rethink how digital banking users interact with their accounts and set their sights on designing a new experience to improve discoverability of account actions, modernize the accounts widget, and help end-users discover more personalized offerings.

Lumin’s product design philosophy

Creating great user experiences (UX) is a never ending, always evolving process. User needs and expectations are shaped by the apps they use most, not just other digital banking apps. Lumin’s goal is to provide a UX that transforms banking tasks into effortless, enjoyable interactions that build trust, loyalty, and financial well being.

“Great UX is never truly finished” according to Mike West, Lumin’s VP of User Experience. “Our recent Account page update demonstrates our continuous commitment to thoughtful innovation—strengthening user engagement without sacrificing user familiarity or trust.”

Collaboration is the key to unlocking creative potential. To understand how to improve the accounts experience, our UX team collaborated closely with clients, end-users, and cross-functional teams within Lumin to reimagine a new accounts experience.

With Clients

| Clients participate in the design process via our Design Advisory Group, weekly demos, beta tests, workshops, and feature requests. |

With end-users

We include the voice of our user in every step of the design process through surveys, user tests, Lumin’s Insiders Group, app feedback, and behavioral analytics.

Across Lumin

| Our insights, design, product, and development teams collaborate to build a component-driven product allowing for quick implementation and a focus on innovation over maintenance. |

Collaborating with all these groups helped Lumin’s UX team identify and define specific goals to create a better experience managing accounts within digital banking:

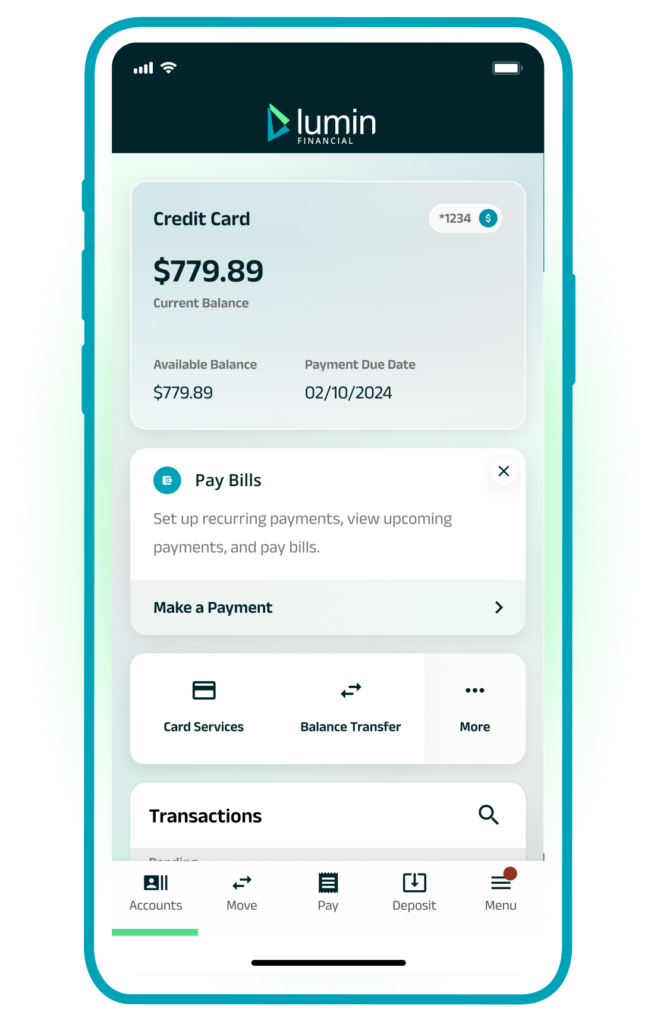

Boost engagement: make priority actions, such as Make A Payment, more easily discoverable to increase user task completion and user engagement.

Intentional content targeting: add targeted content where users naturally explore, especially after a task is completed.

Improve extensibility: enable our clients to configure and build new microapps via Lumin’s software development kit (SDK) for future client-led innovation.

Modernize the experience: evolve the UX to match rising user expectations with what they expect from digital apps they love and use daily.

Design, test, & iterate

Equipped with research, ideas, and defined goals, Lumin’s UX team began testing new account experience concepts and designs with end-users through a series of proven UX research techniques like moderated usability testing, unmoderated preference testing, and A/B testing. Combining these different testing approaches enabled the team to collect a wide and deep set of feedback, data, and insights from testing participants that informed the product strategy and design process.

After several rounds of testing and iterating on designs, Lumin’s UX team identified several new successful concepts as well as unsuccessful designs, all of which were important learnings instrumental to crafting the final designs to optimize and improve the accounts experience.

