Digital Marketing

Increase revenue, deposits, and product adoption.

Maximize your growth with custom digital marketing solutions designed to help you engage with and capture your customers’ interest—directly within digital banking.

Capture interest at the right time with the right users based on their usage signals—and do so at scale.

Our suite of digital marketing solutions helps your financial institution increase account openings and deposits and encourage product adoption.

Digital marketing solutions

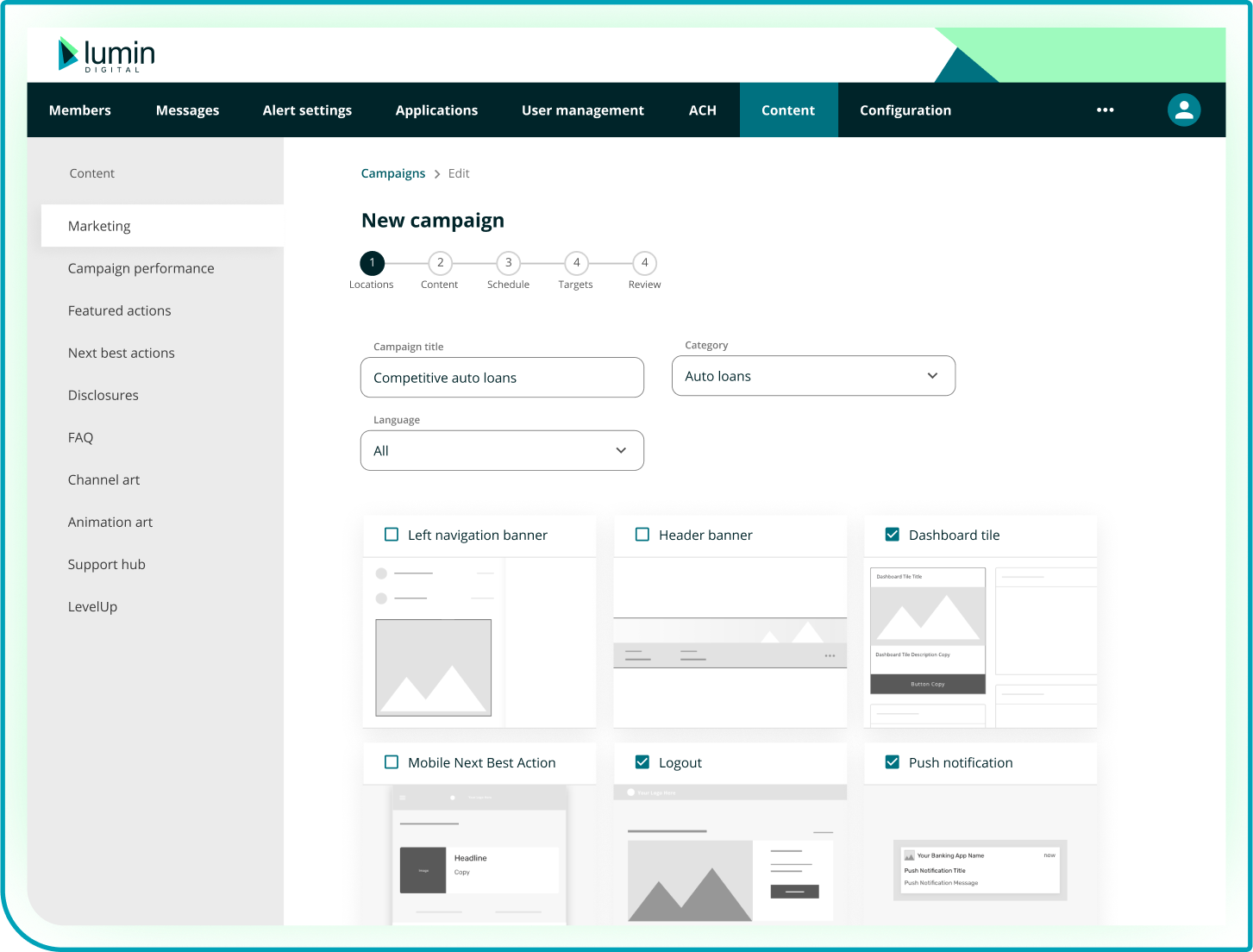

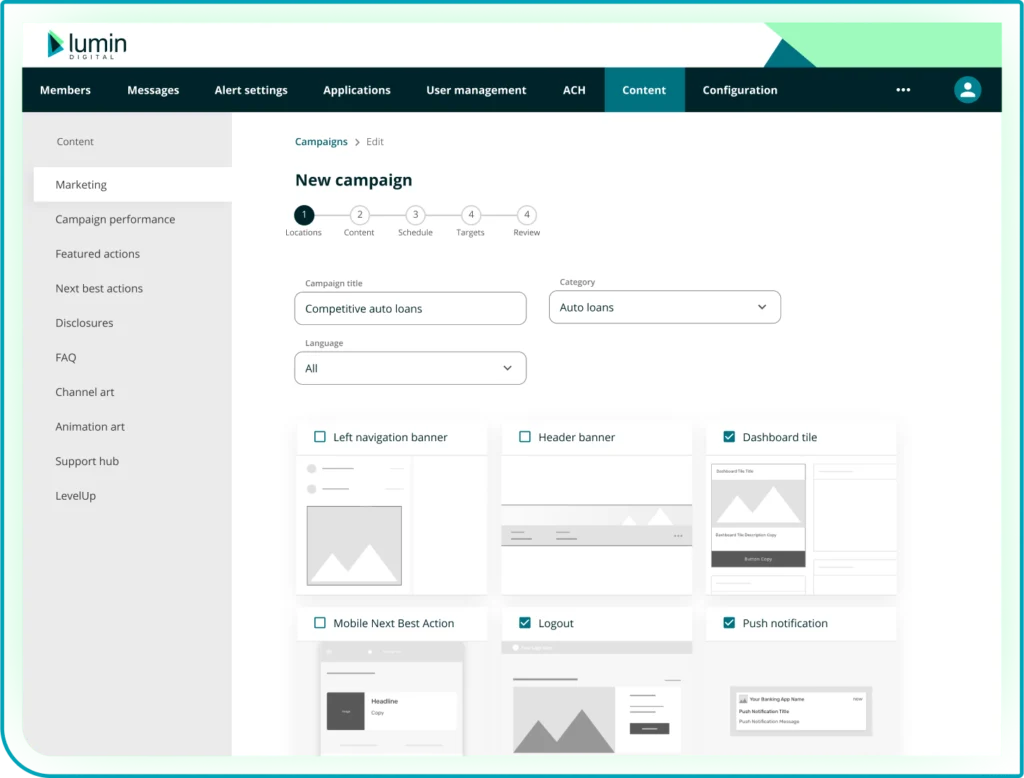

Digital marketing campaigns

Run multiple campaigns concurrently and easily with mobile and desktop parity UX. Optimize messaging and content in thirteen strategic areas across the digital banking UI and enable push notifications to communicate with customers at the optimal time to improve conversion.

