Lumin Digital is the leading, future-ready digital banking solution powering remarkable growth for financial institutions across the United States. Combining innovation, data, and speed, Lumin’s disruption-proof platform was born in the cloud to stay ahead of the evolving expectations of retail and business banking users. With Lumin Digital’s unique approach, our clients innovate and scale at their own pace, optimize digital banking ROI, and create a strong digital relationship with their customers.

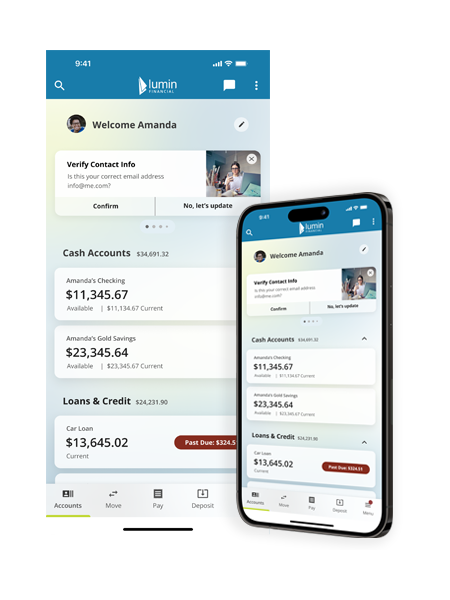

With a purposefully engaging design, these single-page application dashboards allow you to provide users with all of their personal banking information in one place. Up-to-date, real-time data about account and loan balances, transactions, cash flow, spending habits, credit scores, and a host of other helpful items are made available in an optimized interface across all devices.

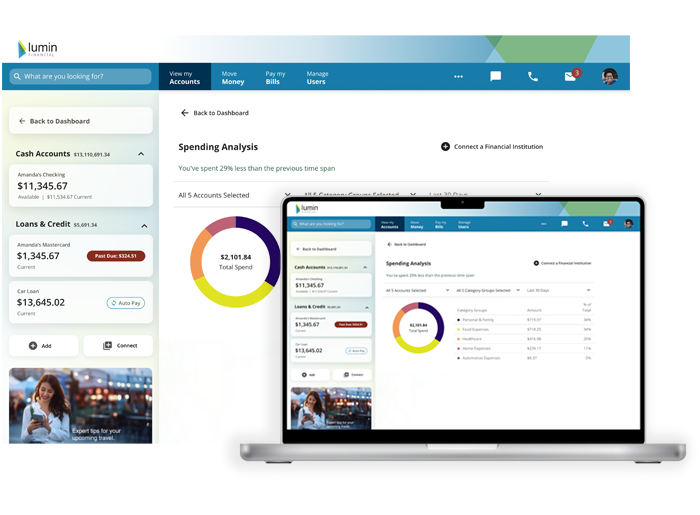

Help your users stay on track by providing them with an at-a-glance financial health check-up. By utilizing easy, intuitive, and informative tools users can visualize and understand their current financial status in relation to their goals. Whether it be long-term planning or short-term budgeting, you can allow users to check their financial pulse quickly and easily.

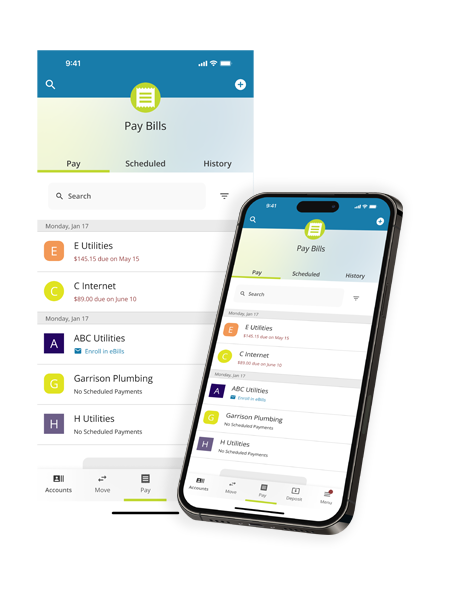

Provides an easily accessible and simple interface for your users to manage all of their bills online. With a consistent experience across all devices, users can set up automatic payments, schedule one-time payments, juggle payees, view their billing history, and more, from any device at any time.

