Admin & Support Portal

Increase operational efficiencies. Reduce costs. Streamline workflows at scale.

Streamlining your employee workflows is critical to reducing costs and increasing operational efficiency.

Improve productivity by enabling your employees to communicate with users and complete critical admin tasks from a single location.

The Lumin platform offers a single-stack suite of tools that centralize workflows for your staff.

Financial institution self-service configuration

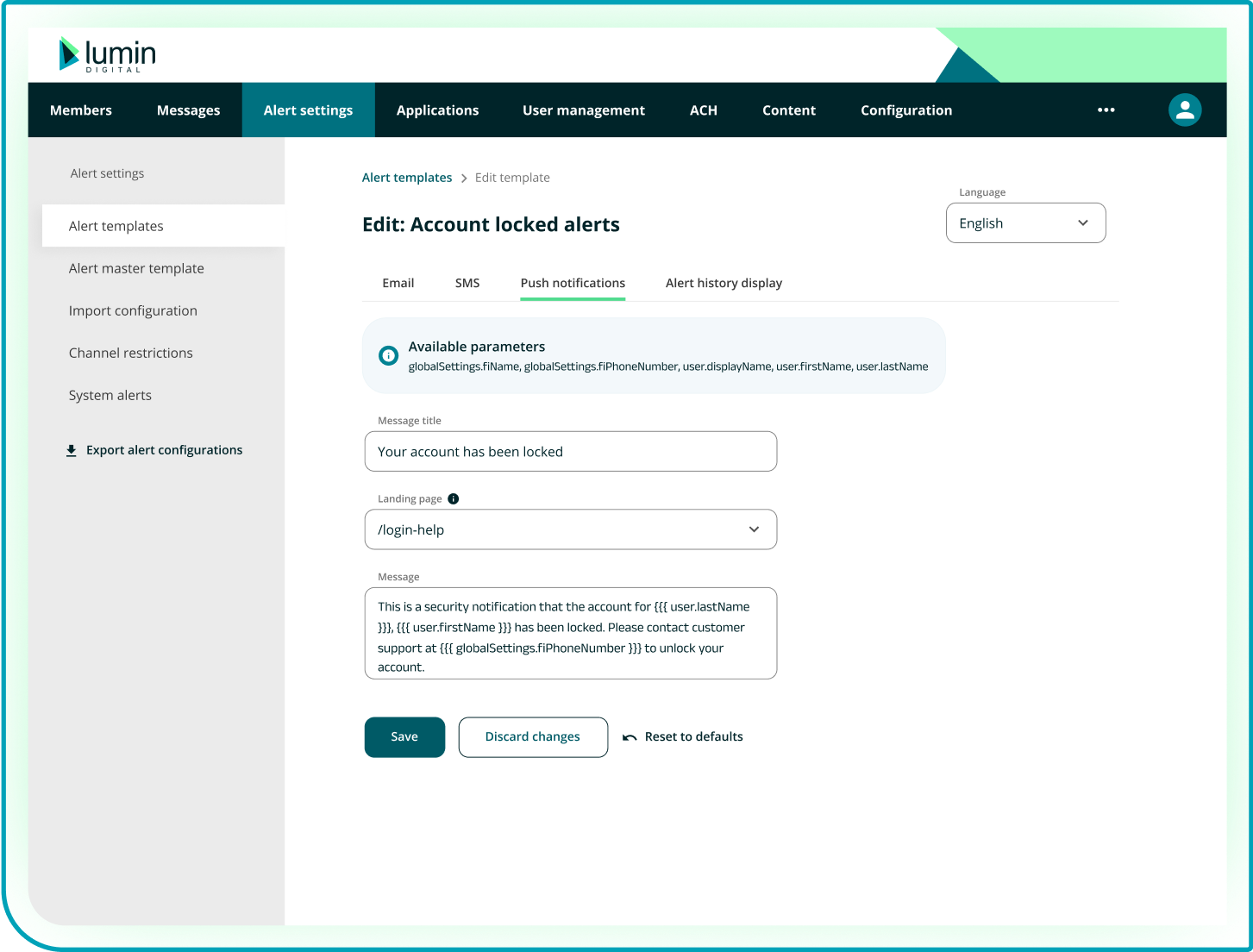

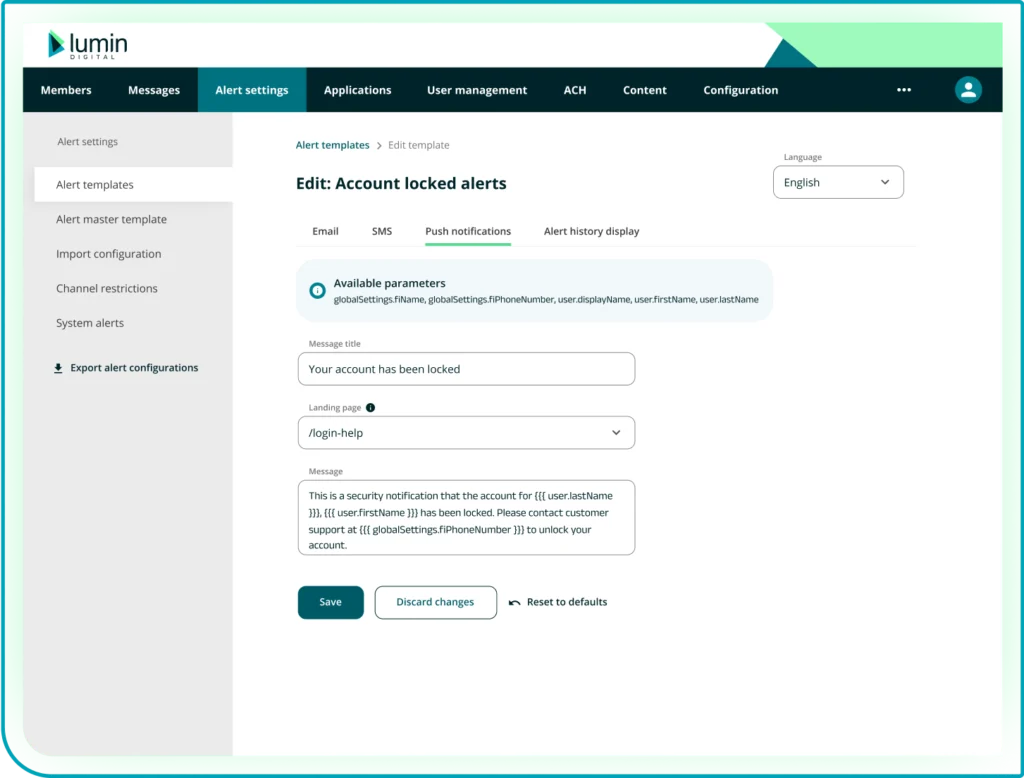

Alert configurations

Create and automate alerts across email, SMS, and push notifications from over 110+ templates based on defined actions within digital banking.

New account application flow design

Configure product lines, application flows, and approval reviews for users to request new accounts and products from digital banking.

Account mapper

Create different account types for your consumer base and set permission levels to interact with digital banking features. Set permission levels for account types, toggle payment options for products, and more.

Customer service

Credential management

Enable your employees to take action quickly if fraud on an account is suspected. Your operations team can quickly change user names, manage MFA to reset passwords on at-risk accounts, and prompt account owners to set new passwords to prevent fraud.

View as a user

Guide users through digital banking by providing FI employees the ability to view the digital banking UI from a user’s perspective on desktop or mobile to help them access features or troubleshoot their accounts.