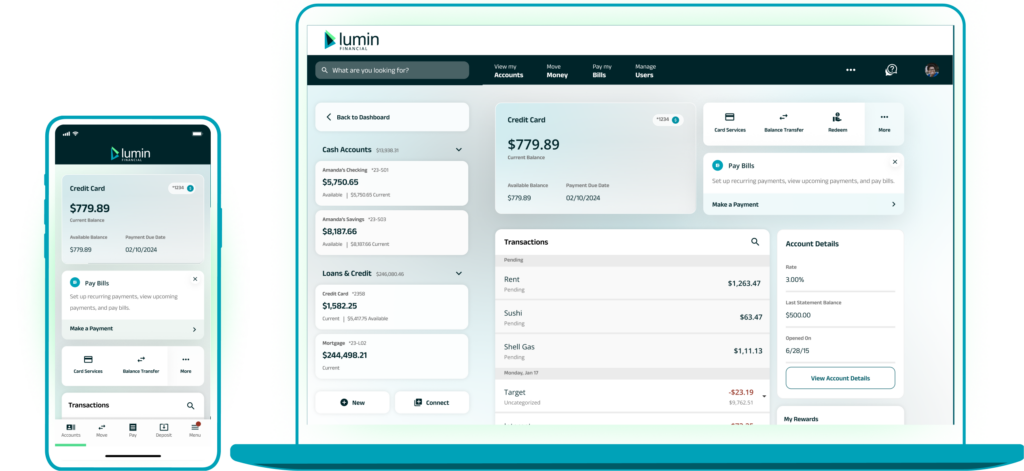

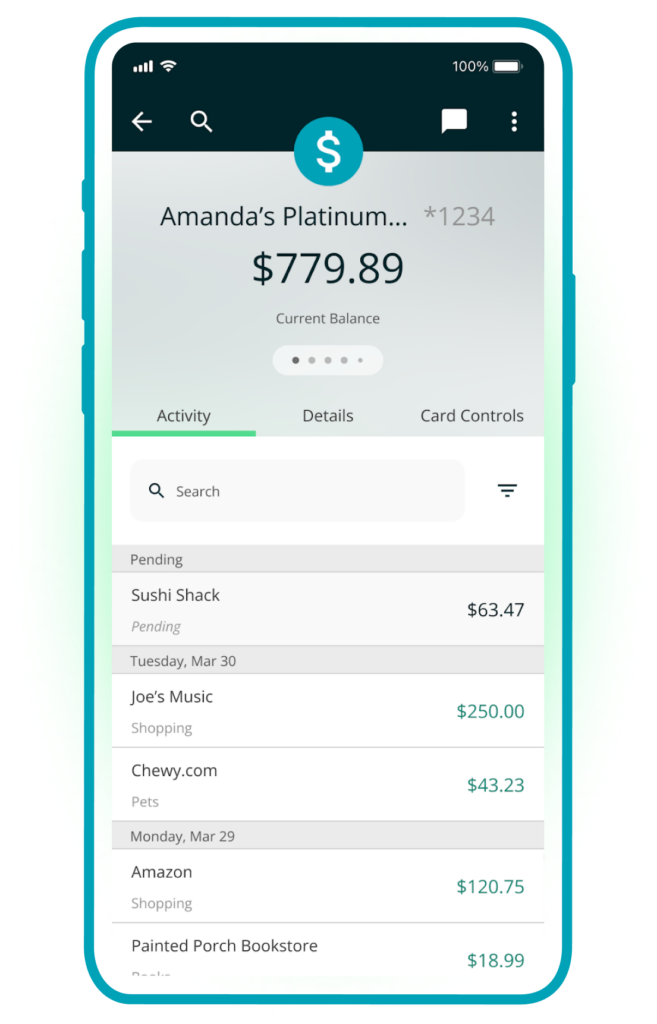

The refreshed account experience

Our new accounts experience helps financial institutions deliver a better digital banking experience to their users, including:

- Communicating account-specific alerts on the user’s dashboard, a key request from end-users

- Modernizing the overall look and feel of the accounts widget, the highest trafficked section of our platform, to meet user expectations

- Improved visibility of account-specific microapps, like financial well widgets and tool, while making it easier to take essential actions like “Make a Payment” or “Lock Card”

Original accounts experience

New accounts experience

Double-digit engagement and adoption increase

Since launching our new accounts experience, the before/after user experience results shows that we’re helping end-users accomplish more:

28%

increase

in clicking “Make a Payment” CTAs

64%

engagement increase

in spend analysis and budget tools

27%

reduction

in searches for account details in other areas of digital banking

10x

increase in adoption

of cash flow tools

2x

increase

in taking account-specific featured actions

20%

engagement increase

in card lock/unlock functions

7x

increase

in card reward redemption

These design changes not only improve the user experience, but also benefit our clients. As we elevate the digital banking experience, we help our clients retain, grow, and engage with their user base—helping solidify their position as the primary financial institution.