Commercial banking

Tap. Scroll. Fund.

Grow with your users.

Cash flow is critical to organizations large and small. Businesses seek mobile-first, future-ready financial solutions to enable growth and protect their investments.

Enable growth and increase productivity for your business users like never before with our mobile-first Commercial Banking solutions.

Businesses require modern banking solutions that enable them to ensure easy, safe, and seamless cash flow in and out of their organization. Whether automating complex processes, preventing fraud, or offering various money movement options, businesses need to stay connected to their cash—on their own terms.

Business Account Management

Simple and secure

Businesses large and small are focused on hitting ambitious financial goals, driving efficiency in operations to keep costs at a minimum, and protecting their investments as they scale and grow. We make it easy for you to help your commercial users streamline financial operations so they can focus on growing with you as a trusted banking partner by their side.

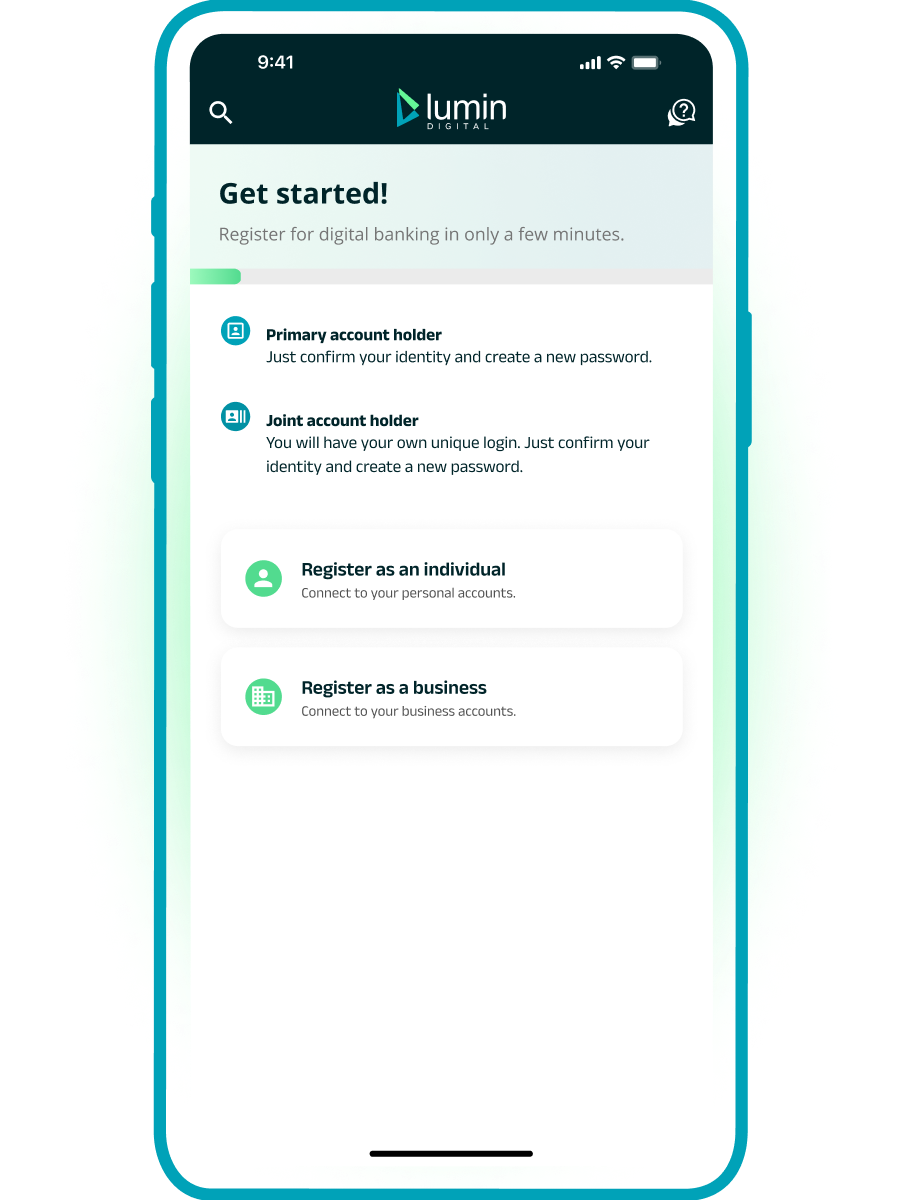

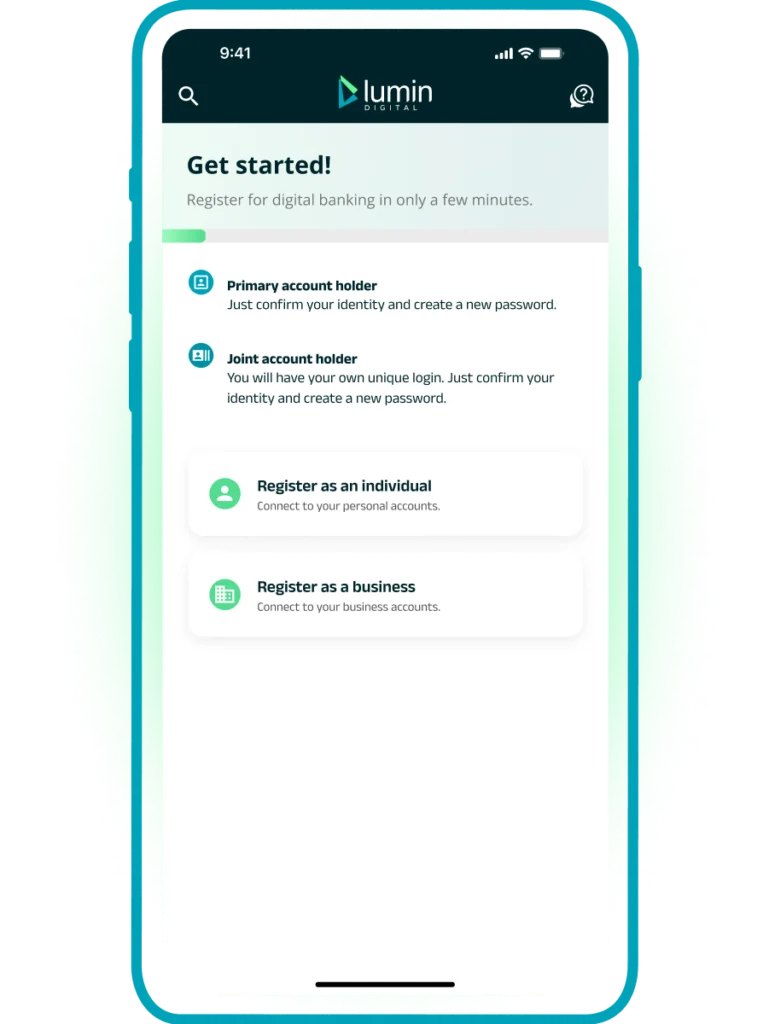

Instant online registration

Users can self-register their businesses instantly without the need for manual help from your institution.