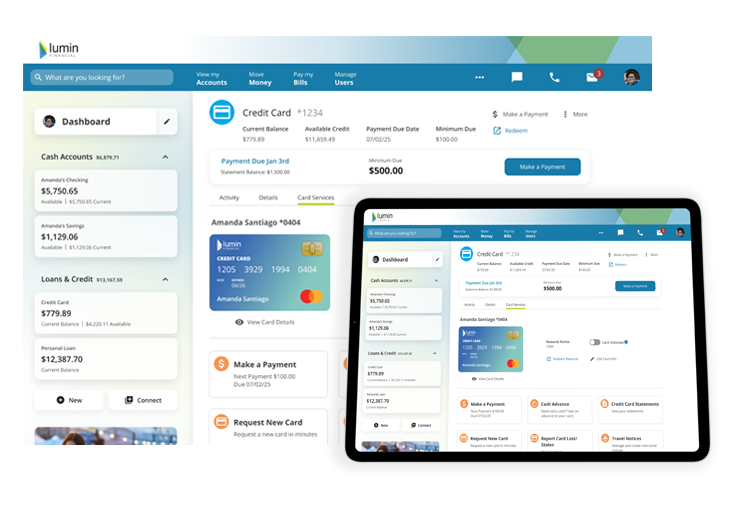

Give your users an intuitive, integrated space to manage and protect their credit and debit cards in the same place they manage their monetary accounts. Users can lock and unlock specific cards at any time, set merchant preferences, transaction alerts, spending limits, and even travel and regional notifications–without having to download an additional application.

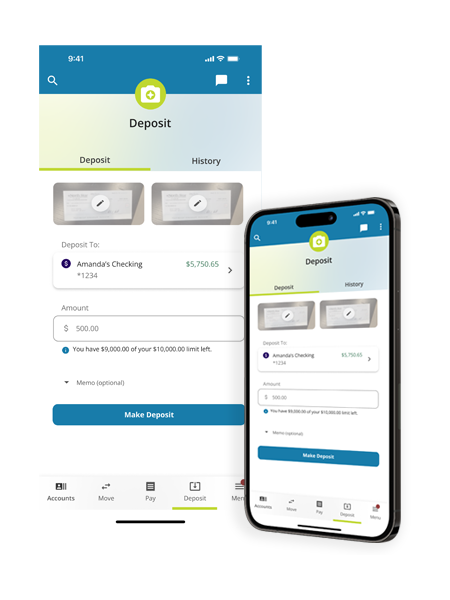

Allow your users to quickly and easily deposit checks into their accounts at any time from any device with a picture. Remote deposit functionality is becoming increasingly popular, and recent enhancements to the platform mean users can deposit multiple checks at the same time.

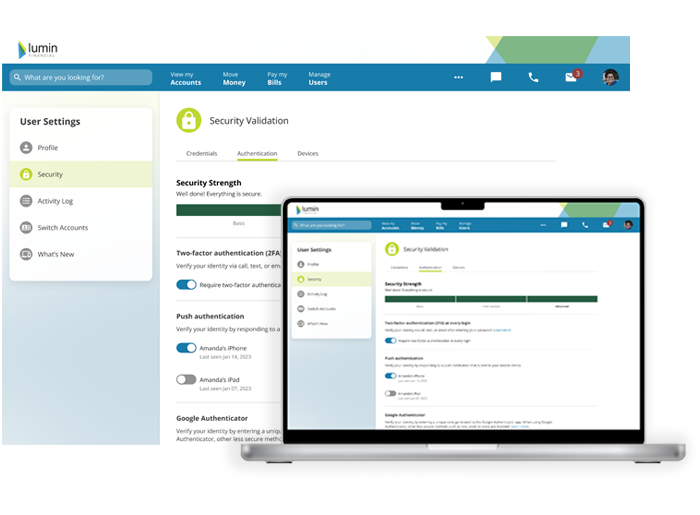

As a cloud-native platform, our security protocols are already integrated into, and running on, multiple layers, providing you and your users with the latest and greatest in digital protections. That includes emerging and ever-present threats such as identity theft and credential stuffing. As opposed to being layered on top or retrofitted as an afterthought, our security systems architecture provides for constant preventative updates, leaves no gaps, and goes beyond the routine security and compliance standards of the day, all while providing a seamless experience to the end user.