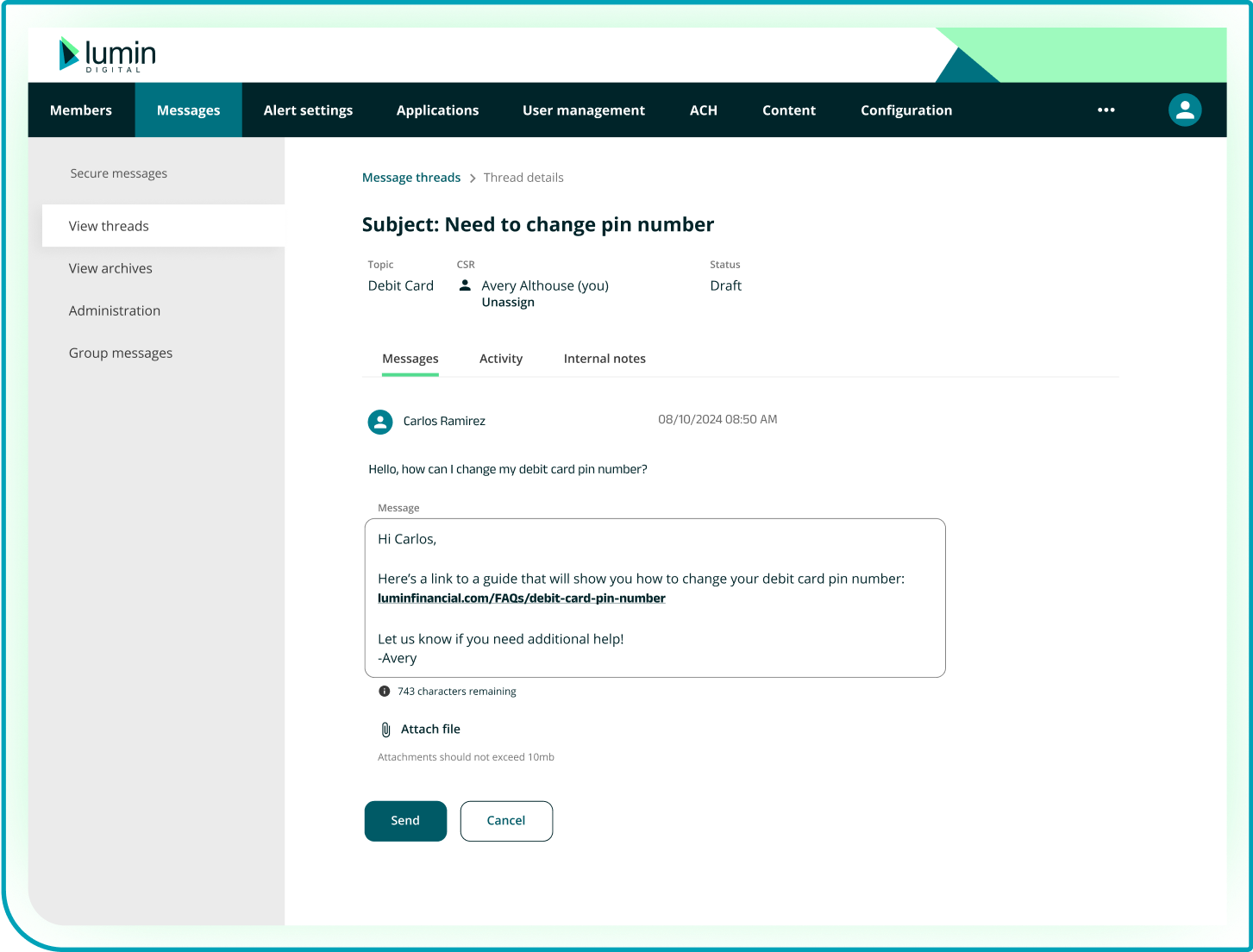

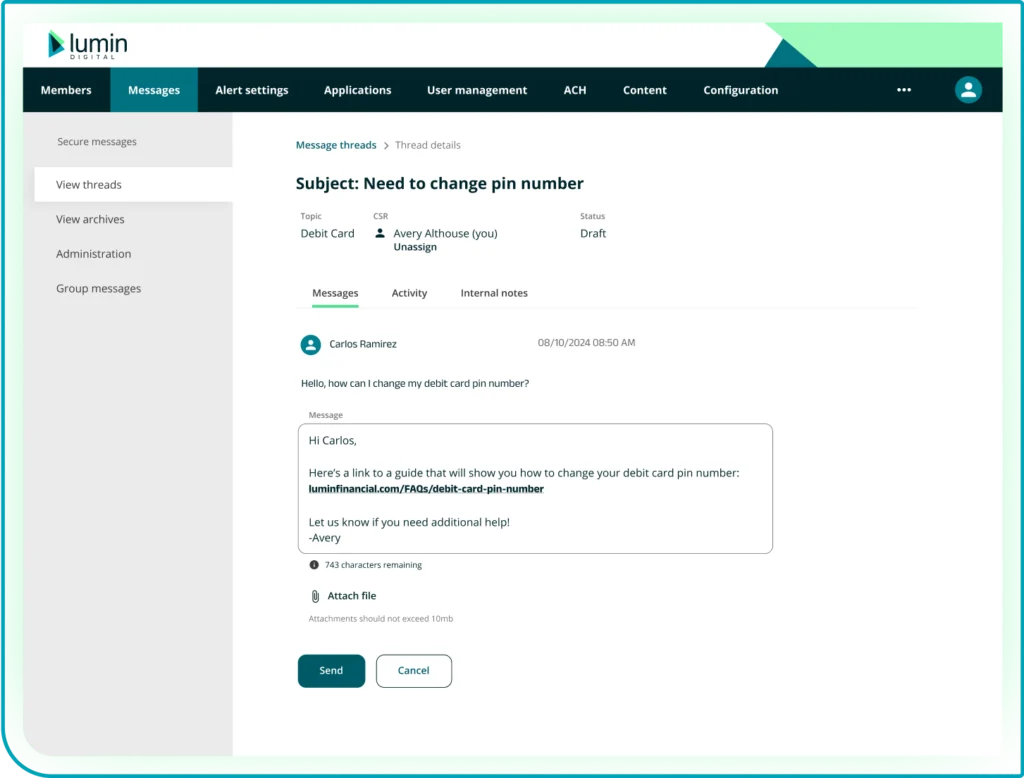

Secure messages & forms

Communicate with users directly within digital banking. Create templates, define topics and categories for user-generated messages, and create queues to route messages to the right internal teams.

Live chat integrations

Enhance the user experience and communicate with users through live chat. Your FI has access to our integrations with a variety of live chat vendors.