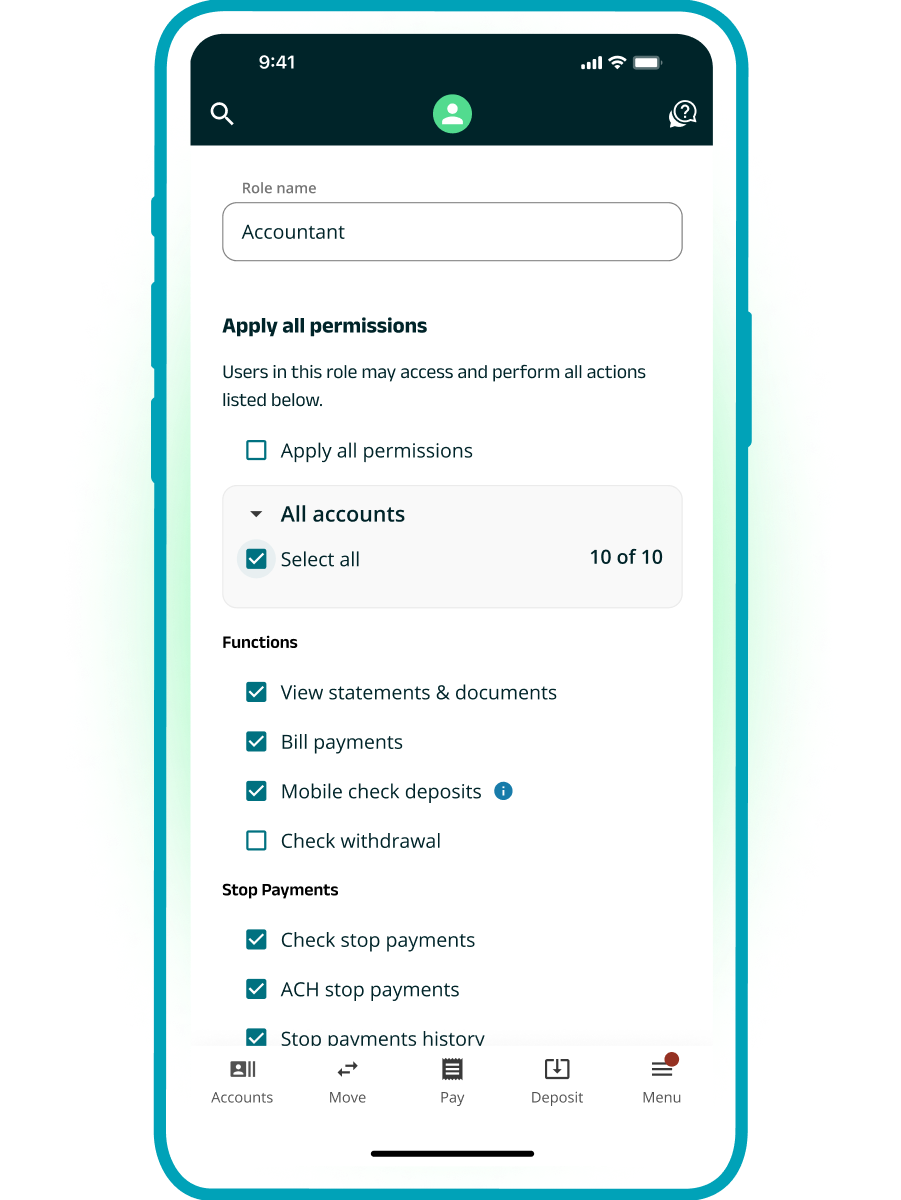

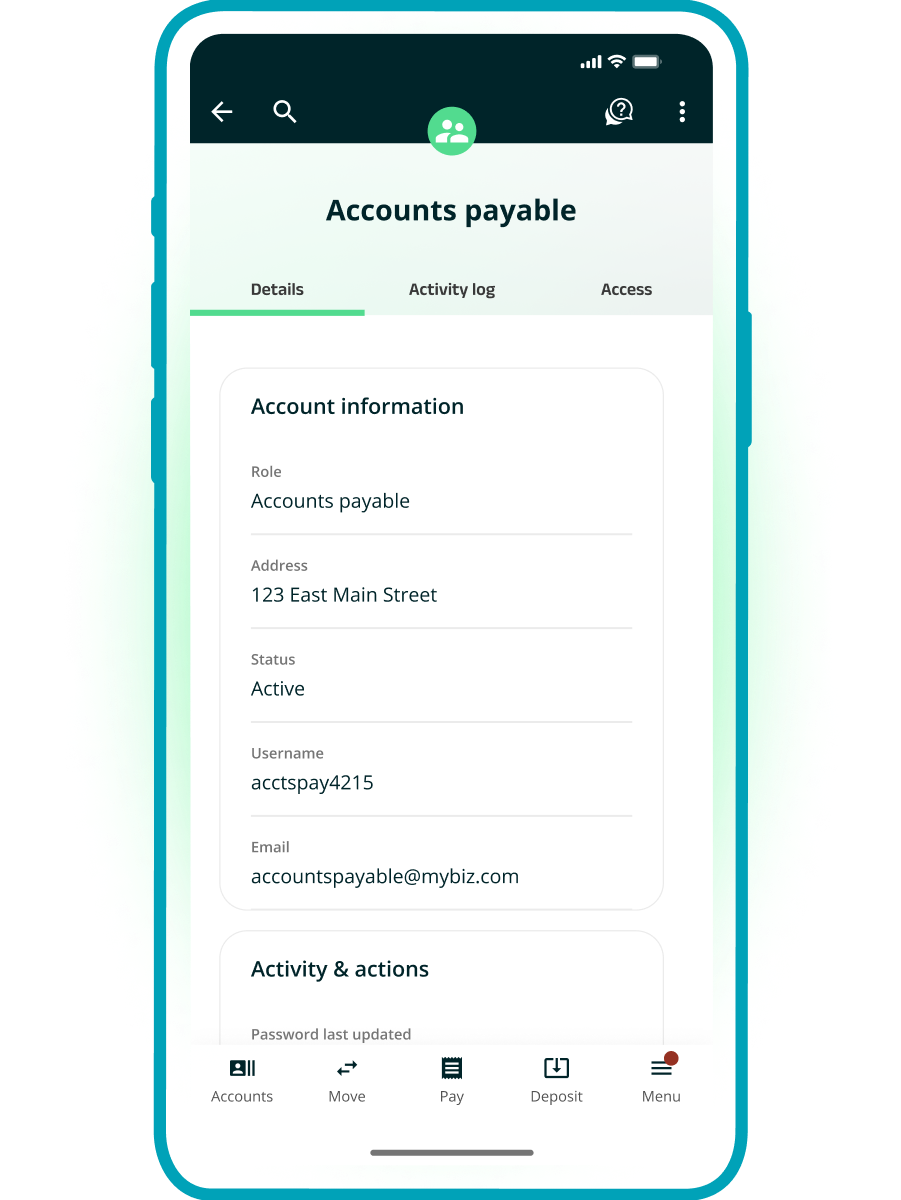

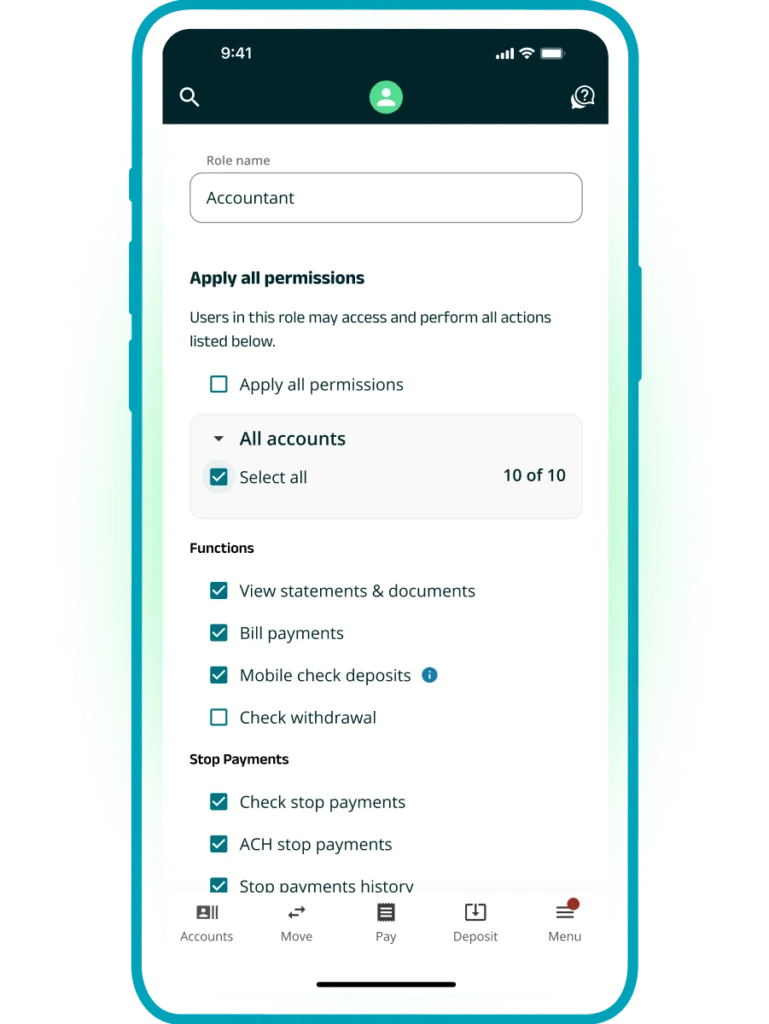

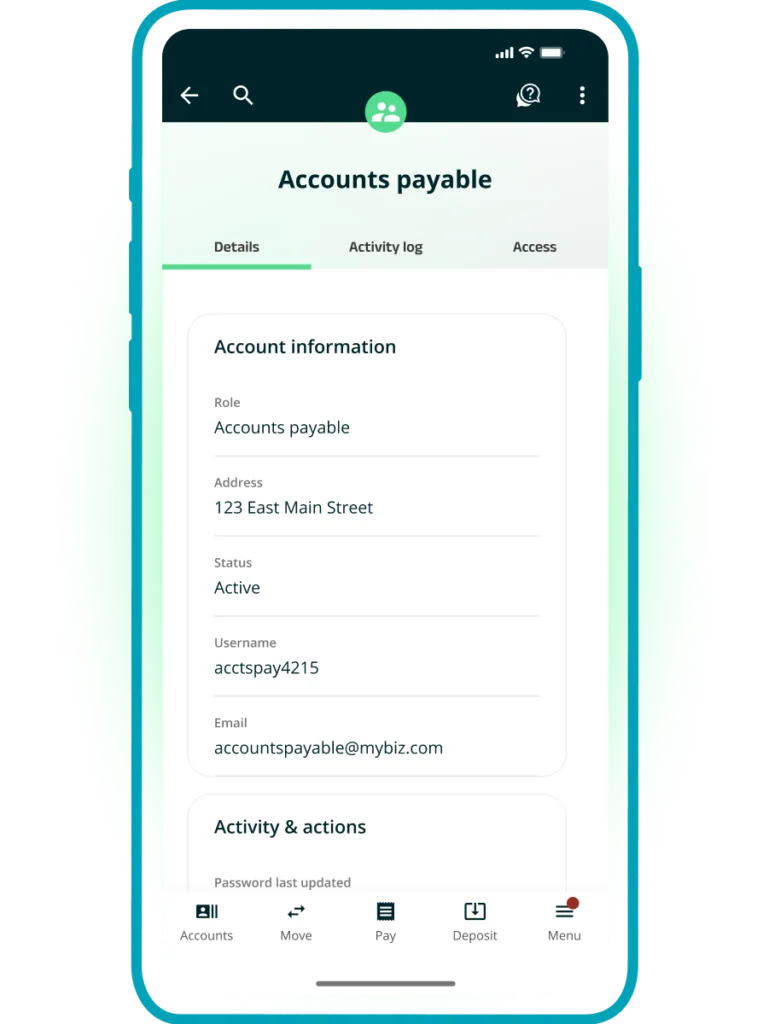

Entitlements

Enable the primary digital banking user at the business to determine when, how, and which features sub-users are able to access within digital banking.

Risk mitigation tools