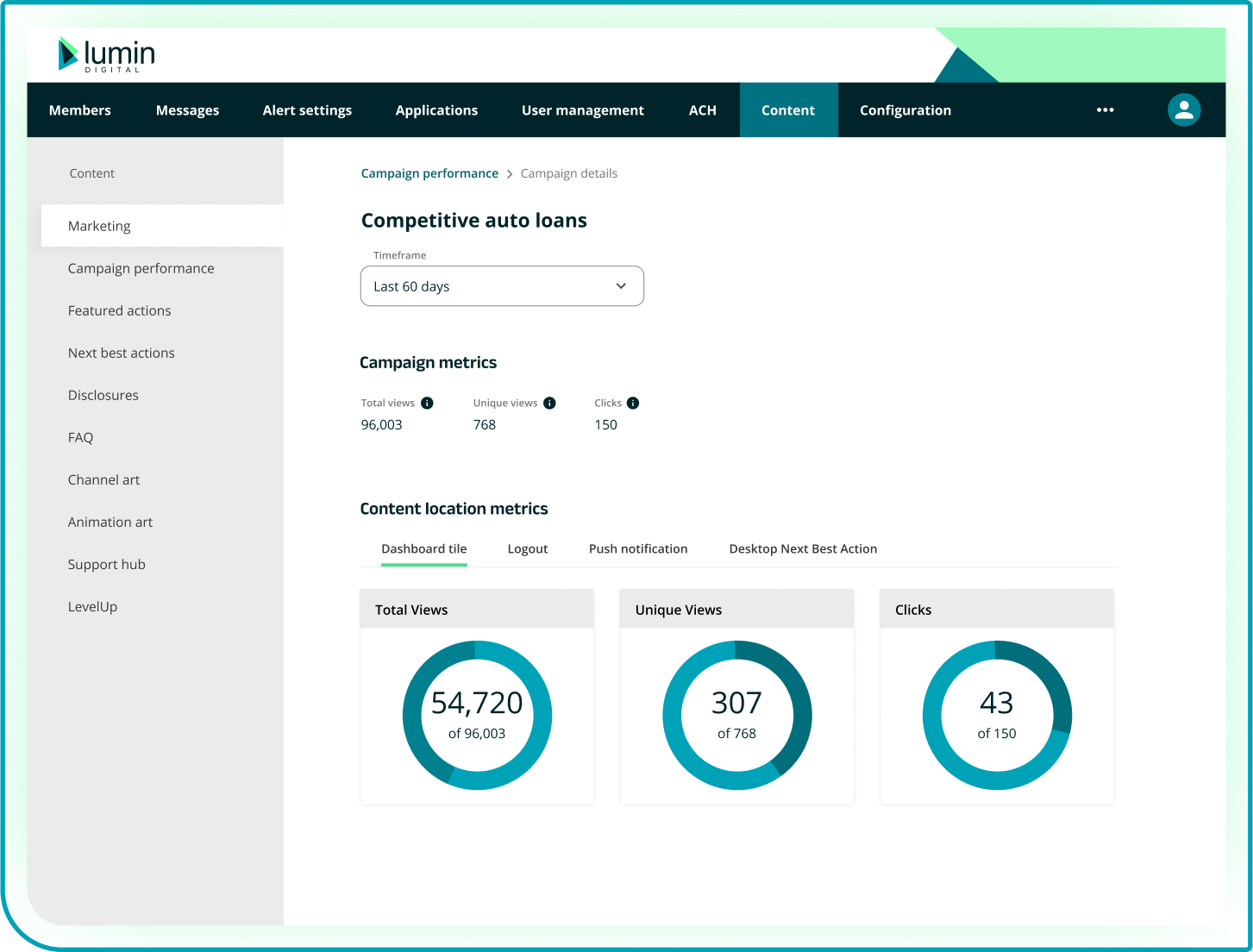

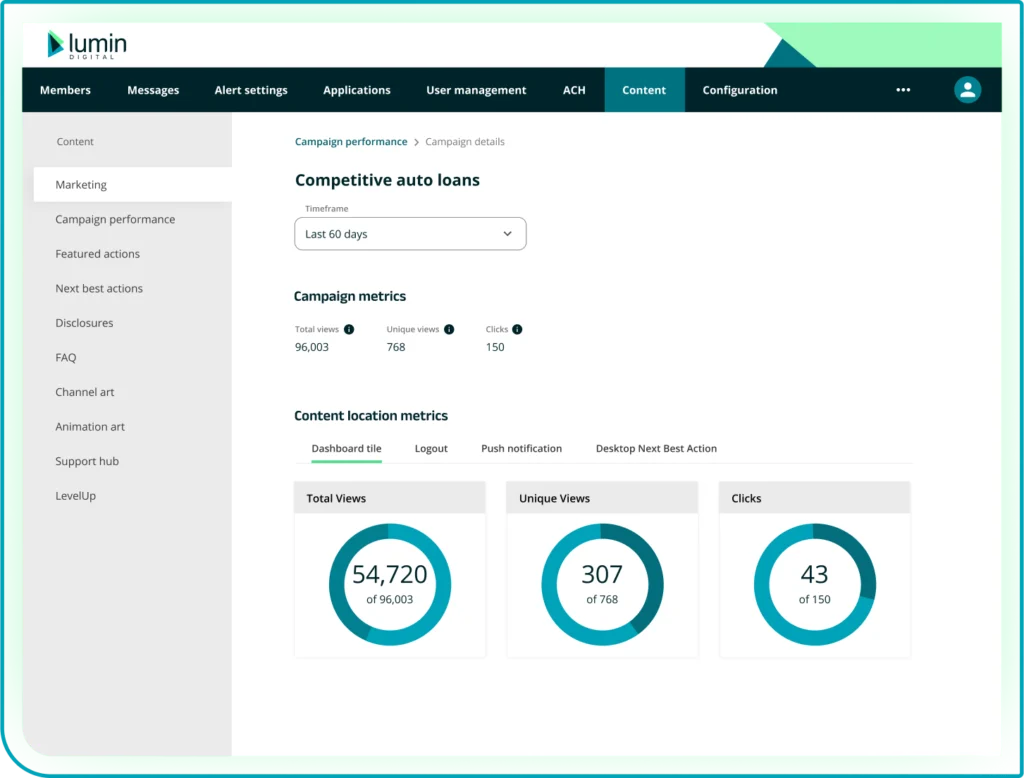

Campaign performance metrics

Understand what’s working and what’s not to continuously improve conversion. Access campaign views to compare performance and understand which calls to action (CTAs) are working, what users are clicking on, and which content is performing best across locations.