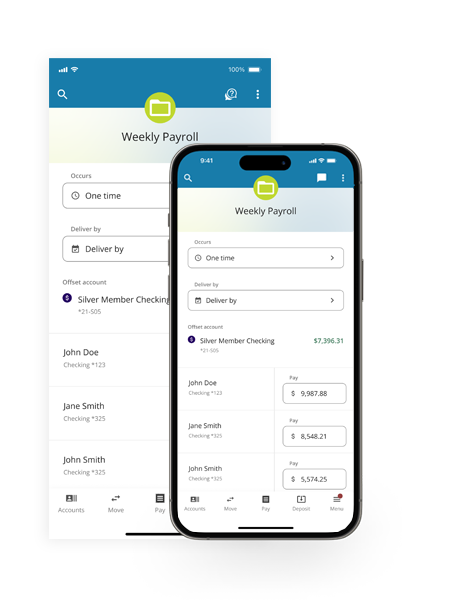

With Lumin’s Business Banking, you’ll have the tools you need to acquire, sustain, and strengthen relationships. We make it easy for you to create tailored solutions for virtually any business type or size. Our suite of highly integrated, user-friendly features includes sub-user and role management from any device, instant online registration, including ACH wire, positive pay, and more.

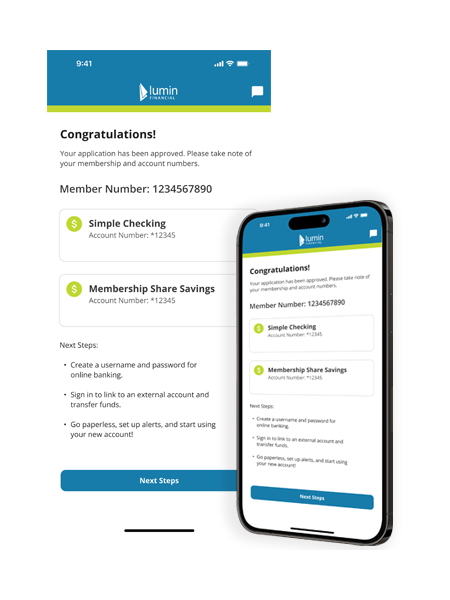

As one of the first cloud-native digital banking platform to offer the digital account opening feature, we’ve made it easy for your users (current and potential) to open a checking or savings account in under five minutes with a few clicks. This action doesn’t require a separate, third-party vendor to complete, and the new account can even be funded with a debit card, making it even easier to make initial deposits.

Your institution likely uses multiple vendors to help enhance your digital banking operations, and our platform can seamlessly integrate with all of them. This not only provides your users with a better, consistent experience, but helps you save time and money as we will help create and manage those vendor relationships to develop the best possible outcomes. It all comes from our flexible cloud-native system architecture.

Through our software development kit (SDK), you can extend the platform into your institution’s other areas of focus, providing you with a flexible way to integrate with other providers. It allows you and your in-house team to manage the platform on your own, in addition to the support and regular enhancements provided by

our team.

Lumin Analytics is a streaming data and analysis platform that allows your organization to get even more value from our core digital banking solution. With real-time visibility, actionable insights, and advanced automation capabilities, Lumin Analytics helps our customers turn their data into impact.

Fill out the form to request a personalized walk-through from one of our experts and learn more about how we can help your organization.

3001 Bishop Drive, Suite 110

San Ramon, CA 94583

[email protected] | 833.335.8646