Protect your business users with a robust set of tools to help them mitigate risk and fraud:

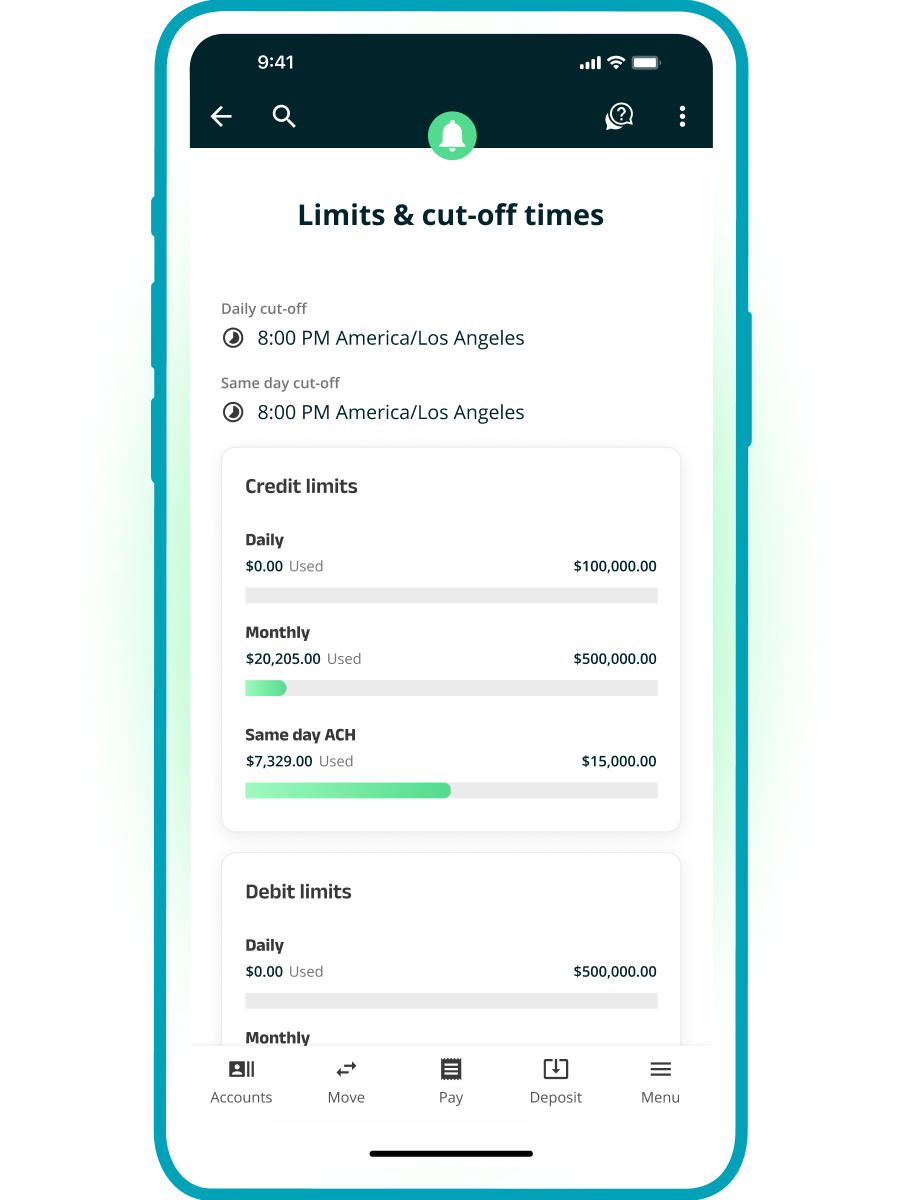

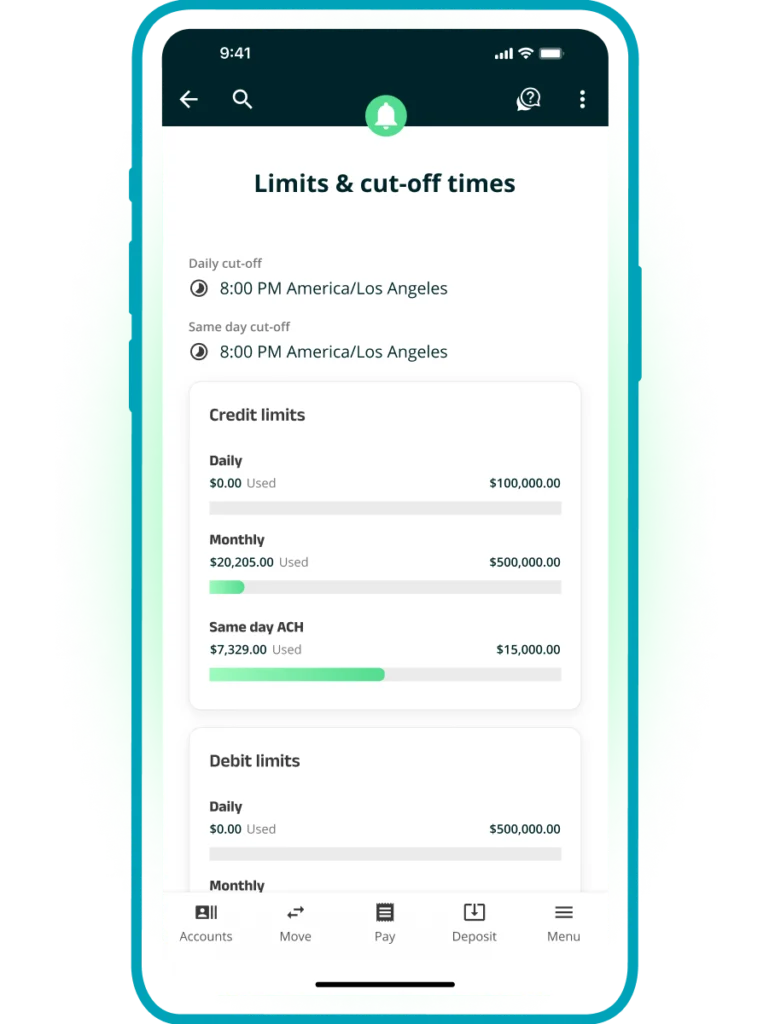

- Transaction limits

Business owners can set limits on transaction amounts to limit employees’ transfer capabilities to better manage cash outflow. - Pre-funding for ACH and wires