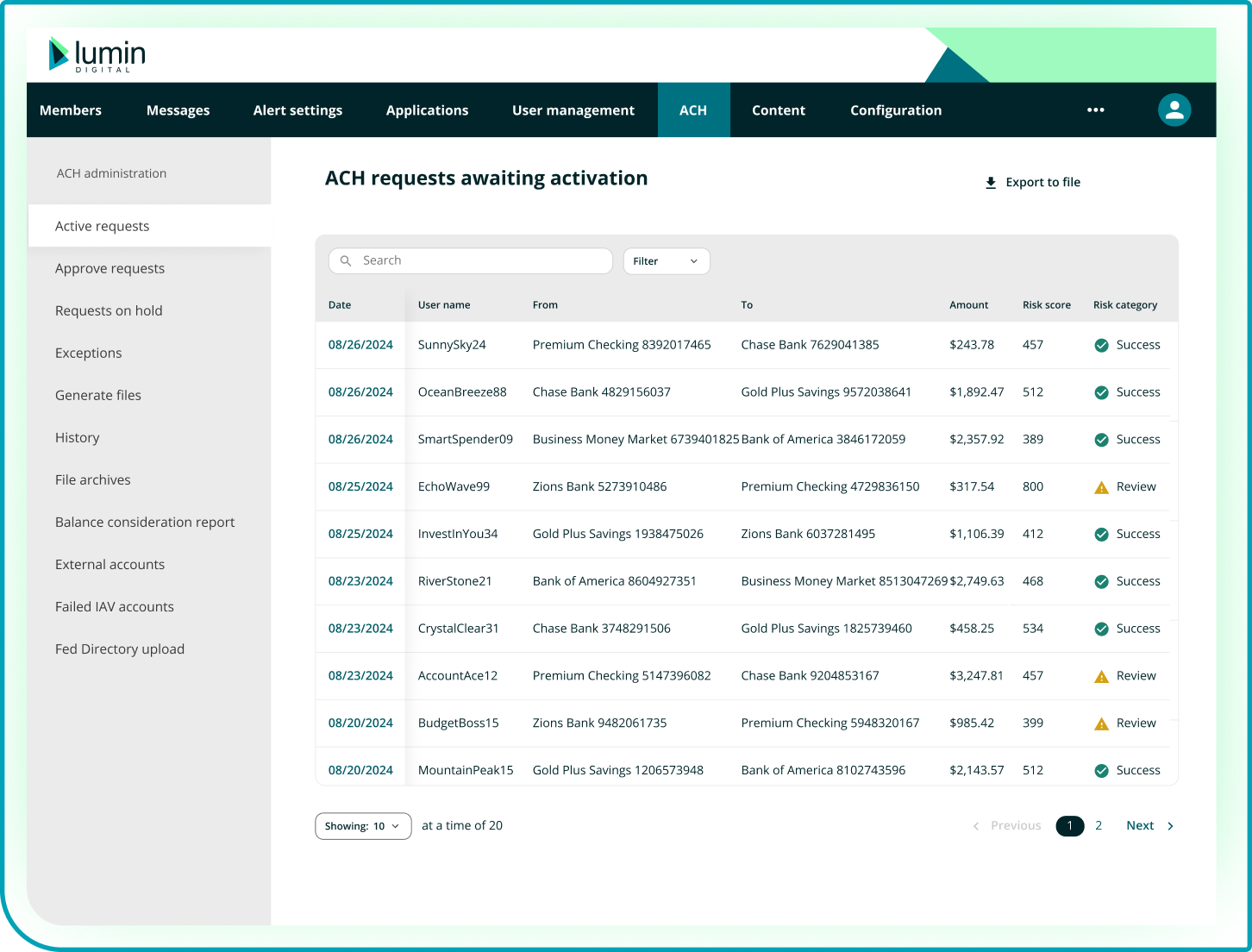

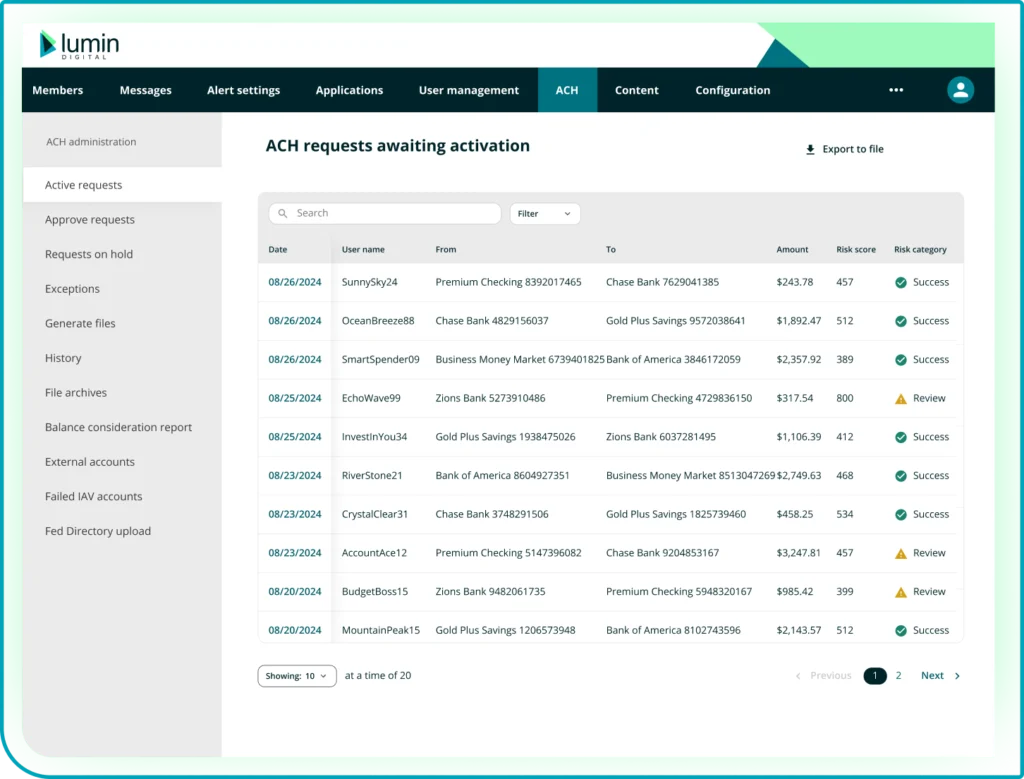

ACH management

Retail ACH

- General ACH management

Manage ACH file generation, ACH transfers/payments, daily cutoff times, ACH holidays, and more. Your operations staff can search for specific transfer requests to approve or reject high-risk requests. Our ACH service also supports trial deposit management, allowing call center representatives to verify, reset, and delete trial deposits on behalf of your users. - ACH automation

Activates and approves ACH external transfers below a predetermined risk threshold. - Retail Same Day ACH

Provide your users with Same Day ACH with or without a fee.

Commercial ACH

- Business ACH management

- Review, approve, and reject templates

- Require ACH prenotes for new and edited ACH recipient entries

- Access, search, and download NACHA files for processing

- Manage ACH cutoff times and NACHA file generation times

- ACH automation

Automate processes that identify and approve scheduled business ACH templates at designated daily cut-off times or generate NACHA-formatted files for processing without direct financial institution intervention.