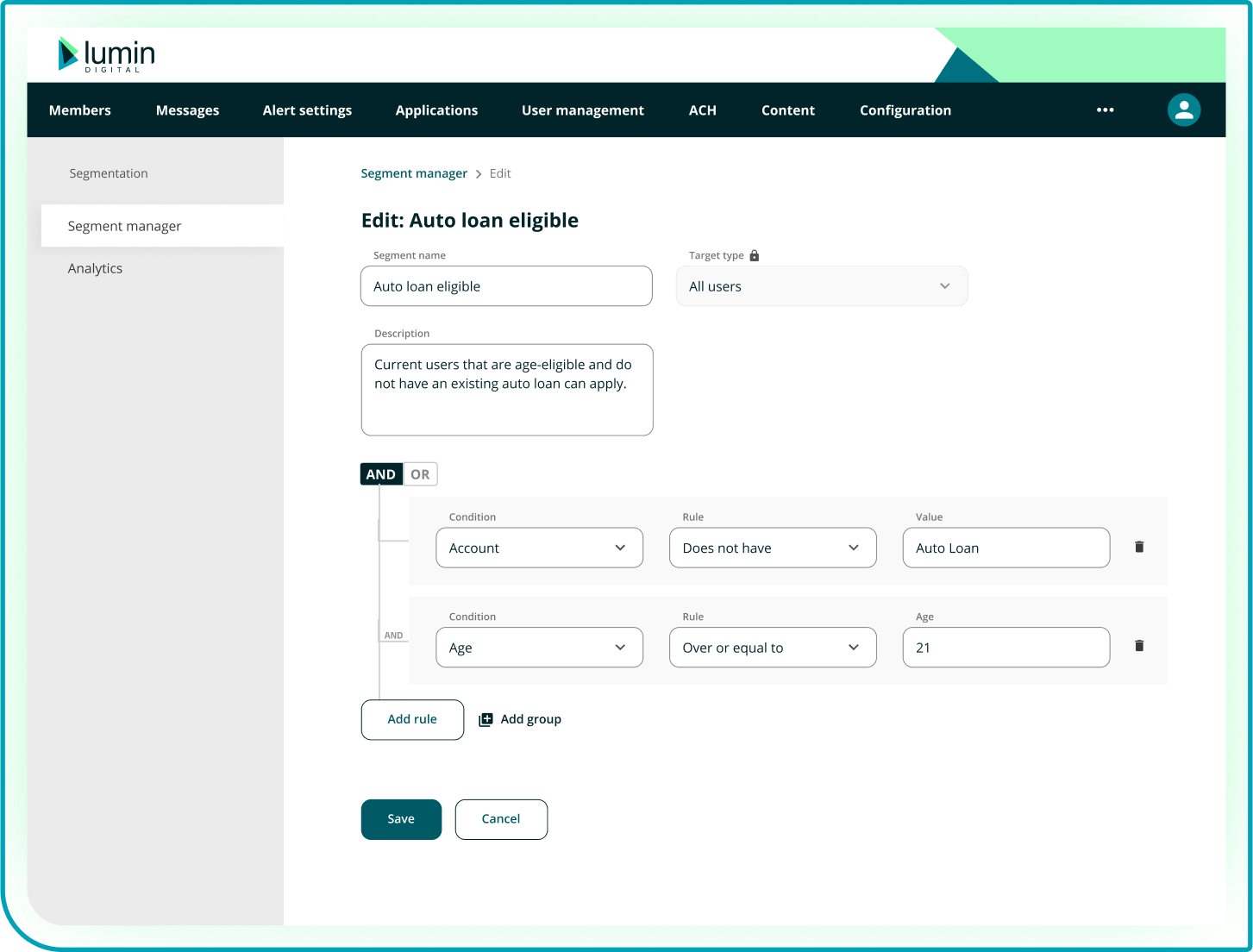

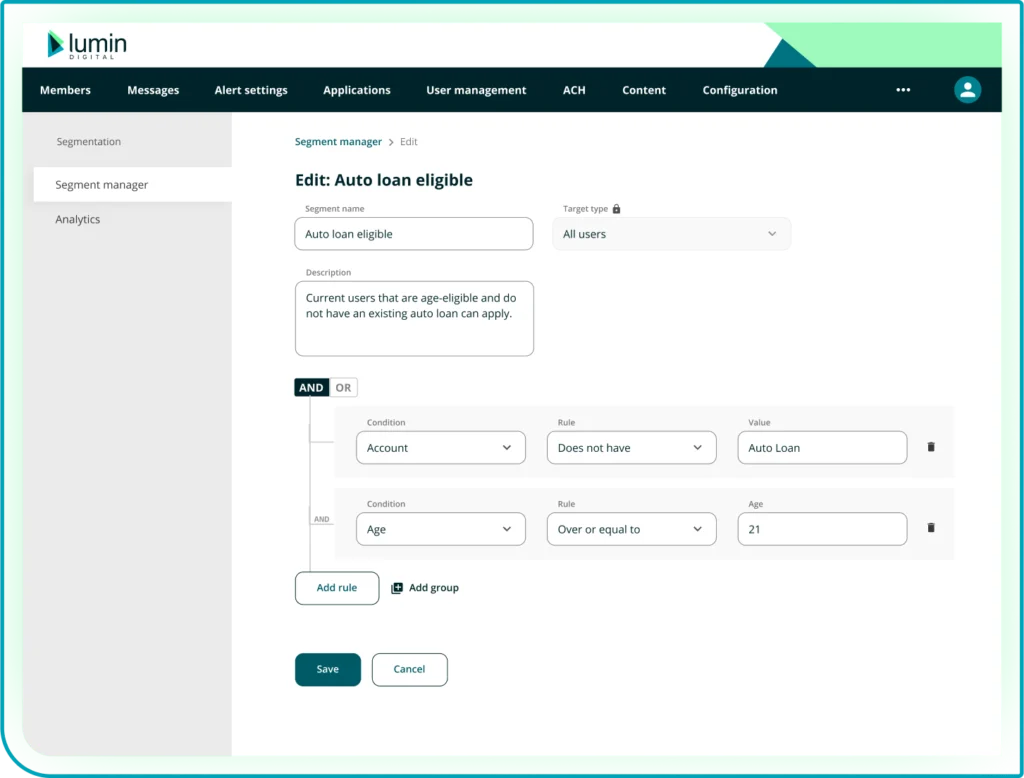

Advanced account targeting

Utilize flexible targeting for each campaign through multi-variable criteria that automates the targeting process. Integrate external data sources beyond digital banking to ensure the right users receive the appropriate messages at the right times.