ACH pre-funding enables financial institution administrators to choose which accounts require pre-funding when an ACH template has been approved by the financial institution. - Balance checks for ACH

Business owners can remain at ease knowing their accounts can be checked for available balance before outgoing ACH payments are initiated. ACH templates and scheduled transfers will not be processed against accounts with insufficient funds, keeping business owners safe from overextending their accounts.

Credit card portfolio management

Empower businesses to centrally manage credit cards with set permissions for employees, including transaction limits based on roles.

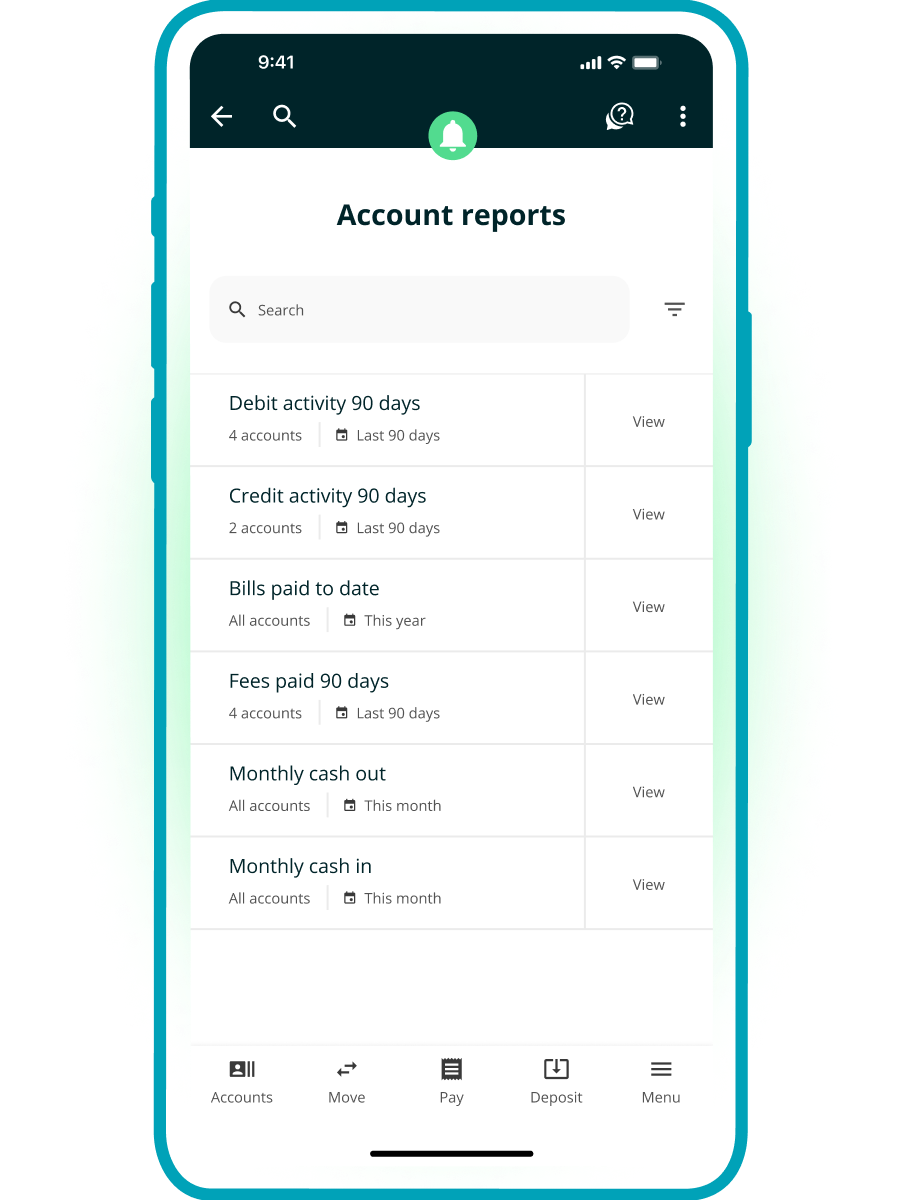

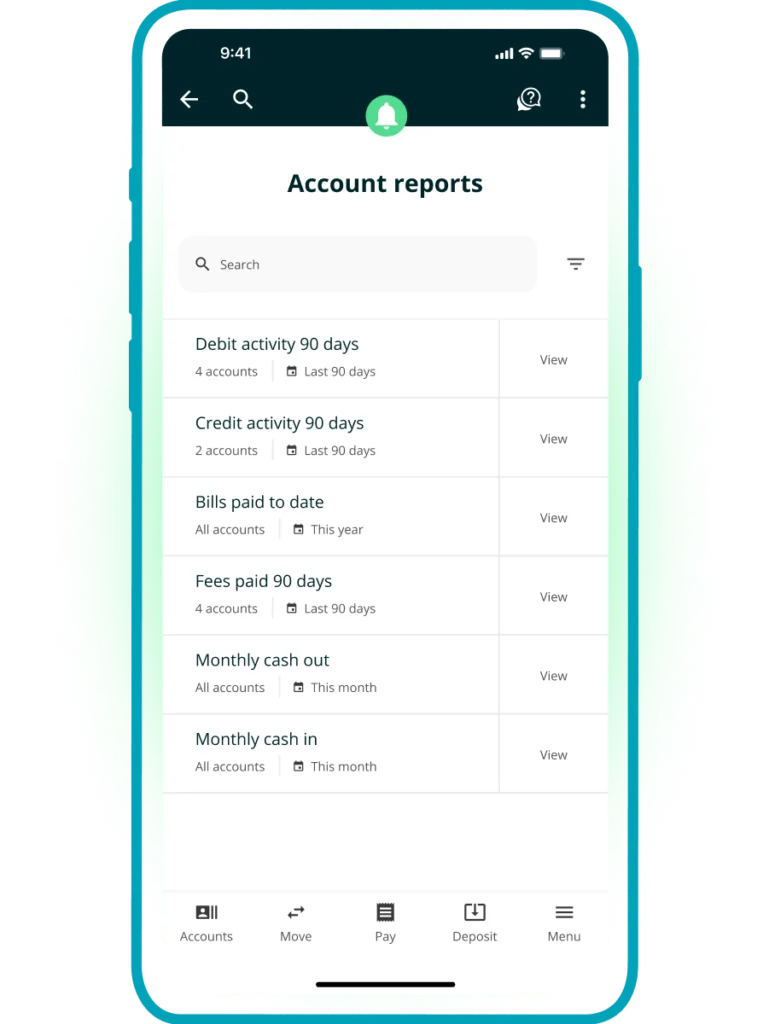

Custom reports

Increase visibility and glean insights across the business on users’ digital banking activities to better understand cash flow and who is making transfers.