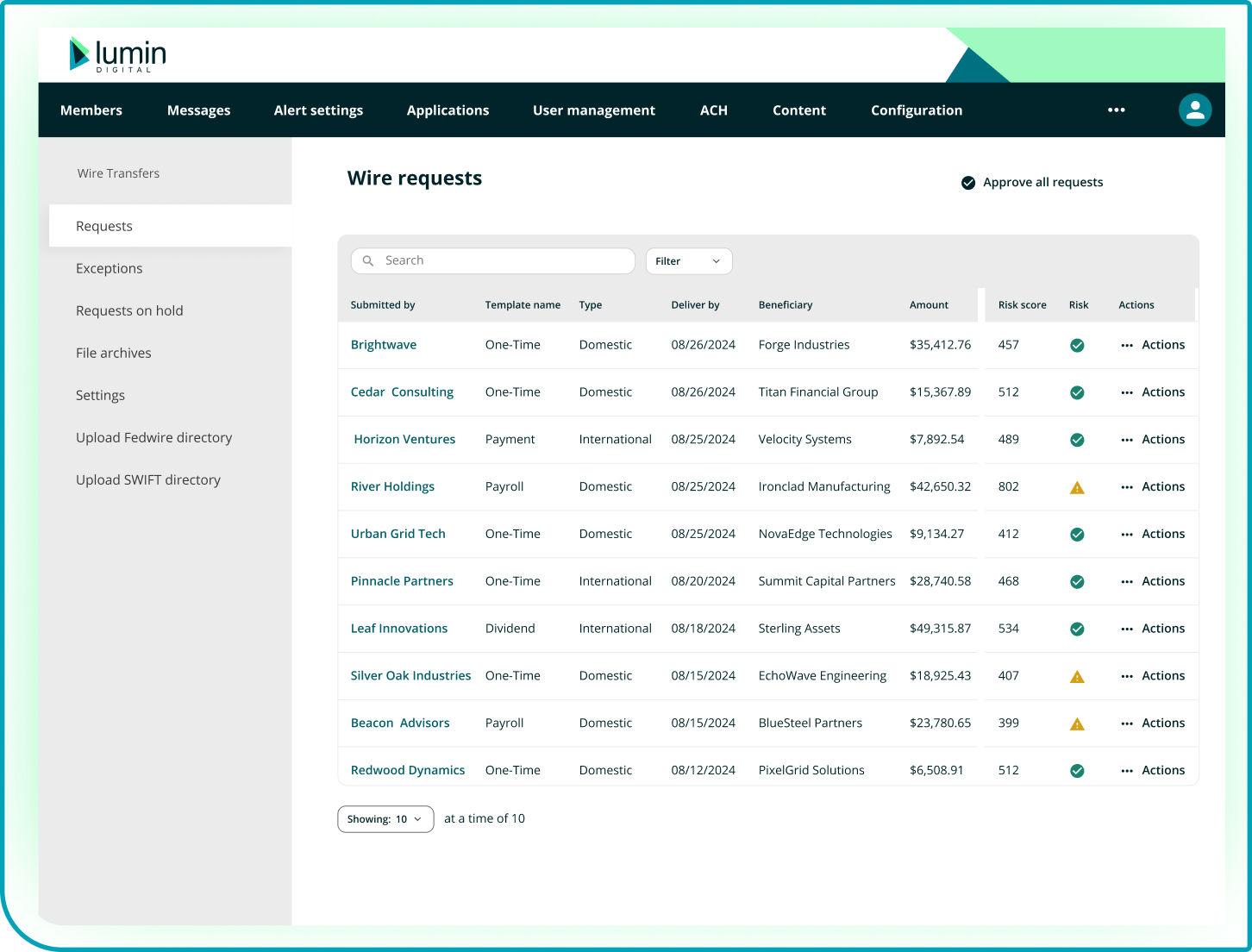

Domestic & international wire transfers

Access a complete set of wire management functionality across retail and commercial customers. Automate wire files for processing, collect fees for wire transfers, and run automated OFAC checks for individual wire requests.

Client Experience

Keep improving your employee’s experience

We’re constantly listening, learning, and analyzing data to improve our platform. In partnership with our clients, we’re building stronger digital banking tools that increase operational efficiencies and decrease costs to keep your staff focused on more important priorities. We learn what’s working, what’s not, and how to constantly improve to make your employees’ experience even stronger.