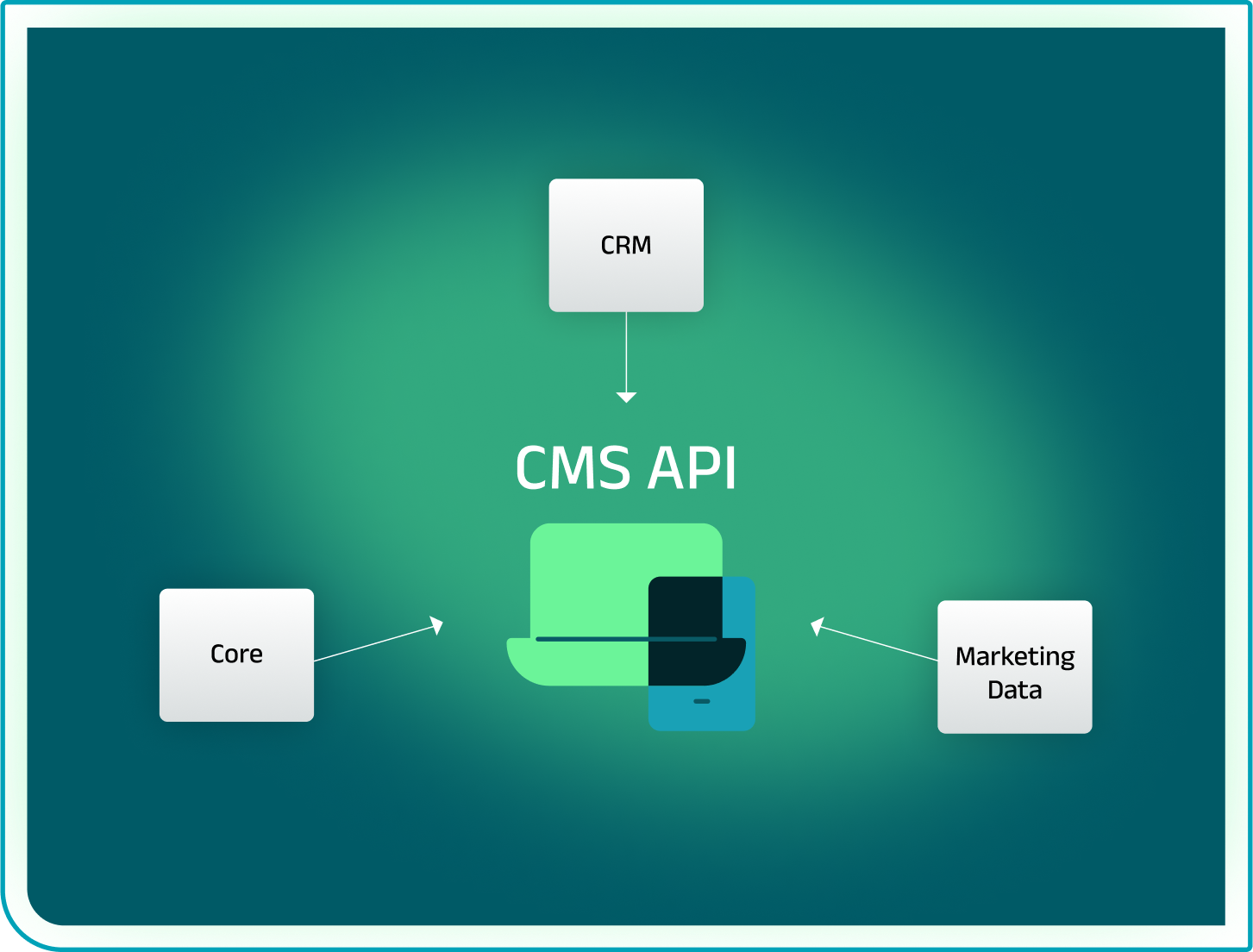

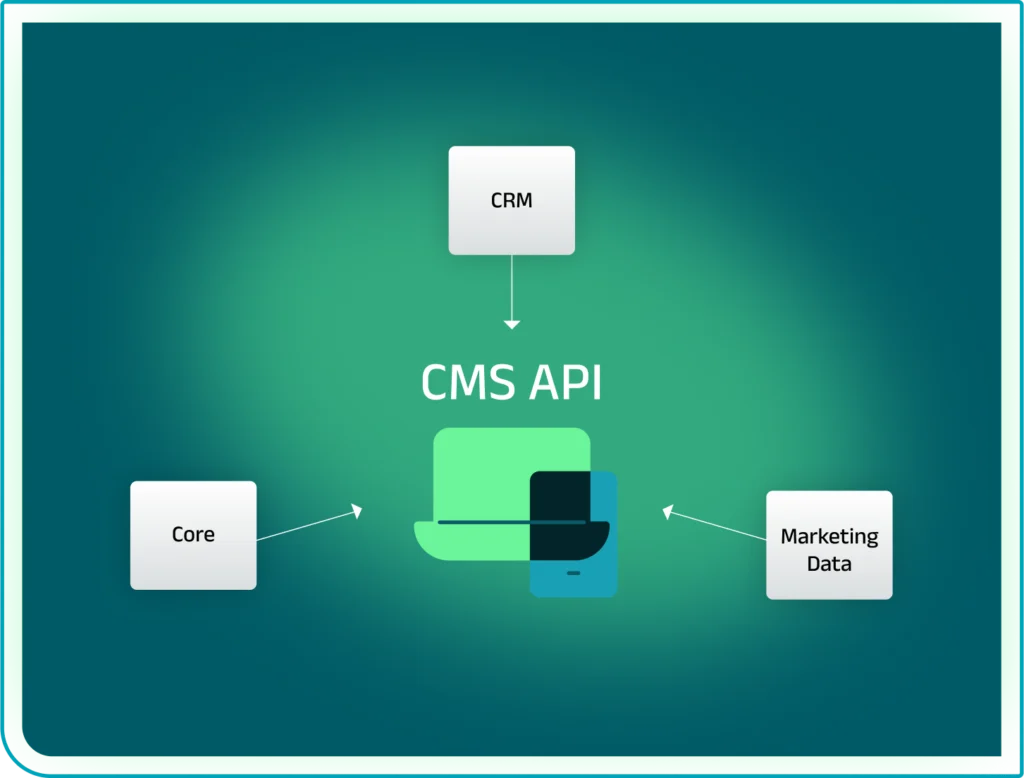

Advanced CMS capabilities

Use the CMS API to extract and load data in the digital banking CMS. Enable additional automation, expanded targeting, and self-serve reporting through the CMS API and your financial institution’s preferred business intelligence tool. Improve a user’s financial planning while surfacing additional products by using behavior-based recommendations. Track the efficacy of campaigns with custom promo codes and UTM tracking.

Client Experience

Keep growing with intelligent marketing

We help you keep growing with intelligent digital marketing solutions that allow you to serve your users in targeted—and scalable—ways. We continue to work with you to understand what can be improved across the platform so you’re continuing to build and extend your banking relationships, even as consumer expectations shift.