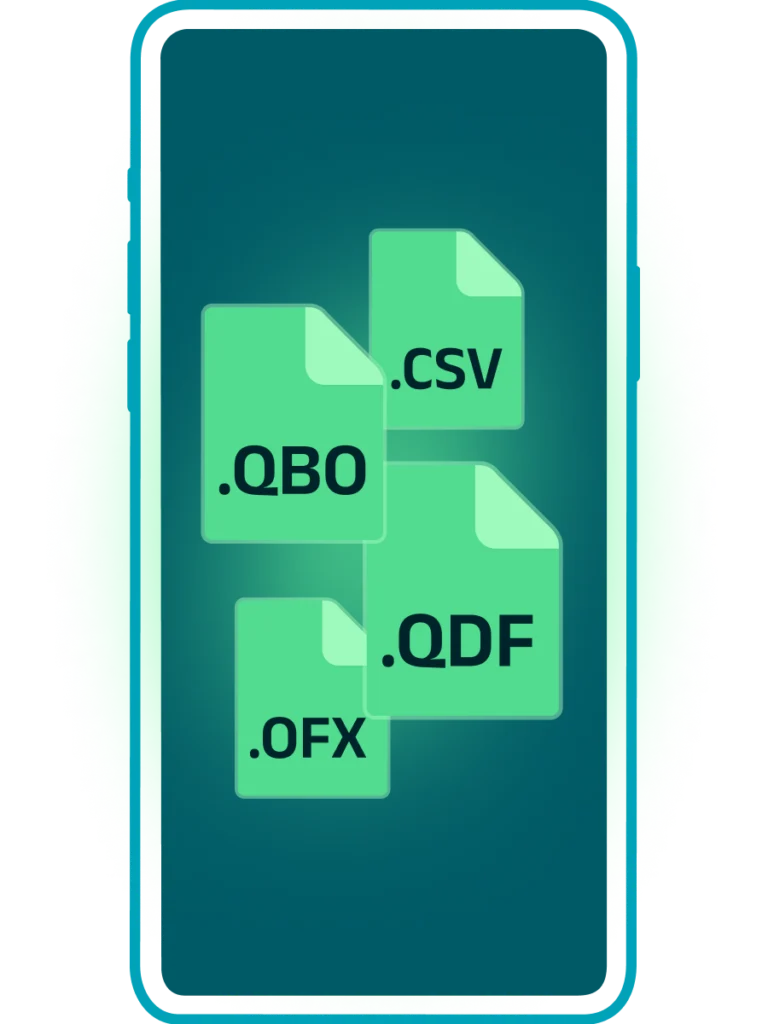

Data exports

Export data in various formats such as Quicken, Quickbooks, .cvs, and BAI-2 output support to reconcile the books however the business manages accounting.

Business Money Movement

Versatile and flexible

Easy and secure money movement in and out of a business is critical to operations. We help your commercial clients stay connected to their cash as they work with their customers, vendors, and partners.

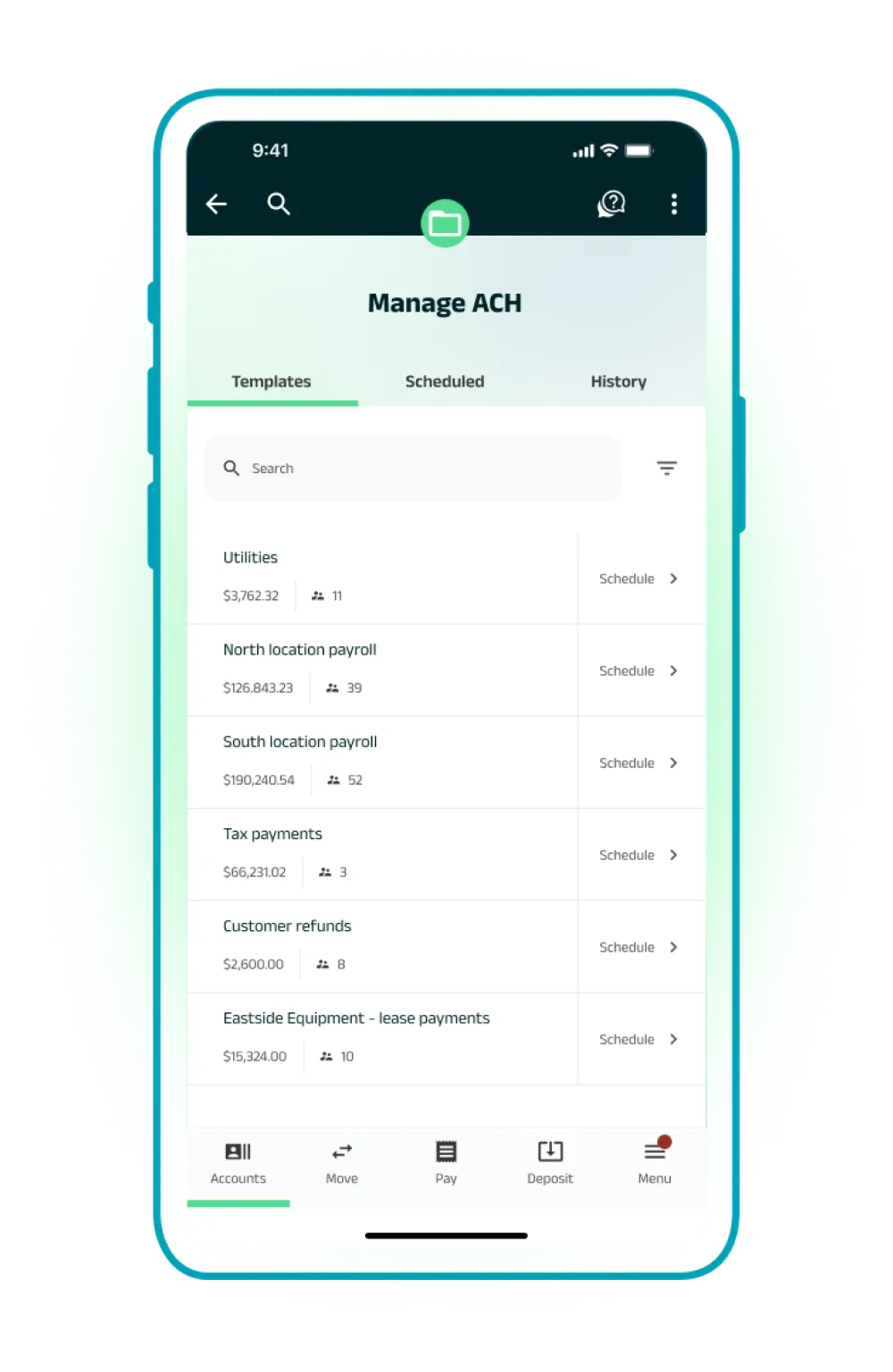

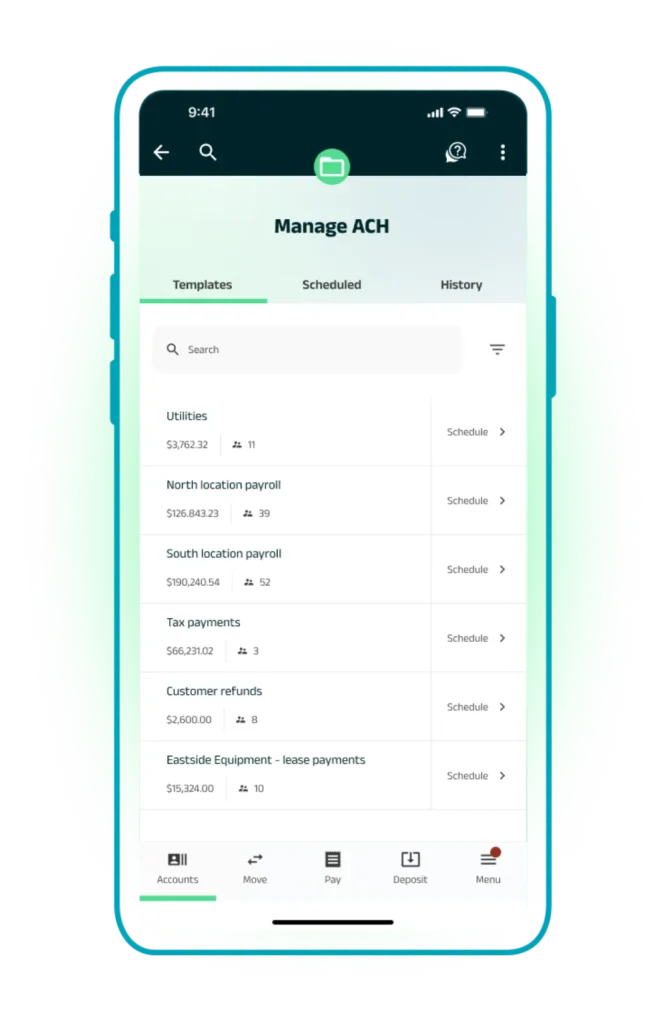

ACH Origination

Provide business owners access to a comprehensive suite of ACH origination tools to provide flexibility based on their specific needs:

- Comprehensive ACH transaction type support

- CCD, Credits

- CDD, Debits

- PPD, Credits

- PPD, Debits

- TEL (telephone-initiated entries)

- WEB (internet-initiated entries)

- ACH recipient hold status

Place holds on ACH recipients to prevent entries from being sent to institutions for review and processing - Business role ACH limits

Supports daily and monthly maximum debit and credit limits based on role as defined in digital banking - ACH import & Pass Thru

The Pass Thru feature allows businesses to upload NACHA-formatted files generated on other platforms for processing. This feature provides businesses with a secure facility to send, review, and approve files before sending to your financial institution for processing. ACH Import enables businesses to import .csv and NACHA-formatted files. - ACH reversals

Businesses are enabled to create and submit ACH reversal transactions, which helps them correct payment errors, undo incorrect transactions, stop payments to incorrect recipients, and rescind duplicate payments.

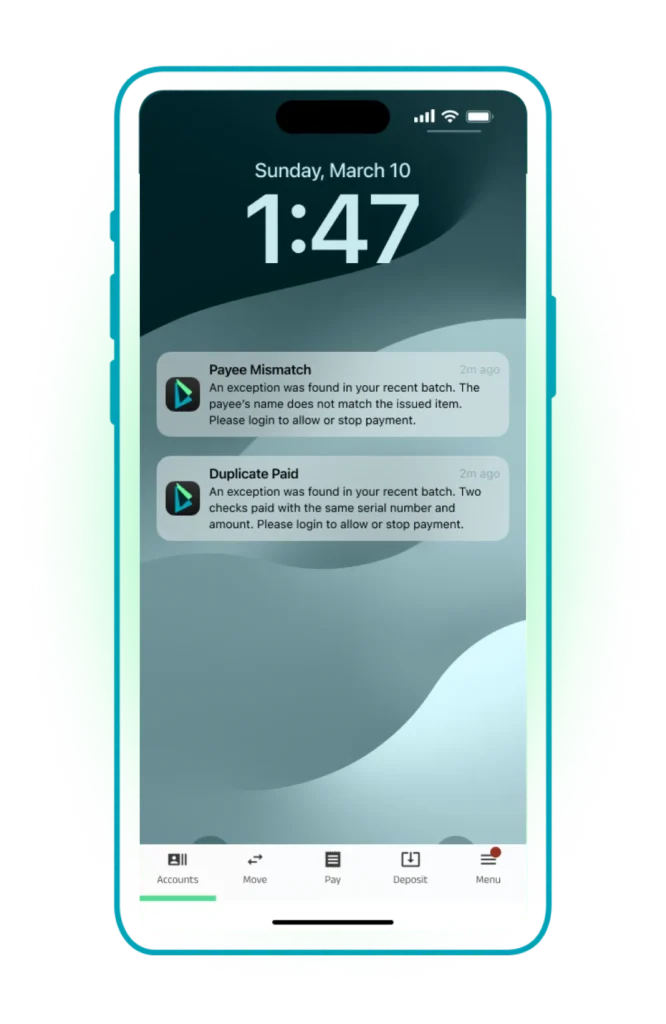

Check & ACH Positive Pay

Keep businesses safe by helping them detect and prevent fraud with Positive Pay for ACH and checks. Allow your business owners to monitor transactions against a list of approved vendors or set up defined parameters that require manual approval.

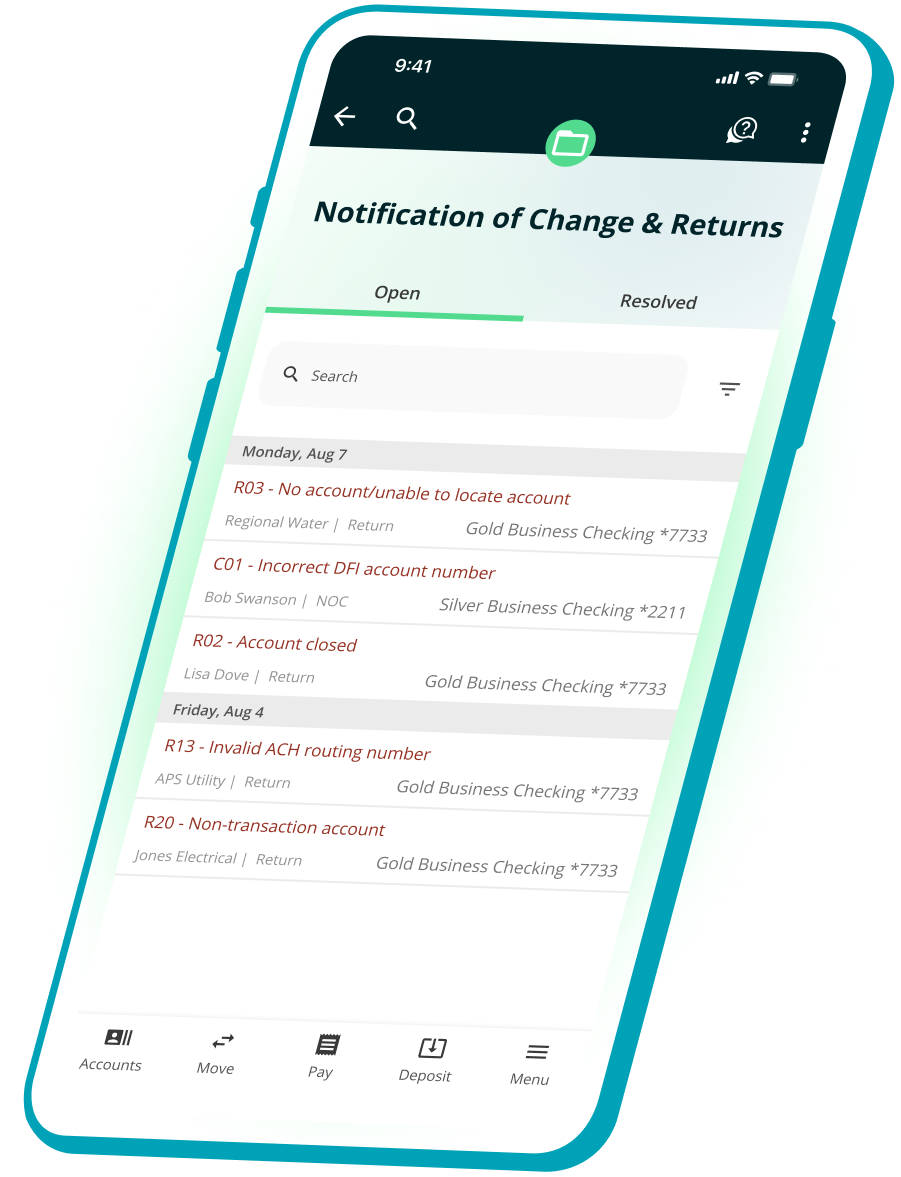

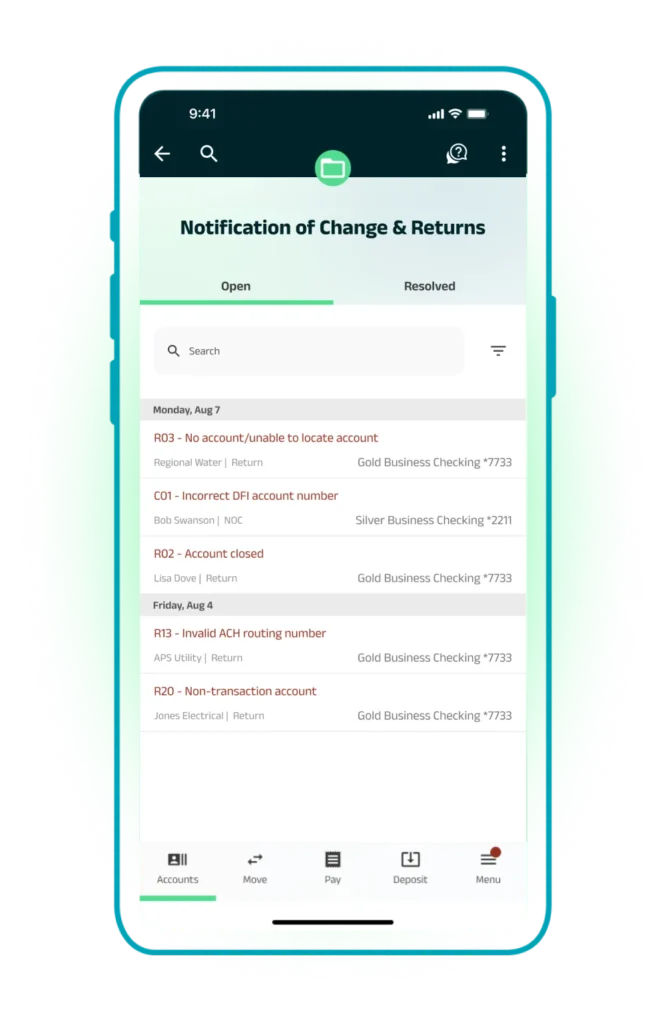

Integrated ACH Notification of Change

Improve efficiency and decrease costs by reducing manual labor and paper-based workflows associated with returned transactions due to incorrect information. Our integrated ACH Notification of Change (NOC) feature enables businesses to receive notifications to correct information before originating additional transactions.

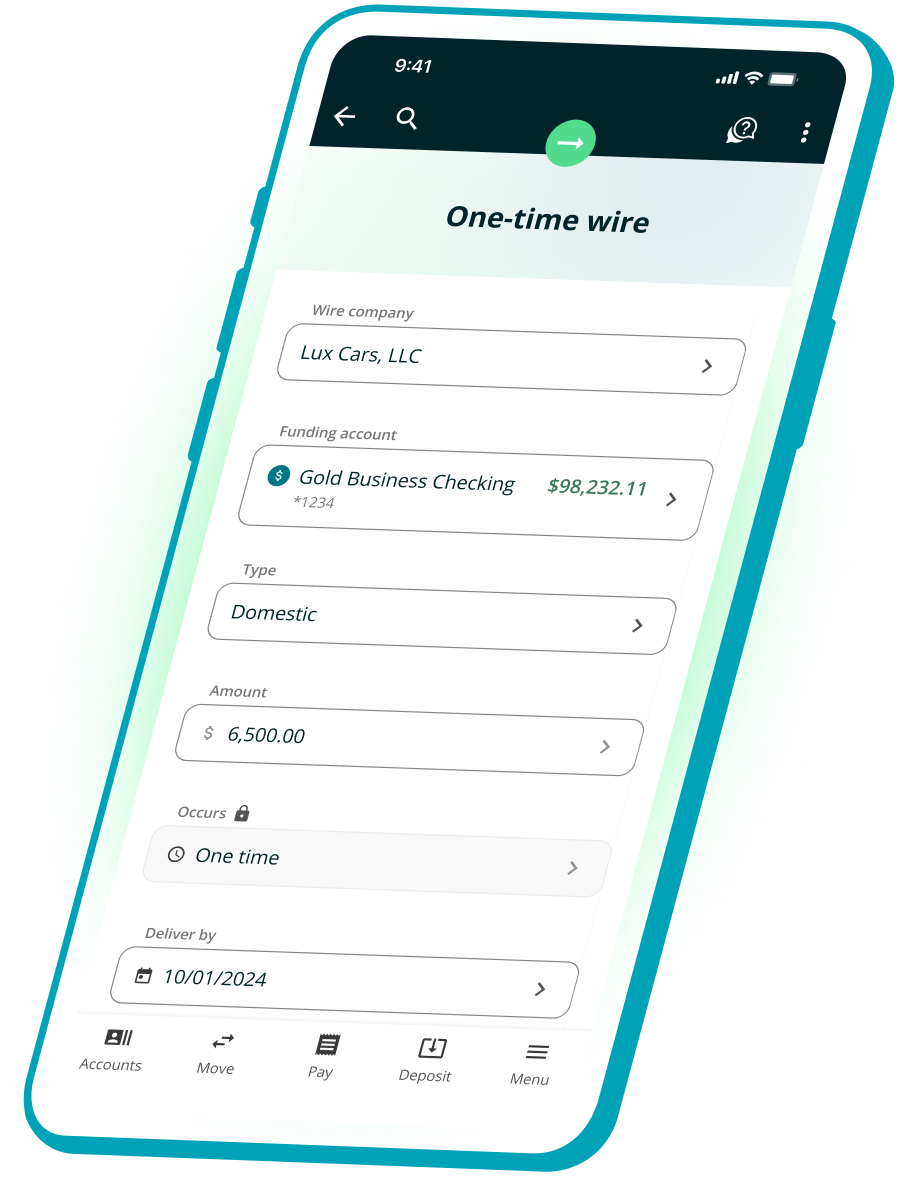

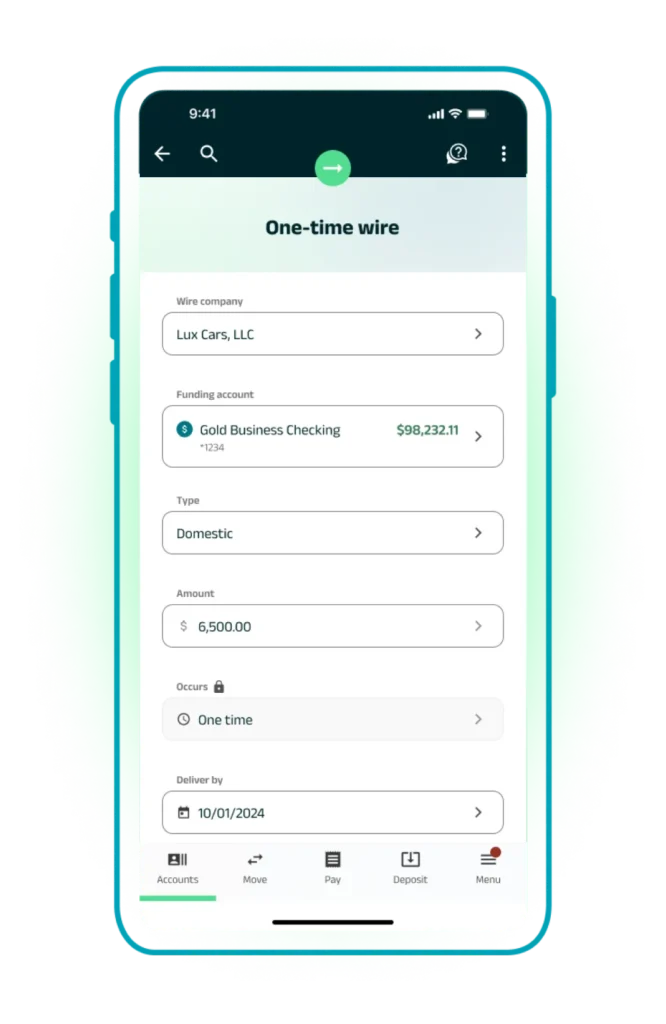

Domestic & international wire transfers

Offer domestic and international wire transfers as an additional form of money movement for your customers.

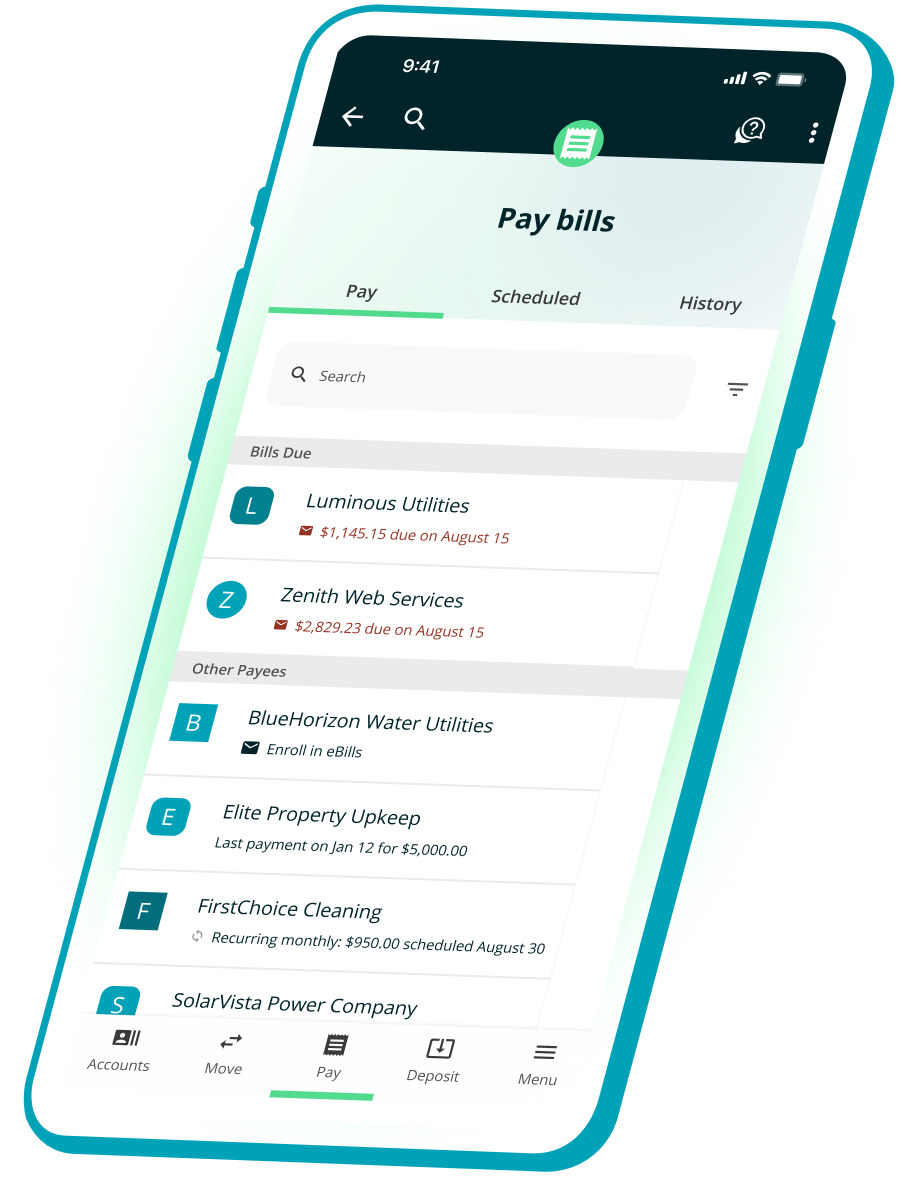

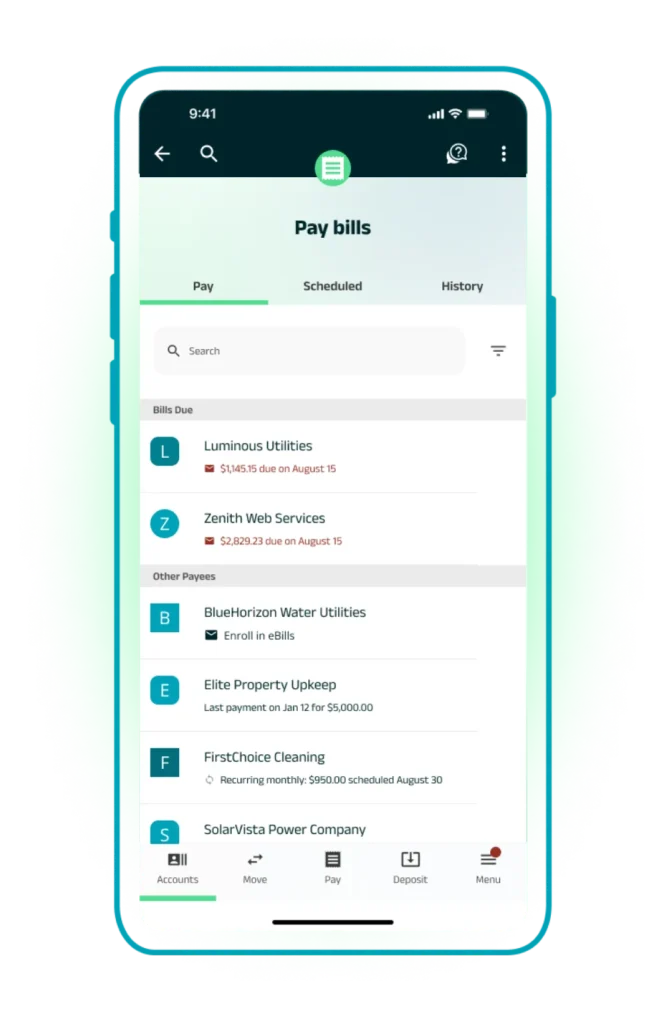

Business bill pay

Make bill payment quick and easy by offering bill pay directly to your business users—all accessible through their digital banking platform.

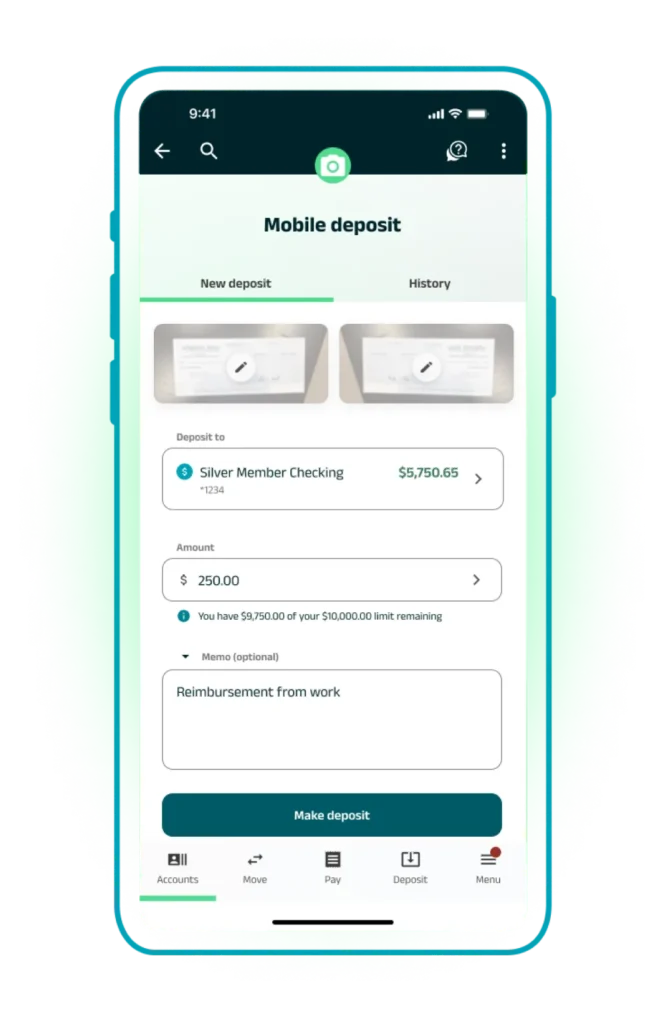

Remote deposit capture

Provide RDC capabilities to commercial users by enabling them to deposit checks individually—helpful for business owners on the go. Businesses can also take advantage of automated scanners for large multi-check volumes, making it easier than ever to increase balances without tedious, manual processes.

Client experience

Building for tomorrow’s expectations

As digital experiences and user expectations evolve, we partner with clients to develop what’s next. From gaining insights from interactions to listening to client feedback to applying learnings across our platform, our approach is based on continuous improvement and partnership—keeping our clients at the forefront of change.